FirstEnergy (NYSE:FE - Free Report) had its price objective cut by Morgan Stanley from $48.00 to $47.00 in a research note issued to investors on Wednesday morning,Benzinga reports. They currently have an overweight rating on the utilities provider's stock.

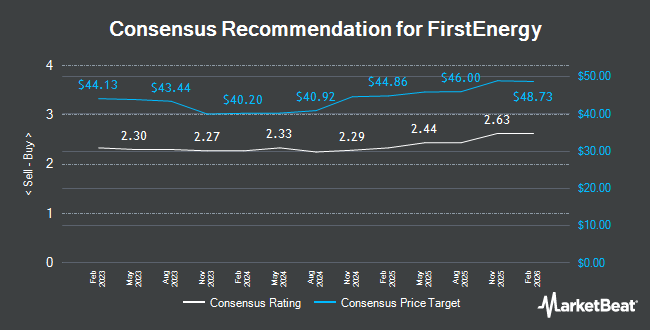

Other research analysts have also issued reports about the company. Evercore ISI increased their price objective on FirstEnergy from $41.00 to $47.00 and gave the stock an "outperform" rating in a research report on Monday, April 28th. Mizuho set a $43.00 price objective on FirstEnergy in a research report on Monday, April 28th. Wells Fargo & Company boosted their target price on FirstEnergy from $41.00 to $44.00 and gave the company an "equal weight" rating in a research report on Friday, April 25th. Guggenheim boosted their target price on FirstEnergy from $45.00 to $47.00 and gave the company a "buy" rating in a research report on Monday, April 7th. Finally, UBS Group boosted their target price on FirstEnergy from $41.00 to $43.00 and gave the company a "neutral" rating in a research report on Friday, March 21st. Eight investment analysts have rated the stock with a hold rating and six have given a buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $45.92.

Check Out Our Latest Report on FE

FirstEnergy Price Performance

Shares of FirstEnergy stock traded up $0.16 on Wednesday, hitting $39.90. 5,596,290 shares of the company were exchanged, compared to its average volume of 3,914,620. The stock has a market capitalization of $23.03 billion, a price-to-earnings ratio of 21.22, a price-to-earnings-growth ratio of 2.44 and a beta of 0.40. The company has a 50-day moving average price of $41.64 and a 200 day moving average price of $40.48. FirstEnergy has a 1-year low of $37.58 and a 1-year high of $44.97. The company has a quick ratio of 0.34, a current ratio of 0.42 and a debt-to-equity ratio of 1.53.

FirstEnergy (NYSE:FE - Get Free Report) last issued its earnings results on Wednesday, April 23rd. The utilities provider reported $0.67 earnings per share for the quarter, topping the consensus estimate of $0.60 by $0.07. The business had revenue of $3.80 billion for the quarter, compared to analysts' expectations of $3.68 billion. FirstEnergy had a return on equity of 11.49% and a net margin of 7.78%. The business's revenue for the quarter was up 14.5% compared to the same quarter last year. During the same period in the previous year, the firm posted $0.55 EPS. As a group, sell-side analysts predict that FirstEnergy will post 2.66 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, CAO Jason Lisowski sold 12,000 shares of the business's stock in a transaction on Thursday, May 22nd. The shares were sold at an average price of $41.97, for a total transaction of $503,640.00. Following the completion of the transaction, the chief accounting officer now owns 183 shares in the company, valued at approximately $7,680.51. The trade was a 98.50% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Insiders own 0.17% of the company's stock.

Hedge Funds Weigh In On FirstEnergy

Several large investors have recently bought and sold shares of FE. Brighton Jones LLC acquired a new position in FirstEnergy in the fourth quarter valued at $256,000. Empowered Funds LLC boosted its stake in FirstEnergy by 11.3% in the fourth quarter. Empowered Funds LLC now owns 10,481 shares of the utilities provider's stock valued at $417,000 after acquiring an additional 1,060 shares in the last quarter. Principal Securities Inc. boosted its stake in FirstEnergy by 21.0% in the fourth quarter. Principal Securities Inc. now owns 2,876 shares of the utilities provider's stock valued at $114,000 after acquiring an additional 500 shares in the last quarter. Allworth Financial LP boosted its stake in FirstEnergy by 292.7% in the fourth quarter. Allworth Financial LP now owns 4,783 shares of the utilities provider's stock valued at $189,000 after acquiring an additional 3,565 shares in the last quarter. Finally, Valmark Advisers Inc. acquired a new position in FirstEnergy in the fourth quarter valued at $270,000. Institutional investors and hedge funds own 89.41% of the company's stock.

FirstEnergy Company Profile

(

Get Free Report)

FirstEnergy Corp., through its subsidiaries, generates, transmits, and distributes electricity in the United States. It operates through Regulated Distribution and Regulated Transmission segments. The company owns and operates coal-fired, nuclear, hydroelectric, wind, and solar power generating facilities.

See Also

Before you consider FirstEnergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstEnergy wasn't on the list.

While FirstEnergy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.