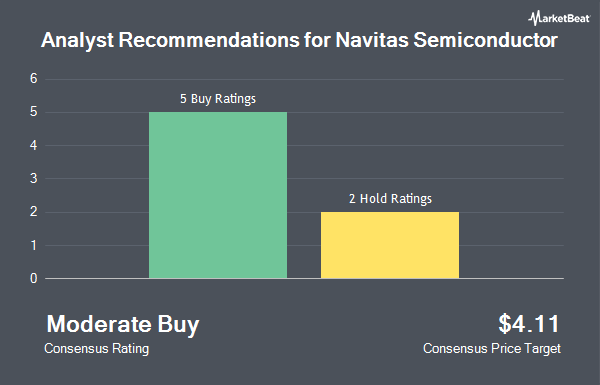

Shares of Navitas Semiconductor Corporation (NASDAQ:NVTS - Get Free Report) have earned an average recommendation of "Moderate Buy" from the six brokerages that are covering the firm, Marketbeat reports. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating and four have issued a buy rating on the company. The average twelve-month target price among brokerages that have covered the stock in the last year is $3.71.

A number of equities research analysts have commented on the company. Rosenblatt Securities raised their price objective on Navitas Semiconductor from $4.00 to $6.00 and gave the stock a "buy" rating in a research report on Thursday, May 22nd. Deutsche Bank Aktiengesellschaft lowered shares of Navitas Semiconductor from a "buy" rating to a "hold" rating and set a $3.50 price objective on the stock. in a research note on Tuesday, June 17th. Robert W. Baird decreased their target price on shares of Navitas Semiconductor from $5.00 to $4.00 and set an "outperform" rating for the company in a research note on Wednesday, March 5th. Morgan Stanley downgraded shares of Navitas Semiconductor from an "equal weight" rating to an "underweight" rating and dropped their price target for the stock from $2.10 to $1.50 in a research note on Monday, April 7th. Finally, Needham & Company LLC cut their price objective on Navitas Semiconductor from $4.00 to $3.00 and set a "buy" rating for the company in a report on Tuesday, May 6th.

Get Our Latest Stock Analysis on NVTS

Insider Buying and Selling

In other news, CEO Eugene Sheridan sold 2,155,783 shares of the firm's stock in a transaction that occurred on Friday, May 23rd. The shares were sold at an average price of $4.49, for a total transaction of $9,679,465.67. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CFO Todd Glickman sold 100,000 shares of the firm's stock in a transaction on Thursday, June 12th. The shares were sold at an average price of $8.00, for a total value of $800,000.00. Following the sale, the chief financial officer now directly owns 134,501 shares of the company's stock, valued at $1,076,008. This represents a 42.64% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 15,084,600 shares of company stock worth $99,761,157. 29.90% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Navitas Semiconductor

Institutional investors have recently modified their holdings of the stock. Edge Capital Group LLC bought a new position in Navitas Semiconductor in the 4th quarter worth approximately $987,000. Bank of New York Mellon Corp raised its position in shares of Navitas Semiconductor by 27.6% during the fourth quarter. Bank of New York Mellon Corp now owns 498,713 shares of the company's stock worth $1,780,000 after acquiring an additional 107,828 shares during the last quarter. SBI Securities Co. Ltd. bought a new position in Navitas Semiconductor in the fourth quarter valued at about $66,000. Charles Schwab Investment Management Inc. increased its position in Navitas Semiconductor by 7.9% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,046,750 shares of the company's stock worth $3,737,000 after purchasing an additional 76,870 shares during the period. Finally, Raymond James Financial Inc. bought a new stake in Navitas Semiconductor during the 4th quarter worth about $44,000. 46.14% of the stock is owned by institutional investors.

Navitas Semiconductor Stock Performance

NVTS stock opened at $7.35 on Wednesday. The stock's fifty day moving average is $4.11 and its two-hundred day moving average is $3.31. The stock has a market capitalization of $1.41 billion, a price-to-earnings ratio of -14.13 and a beta of 2.95. Navitas Semiconductor has a 1 year low of $1.52 and a 1 year high of $9.17.

Navitas Semiconductor (NASDAQ:NVTS - Get Free Report) last issued its quarterly earnings results on Monday, May 5th. The company reported ($0.06) earnings per share for the quarter, hitting analysts' consensus estimates of ($0.06). Navitas Semiconductor had a negative return on equity of 22.62% and a negative net margin of 131.83%. The firm had revenue of $14.02 million for the quarter, compared to analysts' expectations of $14.01 million. During the same quarter last year, the business posted ($0.06) EPS. Navitas Semiconductor's revenue was down 39.7% on a year-over-year basis. As a group, analysts predict that Navitas Semiconductor will post -0.51 EPS for the current fiscal year.

Navitas Semiconductor Company Profile

(

Get Free ReportNavitas Semiconductor Corporation designs, develops, and markets gallium nitride power integrated circuits, silicon carbide, associated high-speed silicon system controllers, and digital isolators used in power conversion and charging. The company's products are used in mobile, consumer, data center, solar, electric vehicle, industrial motor drive, smart grid, and transportation applications.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Navitas Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Navitas Semiconductor wasn't on the list.

While Navitas Semiconductor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.