Mercury Systems (NASDAQ:MRCY - Free Report) had its target price raised by Truist Financial from $60.00 to $71.00 in a report published on Tuesday morning,Benzinga reports. Truist Financial currently has a buy rating on the technology company's stock.

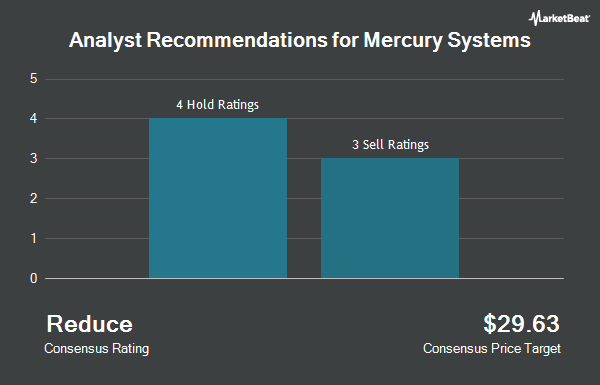

Other analysts also recently issued reports about the company. Royal Bank Of Canada raised their target price on Mercury Systems from $50.00 to $55.00 and gave the company a "sector perform" rating in a research note on Thursday, July 3rd. Raymond James Financial upgraded Mercury Systems from an "outperform" rating to a "strong-buy" rating and raised their target price for the company from $55.00 to $80.00 in a research note on Tuesday. The Goldman Sachs Group raised their target price on Mercury Systems from $30.00 to $33.00 and gave the company a "sell" rating in a research note on Monday, May 12th. Robert W. Baird raised their target price on Mercury Systems from $58.00 to $70.00 and gave the company an "outperform" rating in a research note on Tuesday. Finally, JPMorgan Chase & Co. raised their target price on Mercury Systems from $48.00 to $56.00 and gave the company a "neutral" rating in a research note on Monday, June 16th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating, three have given a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $59.13.

View Our Latest Stock Analysis on MRCY

Mercury Systems Trading Down 2.7%

Mercury Systems stock traded down $1.86 during trading hours on Tuesday, reaching $66.53. 212,375 shares of the company's stock were exchanged, compared to its average volume of 611,995. The company has a quick ratio of 2.25, a current ratio of 3.52 and a debt-to-equity ratio of 0.40. The firm's 50 day simple moving average is $52.69 and its 200 day simple moving average is $48.17. Mercury Systems has a twelve month low of $32.32 and a twelve month high of $69.95. The firm has a market capitalization of $3.99 billion, a PE ratio of -101.14, a PEG ratio of 3.19 and a beta of 0.72.

Mercury Systems (NASDAQ:MRCY - Get Free Report) last issued its quarterly earnings results on Monday, August 11th. The technology company reported $0.47 earnings per share for the quarter, topping analysts' consensus estimates of $0.21 by $0.26. Mercury Systems had a positive return on equity of 0.58% and a negative net margin of 4.16%. The firm had revenue of $273.11 million during the quarter, compared to the consensus estimate of $244.56 million. During the same period last year, the business posted $0.23 EPS. The business's revenue was up 9.9% compared to the same quarter last year. Research analysts predict that Mercury Systems will post -0.08 earnings per share for the current year.

Insider Activity at Mercury Systems

In related news, EVP Steven Ratner sold 1,839 shares of Mercury Systems stock in a transaction that occurred on Monday, June 16th. The shares were sold at an average price of $53.48, for a total value of $98,349.72. Following the sale, the executive vice president owned 35,174 shares of the company's stock, valued at approximately $1,881,105.52. The trade was a 4.97% decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Company insiders own 1.60% of the company's stock.

Institutional Investors Weigh In On Mercury Systems

A number of hedge funds have recently modified their holdings of MRCY. Neo Ivy Capital Management bought a new stake in Mercury Systems during the 4th quarter valued at $33,000. Quaker Wealth Management LLC raised its holdings in Mercury Systems by 200.0% during the 2nd quarter. Quaker Wealth Management LLC now owns 644 shares of the technology company's stock valued at $35,000 after acquiring an additional 1,288 shares during the period. Federated Hermes Inc. bought a new stake in Mercury Systems during the 2nd quarter valued at $43,000. GAMMA Investing LLC raised its holdings in Mercury Systems by 59.6% during the 1st quarter. GAMMA Investing LLC now owns 1,058 shares of the technology company's stock valued at $46,000 after acquiring an additional 395 shares during the period. Finally, EverSource Wealth Advisors LLC raised its holdings in Mercury Systems by 33.7% during the 2nd quarter. EverSource Wealth Advisors LLC now owns 929 shares of the technology company's stock valued at $50,000 after acquiring an additional 234 shares during the period. Institutional investors own 95.99% of the company's stock.

Mercury Systems Company Profile

(

Get Free Report)

Mercury Systems, Inc, a technology company, manufactures and sells components, products, modules, and subsystems for aerospace and defense industries in the United States, Europe, and the Asia Pacific. Its products and solutions are deployed in approximately 300 programs with 25 defense contractors and commercial aviation customers.

See Also

Before you consider Mercury Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mercury Systems wasn't on the list.

While Mercury Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.