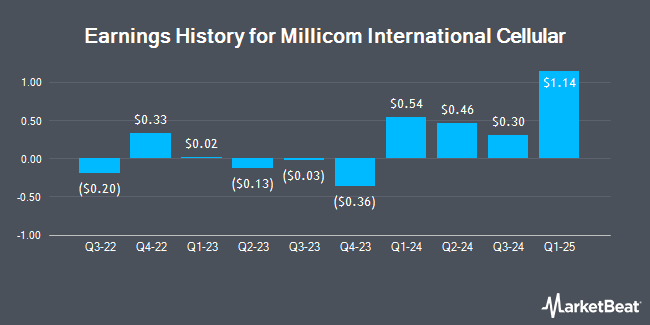

Millicom International Cellular (NASDAQ:TIGO - Get Free Report) issued its quarterly earnings results on Thursday, August 7th. The technology company reported $0.51 earnings per share for the quarter, missing the consensus estimate of $0.54 by ($0.03), Zacks reports. The business had revenue of $1.37 billion during the quarter, compared to analyst estimates of $1.40 billion. Millicom International Cellular had a return on equity of 10.32% and a net margin of 16.97%.

Millicom International Cellular Stock Performance

Shares of NASDAQ:TIGO traded up $0.08 during trading on Thursday, hitting $44.09. The stock had a trading volume of 914,015 shares, compared to its average volume of 1,243,771. Millicom International Cellular has a 12-month low of $23.61 and a 12-month high of $44.56. The stock has a market capitalization of $7.59 billion, a price-to-earnings ratio of 7.78 and a beta of 1.04. The company has a quick ratio of 0.74, a current ratio of 0.89 and a debt-to-equity ratio of 1.59. The stock has a 50-day simple moving average of $38.93 and a two-hundred day simple moving average of $33.59.

Millicom International Cellular Cuts Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Tuesday, July 8th were paid a $0.75 dividend. This represents a $3.00 annualized dividend and a dividend yield of 6.8%. The ex-dividend date was Tuesday, July 8th. Millicom International Cellular's dividend payout ratio (DPR) is presently 52.91%.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the stock. EverSource Wealth Advisors LLC raised its position in Millicom International Cellular by 55.1% during the second quarter. EverSource Wealth Advisors LLC now owns 1,413 shares of the technology company's stock valued at $53,000 after acquiring an additional 502 shares in the last quarter. WINTON GROUP Ltd purchased a new position in Millicom International Cellular during the second quarter valued at approximately $263,000. AQR Capital Management LLC grew its holdings in Millicom International Cellular by 5.0% in the first quarter. AQR Capital Management LLC now owns 9,587 shares of the technology company's stock valued at $290,000 after purchasing an additional 453 shares during the period. Acadian Asset Management LLC acquired a new stake in Millicom International Cellular in the first quarter valued at approximately $819,000. Finally, Jane Street Group LLC acquired a new stake in Millicom International Cellular in the first quarter valued at approximately $928,000.

Analysts Set New Price Targets

TIGO has been the subject of several recent analyst reports. Scotiabank downgraded Millicom International Cellular from a "sector outperform" rating to a "sector perform" rating and set a $37.00 price target for the company. in a report on Tuesday, June 17th. JPMorgan Chase & Co. raised their price objective on Millicom International Cellular from $50.00 to $55.00 and gave the stock an "overweight" rating in a research note on Thursday. Wall Street Zen upgraded Millicom International Cellular from a "buy" rating to a "strong-buy" rating in a research note on Saturday, August 9th. Finally, UBS Group raised their price objective on Millicom International Cellular from $31.50 to $39.50 and gave the stock a "buy" rating in a research note on Friday, May 16th. Three research analysts have rated the stock with a hold rating, three have issued a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $38.92.

Get Our Latest Stock Report on TIGO

About Millicom International Cellular

(

Get Free Report)

Millicom International Cellular SA provides cable and mobile services in Latin America. It offers mobile services, including mobile data and voice, and short message services; and mobile financial services, such as payments, money transfers, international remittances, savings, real-time loans, and micro-insurance.

Read More

Before you consider Millicom International Cellular, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Millicom International Cellular wasn't on the list.

While Millicom International Cellular currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.