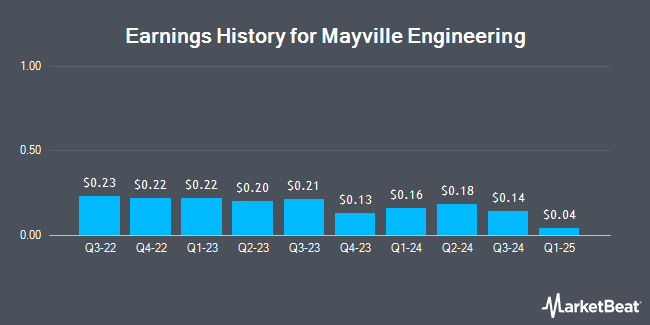

Mayville Engineering (NYSE:MEC - Get Free Report) announced its quarterly earnings results on Tuesday. The company reported $0.07 earnings per share for the quarter, missing analysts' consensus estimates of $0.10 by ($0.03), Zacks reports. Mayville Engineering had a net margin of 3.41% and a return on equity of 8.21%. The company had revenue of $132.33 million during the quarter, compared to the consensus estimate of $137.98 million. Mayville Engineering updated its FY 2025 guidance to EPS.

Mayville Engineering Stock Performance

Shares of NYSE:MEC traded down $0.49 on Friday, hitting $13.75. The company had a trading volume of 317,689 shares, compared to its average volume of 137,003. Mayville Engineering has a 1-year low of $11.72 and a 1-year high of $23.02. The stock has a market cap of $279.40 million, a price-to-earnings ratio of 16.18 and a beta of 1.19. The stock has a 50 day moving average price of $15.83 and a 200 day moving average price of $14.85. The company has a current ratio of 1.63, a quick ratio of 0.91 and a debt-to-equity ratio of 0.28.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on MEC. Citigroup reaffirmed a "buy" rating and issued a $21.00 price target (up previously from $17.00) on shares of Mayville Engineering in a research note on Monday, July 14th. DA Davidson began coverage on shares of Mayville Engineering in a report on Tuesday, June 17th. They set a "buy" rating and a $23.00 target price on the stock.

Check Out Our Latest Stock Report on Mayville Engineering

Insider Activity at Mayville Engineering

In related news, CEO Jagadeesh A. Reddy acquired 7,500 shares of the firm's stock in a transaction on Thursday, August 7th. The shares were purchased at an average cost of $14.06 per share, for a total transaction of $105,450.00. Following the completion of the acquisition, the chief executive officer directly owned 146,285 shares in the company, valued at approximately $2,056,767.10. This trade represents a 5.40% increase in their ownership of the stock. The purchase was disclosed in a filing with the SEC, which is accessible through the SEC website. 7.20% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Mayville Engineering

Several institutional investors and hedge funds have recently modified their holdings of the business. Jane Street Group LLC raised its holdings in Mayville Engineering by 158.6% in the 1st quarter. Jane Street Group LLC now owns 47,194 shares of the company's stock valued at $634,000 after buying an additional 28,946 shares during the last quarter. Geode Capital Management LLC raised its holdings in Mayville Engineering by 9.5% in the 2nd quarter. Geode Capital Management LLC now owns 318,321 shares of the company's stock valued at $5,081,000 after buying an additional 27,552 shares during the last quarter. Finally, Empowered Funds LLC raised its holdings in Mayville Engineering by 7.3% in the 1st quarter. Empowered Funds LLC now owns 98,207 shares of the company's stock valued at $1,319,000 after buying an additional 6,694 shares during the last quarter. 45.44% of the stock is currently owned by institutional investors and hedge funds.

Mayville Engineering Company Profile

(

Get Free Report)

Mayville Engineering Company, Inc, together with its subsidiaries, engages in the production, design, prototyping and tooling, fabrication, aluminum extrusion, coating, and assembling of aftermarket components in the United States. It also supplies engineered components to original equipment manufacturers.

Read More

Before you consider Mayville Engineering, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mayville Engineering wasn't on the list.

While Mayville Engineering currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.