Nebius Group (NASDAQ:NBIS - Get Free Report) will likely be issuing its results before the market opens on Tuesday, September 16th. Analysts expect the company to announce earnings of ($0.40) per share for the quarter.

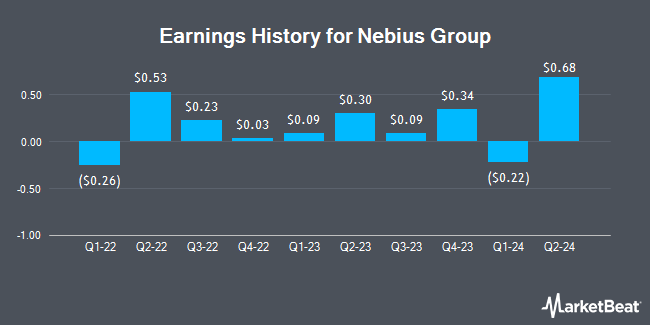

Nebius Group (NASDAQ:NBIS - Get Free Report) last issued its earnings results on Thursday, August 7th. The company reported ($0.38) earnings per share for the quarter, topping the consensus estimate of ($0.41) by $0.03. The firm had revenue of $105.10 million during the quarter, compared to analyst estimates of $95.60 million. On average, analysts expect Nebius Group to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Nebius Group Stock Down 1.7%

NBIS stock traded down $1.54 during mid-day trading on Friday, hitting $87.65. The stock had a trading volume of 14,744,740 shares, compared to its average volume of 13,451,531. The company has a current ratio of 14.70, a quick ratio of 14.70 and a debt-to-equity ratio of 0.31. Nebius Group has a 1-year low of $14.09 and a 1-year high of $100.51. The company has a fifty day moving average of $61.75 and a 200 day moving average of $42.90. The stock has a market capitalization of $20.66 billion, a price-to-earnings ratio of -153.67 and a beta of 3.55.

Institutional Investors Weigh In On Nebius Group

Several hedge funds have recently modified their holdings of the business. NewEdge Advisors LLC acquired a new stake in shares of Nebius Group in the first quarter worth $40,000. Daiwa Securities Group Inc. bought a new stake in Nebius Group in the 2nd quarter valued at $68,000. Geneos Wealth Management Inc. grew its position in Nebius Group by 168.4% in the 2nd quarter. Geneos Wealth Management Inc. now owns 2,410 shares of the company's stock worth $133,000 after purchasing an additional 1,512 shares during the last quarter. Keel Point LLC bought a new position in shares of Nebius Group during the 2nd quarter worth about $216,000. Finally, Orion Porfolio Solutions LLC acquired a new position in shares of Nebius Group during the second quarter valued at about $224,000. 21.90% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several equities analysts recently weighed in on NBIS shares. Wall Street Zen lowered shares of Nebius Group from a "hold" rating to a "sell" rating in a research report on Saturday, September 6th. Arete Research raised shares of Nebius Group to a "strong-buy" rating in a research report on Thursday, June 5th. DA Davidson reaffirmed a "buy" rating and set a $75.00 price objective on shares of Nebius Group in a research report on Tuesday. BWS Financial raised their price objective on shares of Nebius Group from $90.00 to $130.00 and gave the company a "buy" rating in a research report on Tuesday. Finally, The Goldman Sachs Group assumed coverage on Nebius Group in a research report on Monday, July 14th. They issued a "buy" rating and a $68.00 price target for the company. Two research analysts have rated the stock with a Strong Buy rating and five have issued a Buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average price target of $80.80.

Read Our Latest Research Report on Nebius Group

About Nebius Group

(

Get Free Report)

Nebius Group N.V., a technology company, builds intelligent products and services powered by machine learning and other technologies to help consumers and businesses navigate the online and offline world. The company's services include Nebius AI, an AI-centric cloud platform that offers infrastructure and computing capability for AI deployment and machine-learning oriented solutions; and Toloka AI that offers generative AI (GenAI) solutions at every stage of the GenAI lifecycle, such as data annotation and generation, model training and fine-tuning, and quality assessment of large language model for accuracy and reliability.

Read More

Before you consider Nebius Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nebius Group wasn't on the list.

While Nebius Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.