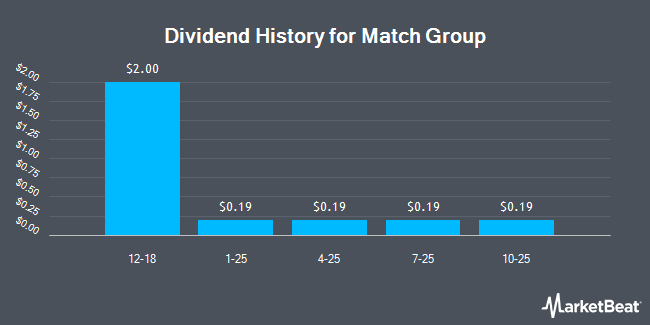

Match Group Inc. (NASDAQ:MTCH - Get Free Report) declared a quarterly dividend on Tuesday, August 5th, RTT News reports. Stockholders of record on Friday, October 3rd will be paid a dividend of 0.19 per share by the technology company on Friday, October 17th. This represents a c) dividend on an annualized basis and a dividend yield of 2.3%.

Match Group has a payout ratio of 29.8% indicating that its dividend is sufficiently covered by earnings. Research analysts expect Match Group to earn $2.82 per share next year, which means the company should continue to be able to cover its $0.76 annual dividend with an expected future payout ratio of 27.0%.

Match Group Stock Performance

Shares of NASDAQ MTCH traded down $0.15 during mid-day trading on Tuesday, reaching $33.73. 8,961,442 shares of the company traded hands, compared to its average volume of 4,764,716. The company's fifty day moving average is $31.95 and its two-hundred day moving average is $31.47. Match Group has a fifty-two week low of $26.39 and a fifty-two week high of $38.77. The stock has a market cap of $8.45 billion, a PE ratio of 16.70, a price-to-earnings-growth ratio of 0.74 and a beta of 1.36.

Match Group (NASDAQ:MTCH - Get Free Report) last announced its earnings results on Tuesday, August 5th. The technology company reported $0.52 earnings per share for the quarter, missing the consensus estimate of $0.79 by ($0.27). Match Group had a net margin of 15.81% and a negative return on equity of 483.83%. Research analysts forecast that Match Group will post 2.44 earnings per share for the current year.

Wall Street Analyst Weigh In

MTCH has been the subject of several research analyst reports. Morgan Stanley cut their price objective on Match Group from $33.00 to $32.00 and set an "equal weight" rating for the company in a research report on Thursday, April 17th. Evercore ISI reaffirmed a "cautious" rating and set a $32.00 price objective on shares of Match Group in a research note on Wednesday, May 21st. Citigroup decreased their price objective on Match Group from $31.00 to $30.00 and set a "neutral" rating for the company in a research note on Friday, May 9th. JPMorgan Chase & Co. decreased their price objective on Match Group from $29.00 to $28.00 and set a "neutral" rating for the company in a research note on Friday, May 9th. Finally, UBS Group upped their price objective on shares of Match Group from $31.00 to $35.00 and gave the company a "neutral" rating in a research report on Wednesday, July 23rd. One analyst has rated the stock with a sell rating, fifteen have assigned a hold rating and five have assigned a buy rating to the stock. According to data from MarketBeat.com, Match Group currently has an average rating of "Hold" and a consensus target price of $34.95.

Read Our Latest Stock Report on MTCH

About Match Group

(

Get Free Report)

Match Group, Inc engages in the provision of dating products. Its portfolio of brands includes Tinder, Hinge, Match, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, and Hakuna, as well as a various other brands, each built to increase users' likelihood of connecting with others. Its services are available in over 40 languages to users worldwide.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Match Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Match Group wasn't on the list.

While Match Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.