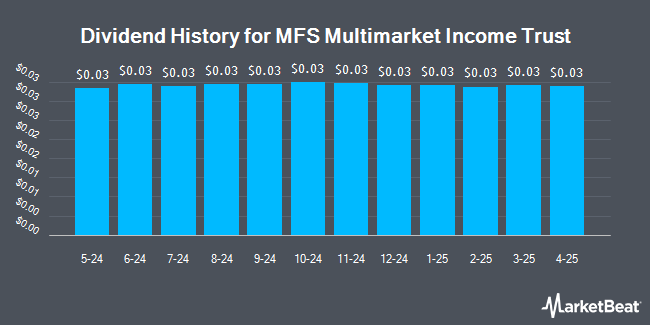

MFS Multimarket Income Trust (NYSE:MMT - Get Free Report) announced a monthly dividend on Monday, August 4th, Wall Street Journal reports. Investors of record on Tuesday, August 19th will be given a dividend of 0.0335 per share by the closed-end fund on Friday, August 29th. This represents a c) annualized dividend and a dividend yield of 8.6%. The ex-dividend date of this dividend is Tuesday, August 19th. This is a 0.5% increase from MFS Multimarket Income Trust's previous monthly dividend of $0.03.

MFS Multimarket Income Trust Price Performance

Shares of MMT stock traded down $0.03 on Friday, hitting $4.69. The stock had a trading volume of 17,088 shares, compared to its average volume of 91,969. MFS Multimarket Income Trust has a 1 year low of $4.31 and a 1 year high of $4.90. The company's 50 day moving average price is $4.65 and its 200-day moving average price is $4.62.

MFS Multimarket Income Trust Company Profile

(

Get Free Report)

MFS Multimarket Income Trust is a closed ended fixed income mutual fund launched and managed by MFS Investment Management, Inc The fund invests in the fixed income markets across the globe with greater emphasis on United States. It seeks to invest in fixed income securities issued by U.S. Government, foreign government, mortgage backed, and other asset-backed securities of U.S.

See Also

Before you consider MFS Multimarket Income Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MFS Multimarket Income Trust wasn't on the list.

While MFS Multimarket Income Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.