Nellore Capital Management LLC raised its stake in Coupang, Inc. (NYSE:CPNG - Free Report) by 6.2% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 2,971,981 shares of the company's stock after purchasing an additional 174,746 shares during the period. Coupang accounts for approximately 8.5% of Nellore Capital Management LLC's investment portfolio, making the stock its 5th largest holding. Nellore Capital Management LLC owned about 0.17% of Coupang worth $65,324,000 at the end of the most recent reporting period.

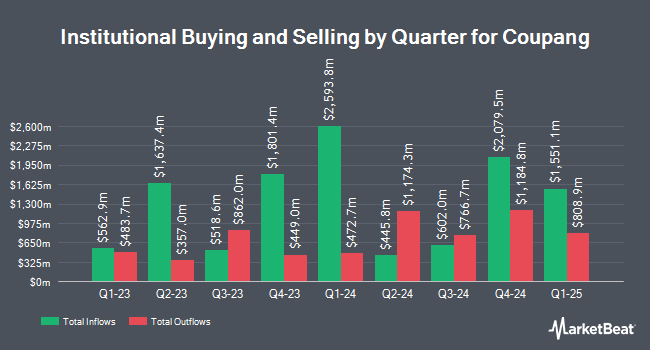

A number of other large investors have also modified their holdings of the business. Price T Rowe Associates Inc. MD grew its stake in shares of Coupang by 29.2% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 75,686,648 shares of the company's stock worth $1,663,594,000 after acquiring an additional 17,123,637 shares during the last quarter. FMR LLC grew its stake in shares of Coupang by 9.1% during the fourth quarter. FMR LLC now owns 29,619,581 shares of the company's stock worth $651,038,000 after acquiring an additional 2,465,973 shares during the last quarter. Durable Capital Partners LP grew its stake in shares of Coupang by 13.6% during the fourth quarter. Durable Capital Partners LP now owns 28,636,287 shares of the company's stock worth $629,426,000 after acquiring an additional 3,420,133 shares during the last quarter. Dragoneer Investment Group LLC lifted its holdings in shares of Coupang by 9.0% during the fourth quarter. Dragoneer Investment Group LLC now owns 20,541,277 shares of the company's stock worth $451,497,000 after purchasing an additional 1,690,826 shares during the period. Finally, Dodge & Cox lifted its holdings in shares of Coupang by 0.6% during the fourth quarter. Dodge & Cox now owns 20,229,320 shares of the company's stock worth $444,640,000 after purchasing an additional 123,900 shares during the period. Hedge funds and other institutional investors own 83.72% of the company's stock.

Insiders Place Their Bets

In other news, major shareholder Svf Investments (Uk) Ltd sold 30,000,000 shares of the stock in a transaction that occurred on Thursday, May 8th. The stock was sold at an average price of $25.75, for a total transaction of $772,500,000.00. Following the transaction, the insider now owns 319,542,259 shares in the company, valued at $8,228,213,169.25. This trade represents a 8.58% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Benjamin Sun sold 250,000 shares of the stock in a transaction that occurred on Monday, March 17th. The shares were sold at an average price of $23.43, for a total value of $5,857,500.00. Following the transaction, the director now owns 1,719,421 shares in the company, valued at $40,286,034.03. This trade represents a 12.69% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 30,334,697 shares of company stock worth $780,547,061. Corporate insiders own 13.60% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on CPNG. Mizuho raised Coupang to a "hold" rating in a report on Friday, April 18th. Deutsche Bank Aktiengesellschaft raised Coupang from a "hold" rating to a "buy" rating and set a $28.50 target price for the company in a report on Wednesday, February 26th. Finally, Barclays lifted their target price on Coupang from $35.00 to $36.00 and gave the stock an "overweight" rating in a report on Thursday, May 8th. One research analyst has rated the stock with a hold rating and six have given a buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $29.64.

View Our Latest Stock Analysis on Coupang

Coupang Stock Performance

Coupang stock traded up $0.38 during mid-day trading on Friday, hitting $27.22. The company had a trading volume of 19,843,278 shares, compared to its average volume of 7,858,259. The company has a current ratio of 1.13, a quick ratio of 0.86 and a debt-to-equity ratio of 0.28. Coupang, Inc. has a 12-month low of $18.16 and a 12-month high of $27.73. The company's fifty day moving average is $23.01 and its 200-day moving average is $23.47. The company has a market capitalization of $49.15 billion, a price-to-earnings ratio of 47.76, a P/E/G ratio of 52.20 and a beta of 1.08.

Coupang (NYSE:CPNG - Get Free Report) last released its quarterly earnings data on Tuesday, May 6th. The company reported $0.06 EPS for the quarter, missing the consensus estimate of $0.07 by ($0.01). Coupang had a return on equity of 11.52% and a net margin of 3.57%. The company had revenue of $7.91 billion during the quarter, compared to analysts' expectations of $8.02 billion. The business's revenue was up 11.2% on a year-over-year basis. Equities research analysts predict that Coupang, Inc. will post 0.17 EPS for the current year.

Coupang Company Profile

(

Free Report)

Coupang, Inc, together with its subsidiaries owns and operates retail business through its mobile applications and Internet websites primarily in South Korea. The company operates through Product Commerce and Developing Offerings segments. It sells various products and services in the categories of home goods and décor products, apparel, beauty products, fresh food and groceries, sporting goods, electronics, and everyday consumables, as well as travel, and restaurant order and delivery services.

Featured Stories

Before you consider Coupang, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coupang wasn't on the list.

While Coupang currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report