Comcast (NASDAQ:CMCSA - Get Free Report) received a $40.00 price objective from investment analysts at Morgan Stanley in a research note issued on Wednesday, MarketBeat reports. The firm presently has an "equal weight" rating on the cable giant's stock. Morgan Stanley's price target points to a potential upside of 15.72% from the stock's previous close.

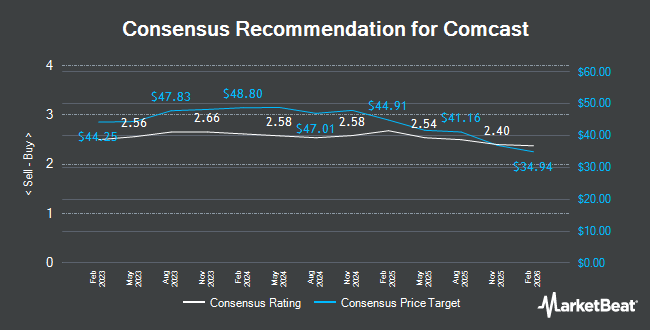

A number of other equities research analysts have also recently weighed in on the company. Evercore ISI lowered their price target on Comcast from $44.00 to $40.00 and set an "outperform" rating on the stock in a report on Friday, April 25th. Rosenblatt Securities restated a "neutral" rating and issued a $36.00 price target on shares of Comcast in a report on Monday, April 28th. Rothschild & Co Redburn lowered their price target on Comcast from $44.00 to $35.00 in a report on Friday, June 20th. JPMorgan Chase & Co. lowered their price target on Comcast from $39.00 to $37.00 and set a "neutral" rating on the stock in a report on Friday, April 25th. Finally, Barclays lowered their price target on Comcast from $37.00 to $35.00 and set an "equal weight" rating on the stock in a report on Monday, April 28th. Three research analysts have rated the stock with a sell rating, eleven have given a hold rating, twelve have given a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $41.10.

Get Our Latest Analysis on CMCSA

Comcast Stock Performance

NASDAQ CMCSA traded down $0.14 on Wednesday, hitting $34.57. 4,979,114 shares of the company's stock were exchanged, compared to its average volume of 21,860,550. The company has a debt-to-equity ratio of 1.06, a current ratio of 0.65 and a quick ratio of 0.65. The firm's 50-day moving average price is $35.00 and its two-hundred day moving average price is $35.35. Comcast has a fifty-two week low of $31.44 and a fifty-two week high of $45.31. The firm has a market cap of $129.06 billion, a price-to-earnings ratio of 8.49, a P/E/G ratio of 1.66 and a beta of 0.95.

Comcast (NASDAQ:CMCSA - Get Free Report) last released its earnings results on Thursday, April 24th. The cable giant reported $1.09 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.01 by $0.08. Comcast had a return on equity of 19.70% and a net margin of 12.72%. The company had revenue of $29.89 billion for the quarter, compared to analysts' expectations of $29.82 billion. During the same quarter in the previous year, the firm posted $1.04 EPS. The firm's quarterly revenue was down .6% on a year-over-year basis. On average, research analysts expect that Comcast will post 4.33 EPS for the current year.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in the company. Foster Group Inc. grew its position in Comcast by 4.0% in the second quarter. Foster Group Inc. now owns 7,418 shares of the cable giant's stock valued at $265,000 after purchasing an additional 282 shares in the last quarter. Sculati Wealth Management LLC lifted its position in Comcast by 0.9% during the 4th quarter. Sculati Wealth Management LLC now owns 30,792 shares of the cable giant's stock worth $1,156,000 after buying an additional 285 shares in the last quarter. Beck Mack & Oliver LLC lifted its position in Comcast by 2.0% during the 4th quarter. Beck Mack & Oliver LLC now owns 15,539 shares of the cable giant's stock worth $583,000 after buying an additional 300 shares in the last quarter. Toth Financial Advisory Corp lifted its position in Comcast by 9.0% during the 1st quarter. Toth Financial Advisory Corp now owns 3,630 shares of the cable giant's stock worth $134,000 after buying an additional 300 shares in the last quarter. Finally, Clearstead Trust LLC lifted its position in Comcast by 5.2% during the 1st quarter. Clearstead Trust LLC now owns 6,142 shares of the cable giant's stock worth $227,000 after buying an additional 305 shares in the last quarter. 84.32% of the stock is owned by hedge funds and other institutional investors.

About Comcast

(

Get Free Report)

Comcast Corporation operates as a media and technology company worldwide. It operates through Residential Connectivity & Platforms, Business Services Connectivity, Media, Studios, and Theme Parks segments. The Residential Connectivity & Platforms segment provides residential broadband and wireless connectivity services, residential and business video services, sky-branded entertainment television networks, and advertising.

See Also

Before you consider Comcast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comcast wasn't on the list.

While Comcast currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.