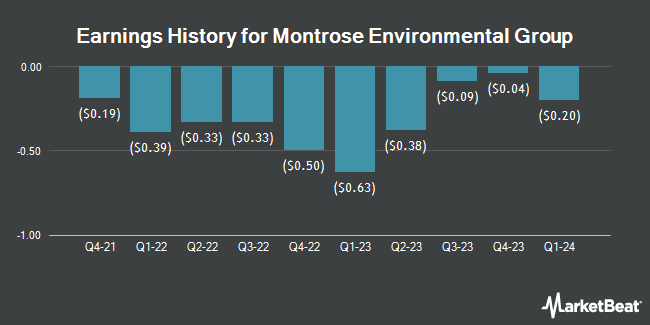

Montrose Environmental Group (NYSE:MEG - Get Free Report) will likely be issuing its Q2 2025 quarterly earnings data after the market closes on Wednesday, August 6th. Analysts expect the company to announce earnings of $0.24 per share and revenue of $188.26 million for the quarter.

Montrose Environmental Group Stock Performance

Shares of MEG stock traded down $2.19 on Friday, hitting $20.50. The company's stock had a trading volume of 318,505 shares, compared to its average volume of 271,138. The company has a debt-to-equity ratio of 0.58, a quick ratio of 2.05 and a current ratio of 2.05. The stock's 50 day moving average is $22.04 and its 200-day moving average is $18.98. Montrose Environmental Group has a fifty-two week low of $10.51 and a fifty-two week high of $34.56. The company has a market capitalization of $710.53 million, a PE ratio of -8.84, a PEG ratio of 7.97 and a beta of 1.90.

Montrose Environmental Group declared that its board has approved a share repurchase program on Wednesday, May 7th that authorizes the company to repurchase $40.00 million in shares. This repurchase authorization authorizes the company to reacquire up to 7.7% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's management believes its shares are undervalued.

Wall Street Analyst Weigh In

Separately, Needham & Company LLC increased their target price on shares of Montrose Environmental Group from $28.00 to $30.00 and gave the stock a "buy" rating in a report on Friday, May 9th. Two investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, Montrose Environmental Group presently has an average rating of "Moderate Buy" and a consensus price target of $31.80.

Get Our Latest Analysis on Montrose Environmental Group

Institutional Inflows and Outflows

An institutional investor recently raised its position in Montrose Environmental Group stock. Goldman Sachs Group Inc. lifted its stake in shares of Montrose Environmental Group, Inc. (NYSE:MEG - Free Report) by 39.6% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 326,969 shares of the company's stock after buying an additional 92,671 shares during the quarter. Goldman Sachs Group Inc. owned about 0.94% of Montrose Environmental Group worth $4,663,000 as of its most recent filing with the Securities & Exchange Commission. 87.87% of the stock is owned by institutional investors and hedge funds.

Montrose Environmental Group Company Profile

(

Get Free Report)

Montrose Environmental Group, Inc operates as an environmental services company in the United States, Canada, and internationally. The company operates in three segments: Assessment, Permitting and Response; Measurement and Analysis; and Remediation and Reuse. The Assessment, Permitting and Response segment provides scientific advisory and consulting services to support environmental assessments; environmental emergency response and recovery; toxicology consulting and environmental audits and permits for current operations; facility upgrades; new projects; decommissioning projects; and development projects.

Featured Articles

Before you consider Montrose Environmental Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Montrose Environmental Group wasn't on the list.

While Montrose Environmental Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.