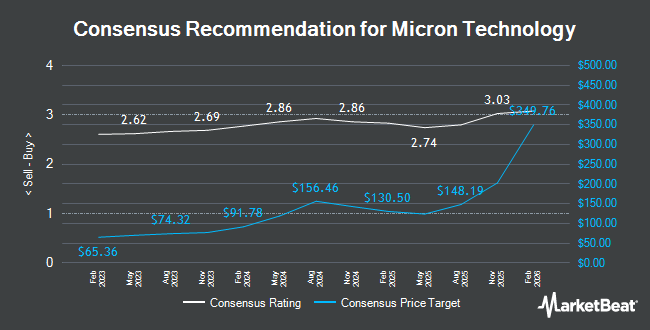

Micron Technology (NASDAQ:MU - Get Free Report) was downgraded by research analysts at Wall Street Zen from a "strong-buy" rating to a "buy" rating in a report issued on Saturday.

MU has been the topic of a number of other research reports. Barclays increased their price objective on Micron Technology from $140.00 to $175.00 and gave the company an "overweight" rating in a report on Friday, September 19th. TD Cowen increased their price objective on Micron Technology from $150.00 to $180.00 and gave the company a "buy" rating in a report on Friday, September 19th. Needham & Company LLC increased their price objective on Micron Technology from $150.00 to $200.00 and gave the company a "buy" rating in a report on Wednesday, September 24th. Arete Research upgraded Micron Technology to a "strong-buy" rating in a report on Friday, July 18th. Finally, Stifel Nicolaus upped their target price on Micron Technology from $173.00 to $195.00 and gave the company a "buy" rating in a research report on Monday, September 22nd. Four analysts have rated the stock with a Strong Buy rating, twenty-two have given a Buy rating and five have assigned a Hold rating to the company. Based on data from MarketBeat.com, Micron Technology presently has an average rating of "Moderate Buy" and an average price target of $184.77.

Check Out Our Latest Stock Analysis on Micron Technology

Micron Technology Price Performance

Shares of NASDAQ MU opened at $187.83 on Friday. The stock's 50-day moving average is $134.89 and its two-hundred day moving average is $110.70. The company has a debt-to-equity ratio of 0.26, a current ratio of 2.52 and a quick ratio of 1.79. Micron Technology has a 1-year low of $61.54 and a 1-year high of $191.85. The company has a market cap of $210.20 billion, a price-to-earnings ratio of 24.75, a price-to-earnings-growth ratio of 0.40 and a beta of 1.56.

Insiders Place Their Bets

In other news, Director Mary Pat Mccarthy sold 2,404 shares of the firm's stock in a transaction on Tuesday, September 2nd. The stock was sold at an average price of $115.67, for a total transaction of $278,070.68. Following the sale, the director owned 20,146 shares in the company, valued at $2,330,287.82. This trade represents a 10.66% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO Sanjay Mehrotra sold 15,000 shares of the firm's stock in a transaction on Wednesday, October 1st. The stock was sold at an average price of $180.86, for a total value of $2,712,900.00. Following the sale, the chief executive officer owned 310,148 shares in the company, valued at $56,093,367.28. This trade represents a 4.61% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 109,456 shares of company stock worth $15,698,445 over the last ninety days. Company insiders own 0.30% of the company's stock.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the company. 180 Wealth Advisors LLC boosted its holdings in Micron Technology by 1.9% in the second quarter. 180 Wealth Advisors LLC now owns 5,235 shares of the semiconductor manufacturer's stock valued at $645,000 after acquiring an additional 99 shares during the last quarter. SilverOak Wealth Management LLC boosted its holdings in Micron Technology by 3.5% in the second quarter. SilverOak Wealth Management LLC now owns 2,955 shares of the semiconductor manufacturer's stock valued at $364,000 after acquiring an additional 100 shares during the last quarter. Beta Wealth Group Inc. boosted its holdings in Micron Technology by 1.5% in the second quarter. Beta Wealth Group Inc. now owns 6,805 shares of the semiconductor manufacturer's stock valued at $839,000 after acquiring an additional 102 shares during the last quarter. HMS Capital Management LLC boosted its holdings in Micron Technology by 0.6% in the second quarter. HMS Capital Management LLC now owns 19,271 shares of the semiconductor manufacturer's stock valued at $2,375,000 after acquiring an additional 107 shares during the last quarter. Finally, D.B. Root & Company LLC lifted its stake in shares of Micron Technology by 3.7% during the first quarter. D.B. Root & Company LLC now owns 3,018 shares of the semiconductor manufacturer's stock worth $262,000 after purchasing an additional 108 shares in the last quarter. Institutional investors and hedge funds own 80.84% of the company's stock.

Micron Technology Company Profile

(

Get Free Report)

Micron Technology, Inc designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. It provides memory and storage technologies comprising dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; non-volatile and re-writeable semiconductor storage devices; and non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Micron Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Micron Technology wasn't on the list.

While Micron Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.