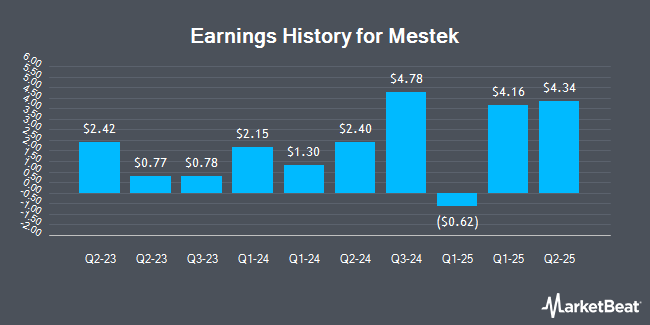

Mestek (OTCMKTS:MCCK - Get Free Report) released its quarterly earnings data on Monday. The company reported $4.34 earnings per share (EPS) for the quarter, Zacks reports. The business had revenue of $97.47 million during the quarter.

Mestek Trading Down 2.0%

OTCMKTS:MCCK traded down $1.00 on Friday, hitting $48.00. The company's stock had a trading volume of 1,099 shares, compared to its average volume of 876. The stock has a fifty day moving average of $43.48 and a two-hundred day moving average of $37.21. The firm has a market capitalization of $362.11 million, a P/E ratio of 3.79 and a beta of 0.49. Mestek has a one year low of $28.50 and a one year high of $52.00.

About Mestek

(

Get Free Report)

Mestek, Inc, together with its subsidiaries, manufactures and sells heating, ventilating, and air conditioning products and equipment; and metal forming equipment in the United States and internationally. The company offers equipment for heating, ventilation, and air conditioning primarily under the Lockformer, lowaPrecision, Engel, and Lion brands; roll forming and flexible fabrication equipment; metal stamping products, including uncoilers, straighteners, press feeds, and dies; and coil metal processing products, including cut-to-length, multi-blanking, and coil slitting and precision corrective levelers.

See Also

Before you consider Mestek, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mestek wasn't on the list.

While Mestek currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.