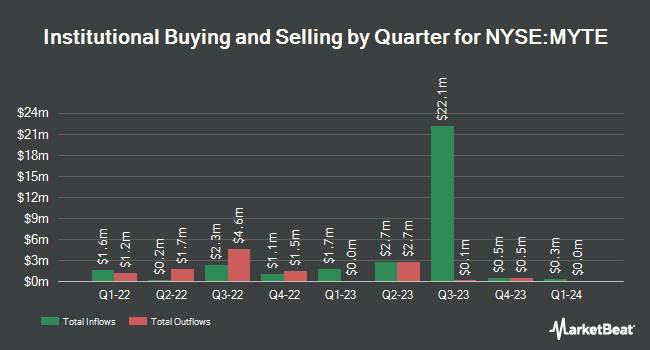

CastleKnight Management LP increased its holdings in shares of MYT Netherlands Parent B.V. (NYSE:MYTE - Free Report) by 286.8% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 652,141 shares of the company's stock after purchasing an additional 483,541 shares during the period. CastleKnight Management LP owned approximately 0.76% of MYT Netherlands Parent B.V. worth $4,630,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also bought and sold shares of the stock. Bank of America Corp DE boosted its position in MYT Netherlands Parent B.V. by 9,153.3% in the fourth quarter. Bank of America Corp DE now owns 4,164 shares of the company's stock worth $30,000 after purchasing an additional 4,119 shares during the last quarter. JPMorgan Chase & Co. bought a new position in shares of MYT Netherlands Parent B.V. during the 4th quarter worth $80,000. XTX Topco Ltd purchased a new stake in MYT Netherlands Parent B.V. in the 4th quarter worth about $96,000. BNP Paribas Financial Markets bought a new stake in MYT Netherlands Parent B.V. in the 4th quarter valued at about $106,000. Finally, Coronation Fund Managers Ltd. bought a new position in MYT Netherlands Parent B.V. in the 4th quarter worth about $124,000. 10.07% of the stock is owned by institutional investors.

MYT Netherlands Parent B.V. Stock Performance

MYTE traded down $0.12 during midday trading on Friday, hitting $7.74. 94,362 shares of the company traded hands, compared to its average volume of 198,895. The firm has a market capitalization of $663.31 million, a PE ratio of -18.00 and a beta of 1.08. The company has a quick ratio of 0.22, a current ratio of 1.78 and a debt-to-equity ratio of 0.09. MYT Netherlands Parent B.V. has a 52 week low of $3.22 and a 52 week high of $12.50. The company's 50-day moving average is $7.97 and its 200 day moving average is $8.04.

MYT Netherlands Parent B.V. (NYSE:MYTE - Get Free Report) last announced its quarterly earnings results on Tuesday, February 11th. The company reported $0.07 EPS for the quarter, topping the consensus estimate of ($0.03) by $0.10. MYT Netherlands Parent B.V. had a negative net margin of 3.98% and a negative return on equity of 5.88%. On average, research analysts expect that MYT Netherlands Parent B.V. will post -0.39 EPS for the current year.

Analyst Upgrades and Downgrades

Separately, TD Cowen upgraded shares of MYT Netherlands Parent B.V. from a "hold" rating to a "buy" rating and lifted their target price for the stock from $13.00 to $14.00 in a research report on Monday, March 3rd.

Check Out Our Latest Research Report on MYT Netherlands Parent B.V.

MYT Netherlands Parent B.V. Company Profile

(

Free Report)

MYT Netherlands Parent B.V., through its subsidiary, Mytheresa Group GmbH, operates a luxury e-commerce platform for fashion consumers in Germany, the United States, rest of Europe, and internationally. It offers womenswear, menswear, kids wear, and lifestyle products. The company sells clothes, bags, shoes, accessories, and fine jewelry through online and retail stores.

See Also

Before you consider MYT Netherlands Parent B.V., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MYT Netherlands Parent B.V. wasn't on the list.

While MYT Netherlands Parent B.V. currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.