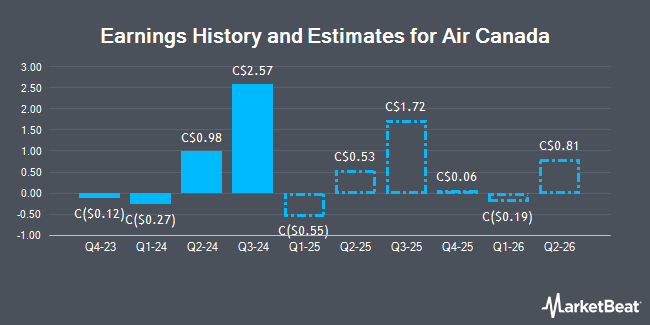

Air Canada (TSE:AC - Free Report) - Investment analysts at National Bank Financial dropped their FY2026 EPS estimates for Air Canada in a research note issued to investors on Thursday, September 25th. National Bank Financial analyst C. Doerksen now expects that the company will post earnings per share of $2.06 for the year, down from their previous estimate of $2.07. National Bank Financial currently has a "Hold" rating on the stock. The consensus estimate for Air Canada's current full-year earnings is $2.58 per share.

Several other analysts have also recently weighed in on the stock. Royal Bank Of Canada reduced their target price on shares of Air Canada from C$27.00 to C$25.00 and set an "outperform" rating on the stock in a report on Wednesday, August 20th. TD Securities reduced their target price on shares of Air Canada from C$25.00 to C$22.00 in a report on Friday. Stifel Nicolaus reduced their target price on shares of Air Canada from C$25.00 to C$24.00 and set a "buy" rating on the stock in a report on Friday. Raymond James Financial raised their target price on shares of Air Canada from C$24.00 to C$27.00 and gave the company a "moderate buy" rating in a report on Tuesday, July 22nd. Finally, Canaccord Genuity Group reduced their target price on shares of Air Canada from C$28.00 to C$25.00 and set a "buy" rating on the stock in a report on Thursday. One research analyst has rated the stock with a Strong Buy rating, nine have issued a Buy rating, three have issued a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat.com, Air Canada currently has a consensus rating of "Moderate Buy" and an average price target of C$24.91.

Read Our Latest Research Report on Air Canada

Air Canada Stock Down 1.1%

Shares of TSE:AC opened at C$17.78 on Monday. The firm's 50 day moving average price is C$19.46 and its 200 day moving average price is C$18.07. The stock has a market cap of C$5.27 billion, a price-to-earnings ratio of 4.50, a price-to-earnings-growth ratio of 0.02 and a beta of 1.73. Air Canada has a fifty-two week low of C$12.69 and a fifty-two week high of C$26.18. The company has a quick ratio of 1.06, a current ratio of 0.92 and a debt-to-equity ratio of 400.00.

Air Canada Company Profile

(

Get Free Report)

Air Canada is Canada's largest airline, generally serving nearly 50 million passengers each year together with its regional partners. Air Canada is a sixth freedom airline, similar to Gulf carriers, which flies many U.S. nationals on long-haul trips with a layover in Canada. In 2019, the company generated CAD 19 billion in total revenue.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Air Canada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Canada wasn't on the list.

While Air Canada currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.