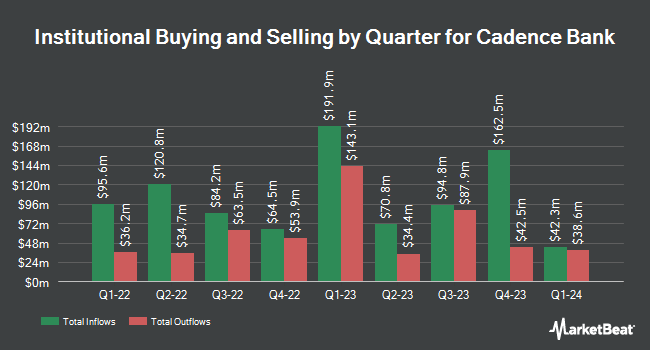

Mercer Global Advisors Inc. ADV trimmed its holdings in Cadence Bank (NYSE:CADE - Free Report) by 79.9% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 13,425 shares of the company's stock after selling 53,291 shares during the period. Mercer Global Advisors Inc. ADV's holdings in Cadence Bank were worth $462,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Oregon Public Employees Retirement Fund boosted its position in shares of Cadence Bank by 0.8% during the fourth quarter. Oregon Public Employees Retirement Fund now owns 37,274 shares of the company's stock worth $1,284,000 after buying an additional 300 shares during the period. Ironwood Investment Management LLC boosted its position in shares of Cadence Bank by 1.2% during the fourth quarter. Ironwood Investment Management LLC now owns 30,170 shares of the company's stock worth $1,039,000 after buying an additional 354 shares during the period. Arizona State Retirement System boosted its position in shares of Cadence Bank by 0.8% during the fourth quarter. Arizona State Retirement System now owns 53,034 shares of the company's stock worth $1,827,000 after buying an additional 415 shares during the period. Sit Investment Associates Inc. boosted its position in shares of Cadence Bank by 2.4% during the fourth quarter. Sit Investment Associates Inc. now owns 25,750 shares of the company's stock worth $887,000 after buying an additional 600 shares during the period. Finally, Victory Capital Management Inc. boosted its position in shares of Cadence Bank by 1.4% during the fourth quarter. Victory Capital Management Inc. now owns 50,453 shares of the company's stock worth $1,738,000 after buying an additional 685 shares during the period. 84.61% of the stock is owned by institutional investors and hedge funds.

Cadence Bank Stock Performance

NYSE CADE traded down $0.15 during trading hours on Monday, hitting $31.67. 1,349,470 shares of the company traded hands, compared to its average volume of 1,291,415. The business's 50-day moving average is $29.50 and its 200-day moving average is $33.22. The stock has a market capitalization of $5.77 billion, a price-to-earnings ratio of 11.43 and a beta of 0.84. Cadence Bank has a twelve month low of $25.22 and a twelve month high of $40.20.

Cadence Bank (NYSE:CADE - Get Free Report) last released its quarterly earnings data on Monday, April 21st. The company reported $0.71 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.64 by $0.07. The firm had revenue of $448.55 million for the quarter, compared to analyst estimates of $451.61 million. Cadence Bank had a return on equity of 9.87% and a net margin of 18.03%. During the same quarter in the prior year, the company earned $0.62 earnings per share. Analysts predict that Cadence Bank will post 2.94 EPS for the current year.

Cadence Bank Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 1st. Shareholders of record on Friday, June 13th will be paid a $0.275 dividend. The ex-dividend date of this dividend is Friday, June 13th. This represents a $1.10 annualized dividend and a yield of 3.47%. Cadence Bank's dividend payout ratio is 38.60%.

Cadence Bank announced that its board has initiated a stock repurchase plan on Friday, April 25th that allows the company to repurchase 10,000,000 outstanding shares. This repurchase authorization allows the company to reacquire shares of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's leadership believes its shares are undervalued.

Wall Street Analysts Forecast Growth

Several research analysts have recently weighed in on CADE shares. Citigroup upped their price objective on Cadence Bank from $37.00 to $38.00 and gave the stock a "neutral" rating in a research report on Monday, January 27th. Barclays reduced their price objective on Cadence Bank from $44.00 to $38.00 and set an "overweight" rating for the company in a research report on Tuesday, April 8th. DA Davidson reduced their price objective on Cadence Bank from $42.00 to $37.00 and set a "buy" rating for the company in a research report on Wednesday, April 23rd. Keefe, Bruyette & Woods increased their price target on Cadence Bank from $38.00 to $40.00 and gave the company an "outperform" rating in a research report on Friday, May 9th. Finally, Piper Sandler reduced their price target on Cadence Bank from $38.00 to $36.00 and set a "neutral" rating for the company in a research report on Wednesday, April 23rd. Four investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat.com, Cadence Bank has a consensus rating of "Moderate Buy" and a consensus price target of $36.82.

Get Our Latest Analysis on Cadence Bank

Cadence Bank Profile

(

Free Report)

Cadence Bank provides commercial banking and financial services. Its products and services include consumer banking, consumer loans, mortgages, home equity lines and loans, credit cards, commercial and business banking, treasury management, specialized and asset-based lending, commercial real estate, equipment financing, and correspondent banking services.

Featured Articles

Before you consider Cadence Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cadence Bank wasn't on the list.

While Cadence Bank currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.