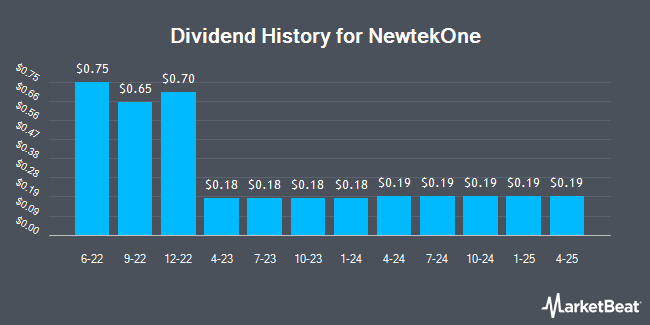

NewtekOne, Inc. (NASDAQ:NEWT - Get Free Report) announced a quarterly dividend on Tuesday, September 30th, RTT News reports. Stockholders of record on Tuesday, October 14th will be given a dividend of 0.19 per share by the business services provider on Friday, October 24th. This represents a c) dividend on an annualized basis and a dividend yield of 6.6%.

NewtekOne has a payout ratio of 33.3% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect NewtekOne to earn $2.12 per share next year, which means the company should continue to be able to cover its $0.76 annual dividend with an expected future payout ratio of 35.8%.

NewtekOne Stock Down 2.2%

NEWT stock opened at $11.59 on Tuesday. NewtekOne has a 52-week low of $9.12 and a 52-week high of $15.49. The company's 50 day simple moving average is $11.92 and its 200-day simple moving average is $11.33. The company has a debt-to-equity ratio of 5.95, a current ratio of 0.75 and a quick ratio of 0.75. The firm has a market capitalization of $305.05 million, a P/E ratio of 5.77 and a beta of 1.25.

NewtekOne (NASDAQ:NEWT - Get Free Report) last posted its earnings results on Monday, July 28th. The business services provider reported $0.52 EPS for the quarter, topping the consensus estimate of $0.50 by $0.02. The company had revenue of $70.20 million during the quarter, compared to the consensus estimate of $73.88 million. NewtekOne had a net margin of 14.65% and a return on equity of 19.16%. NewtekOne has set its FY 2025 guidance at 2.100-2.500 EPS. As a group, equities research analysts anticipate that NewtekOne will post 1.93 EPS for the current year.

Institutional Trading of NewtekOne

Institutional investors have recently made changes to their positions in the business. Trust Co. of Vermont bought a new stake in shares of NewtekOne in the second quarter worth $29,000. IFP Advisors Inc lifted its position in shares of NewtekOne by 74.9% in the second quarter. IFP Advisors Inc now owns 6,776 shares of the business services provider's stock worth $77,000 after purchasing an additional 2,901 shares in the last quarter. CWM LLC lifted its position in shares of NewtekOne by 728.7% in the second quarter. CWM LLC now owns 8,610 shares of the business services provider's stock worth $97,000 after purchasing an additional 7,571 shares in the last quarter. Quantbot Technologies LP bought a new stake in shares of NewtekOne in the second quarter worth $107,000. Finally, EP Wealth Advisors LLC bought a new stake in shares of NewtekOne in the first quarter worth $123,000. Institutional investors own 38.35% of the company's stock.

NewtekOne Company Profile

(

Get Free Report)

NewtekOne, Inc operates as the bank holding company for Newtek Bank, National Association that engages in the provision of various business and financial solutions under the Newtek brand name to the small- and medium-sized business market. The company accepts demand, savings, NOW, money market, and time deposits; and provides loans including SBA loans, commercial and industrial loans, and commercial real estate loans.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NewtekOne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NewtekOne wasn't on the list.

While NewtekOne currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.