Moore Capital Management LP bought a new position in shares of MRC Global Inc. (NYSE:MRC - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 249,673 shares of the oil and gas company's stock, valued at approximately $3,191,000. Moore Capital Management LP owned approximately 0.29% of MRC Global at the end of the most recent quarter.

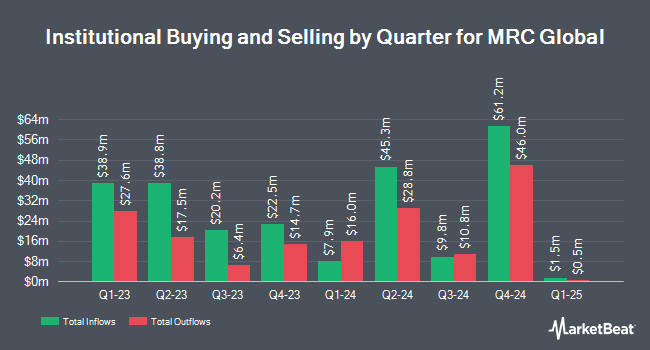

Other institutional investors and hedge funds have also recently modified their holdings of the company. Huntington National Bank acquired a new position in shares of MRC Global during the fourth quarter worth $34,000. Sterling Capital Management LLC grew its stake in shares of MRC Global by 821.2% during the fourth quarter. Sterling Capital Management LLC now owns 2,699 shares of the oil and gas company's stock worth $34,000 after purchasing an additional 2,406 shares in the last quarter. Meeder Asset Management Inc. acquired a new position in shares of MRC Global during the fourth quarter worth $56,000. Longboard Asset Management LP acquired a new position in shares of MRC Global during the fourth quarter worth $134,000. Finally, Ieq Capital LLC acquired a new position in shares of MRC Global during the fourth quarter worth $187,000. Institutional investors and hedge funds own 94.97% of the company's stock.

MRC Global Stock Performance

NYSE MRC traded down $0.04 during trading hours on Friday, hitting $12.81. The company had a trading volume of 675,515 shares, compared to its average volume of 643,218. The company has a debt-to-equity ratio of 0.15, a quick ratio of 1.11 and a current ratio of 1.99. MRC Global Inc. has a 1-year low of $9.23 and a 1-year high of $15.41. The company has a market cap of $1.10 billion, a PE ratio of 14.72 and a beta of 1.63. The business has a 50 day moving average of $11.43 and a 200-day moving average of $12.66.

MRC Global (NYSE:MRC - Get Free Report) last announced its earnings results on Tuesday, May 6th. The oil and gas company reported $0.14 earnings per share for the quarter, topping the consensus estimate of $0.08 by $0.06. MRC Global had a net margin of 3.09% and a return on equity of 19.58%. The business had revenue of $712.00 million during the quarter, compared to the consensus estimate of $710.00 million. During the same quarter in the prior year, the firm earned $0.20 earnings per share. The business's quarterly revenue was down 11.7% compared to the same quarter last year. As a group, equities research analysts expect that MRC Global Inc. will post 0.86 EPS for the current year.

Analyst Ratings Changes

MRC has been the subject of a number of analyst reports. Loop Capital lowered their target price on shares of MRC Global from $18.00 to $17.00 and set a "buy" rating for the company in a research note on Tuesday, March 18th. Susquehanna decreased their price objective on shares of MRC Global from $15.00 to $13.00 and set a "positive" rating for the company in a research note on Monday, April 14th. StockNews.com downgraded shares of MRC Global from a "buy" rating to a "hold" rating in a research note on Thursday. Finally, Stifel Nicolaus upped their price objective on shares of MRC Global from $14.00 to $15.00 and gave the company a "buy" rating in a research note on Thursday, May 8th.

Check Out Our Latest Analysis on MRC Global

About MRC Global

(

Free Report)

MRC Global Inc, through its subsidiaries, distributes pipes, valves, fittings, and other infrastructure products and services in the United States, Canada, and internationally. It offers ball, butterfly, gate, globe, check, diaphragm, needle, and plug valves; other products, such as lined corrosion resistant piping systems, control valves, valve automation, and top work components; and valve modification services, including valve control extensions, welding, hydrotesting, painting, coating, x-raying, and actuation assembly.

Read More

Before you consider MRC Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MRC Global wasn't on the list.

While MRC Global currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.