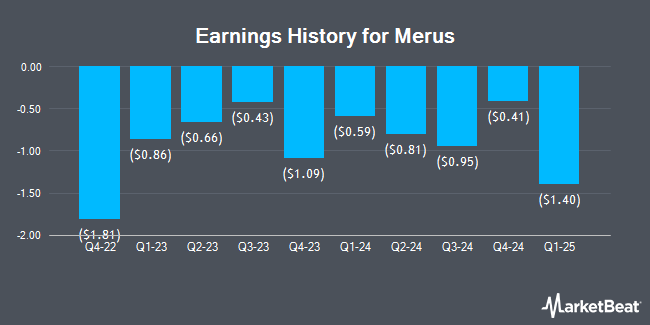

Merus (NASDAQ:MRUS - Get Free Report) is expected to issue its Q1 2025 quarterly earnings data before the market opens on Thursday, August 7th. Analysts expect the company to announce earnings of ($1.17) per share for the quarter.

Merus (NASDAQ:MRUS - Get Free Report) last posted its quarterly earnings data on Wednesday, May 14th. The biotechnology company reported ($1.40) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.17) by ($0.23). The firm had revenue of $26.49 million for the quarter, compared to analysts' expectations of $7.82 million. Merus had a negative return on equity of 35.99% and a negative net margin of 506.73%. On average, analysts expect Merus to post $-4 EPS for the current fiscal year and $-4 EPS for the next fiscal year.

Merus Price Performance

Shares of MRUS stock traded down $0.68 on Friday, hitting $65.56. The stock had a trading volume of 664,677 shares, compared to its average volume of 679,176. The business has a 50 day moving average of $56.89 and a 200 day moving average of $47.82. Merus has a 12-month low of $33.19 and a 12-month high of $67.59. The stock has a market cap of $4.54 billion, a price-to-earnings ratio of -16.07 and a beta of 1.09.

Analysts Set New Price Targets

MRUS has been the topic of a number of recent analyst reports. Wall Street Zen lowered shares of Merus from a "hold" rating to a "sell" rating in a research report on Sunday, July 20th. Wells Fargo & Company cut their price target on shares of Merus from $91.00 to $89.00 and set an "overweight" rating on the stock in a report on Thursday, May 8th. BMO Capital Markets set a $110.00 price target on shares of Merus and gave the company an "outperform" rating in a research report on Friday, May 23rd. Needham & Company LLC restated a "buy" rating and set a $75.00 price target on shares of Merus in a research report on Monday, May 19th. Finally, William Blair restated an "outperform" rating on shares of Merus in a research report on Monday, April 28th. One analyst has rated the stock with a sell rating and eleven have assigned a buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $86.40.

View Our Latest Report on MRUS

Insider Activity

In related news, COO Peter B. Silverman sold 25,000 shares of the firm's stock in a transaction that occurred on Thursday, July 17th. The shares were sold at an average price of $60.00, for a total value of $1,500,000.00. The sale was disclosed in a filing with the SEC, which is available through this link. Insiders have sold 82,500 shares of company stock valued at $4,586,340 over the last quarter. Corporate insiders own 4.57% of the company's stock.

Institutional Inflows and Outflows

A hedge fund recently raised its stake in Merus stock. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its holdings in shares of Merus N.V. (NASDAQ:MRUS - Free Report) by 14.0% during the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 112,522 shares of the biotechnology company's stock after acquiring an additional 13,778 shares during the quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC owned 0.16% of Merus worth $4,736,000 at the end of the most recent quarter. Institutional investors own 96.14% of the company's stock.

About Merus

(

Get Free Report)

Merus N.V., a clinical-stage immuno-oncology company, engages in the development of antibody therapeutics in the Netherlands. Its bispecific antibody candidate pipeline includes Zenocutuzumab (MCLA-128), which is in a phase 2 clinical trials for the treatment of patients with metastatic breast cancer and castration-resistant prostate cancer, as well as in Phase 1/2 clinical trials for the treatment of solid tumors that harbor Neuregulin 1.

Recommended Stories

Before you consider Merus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merus wasn't on the list.

While Merus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.