NexPoint Residential Trust (NYSE:NXRT - Get Free Report)'s stock had its "sell (d)" rating restated by equities researchers at Weiss Ratings in a research note issued to investors on Saturday,Weiss Ratings reports.

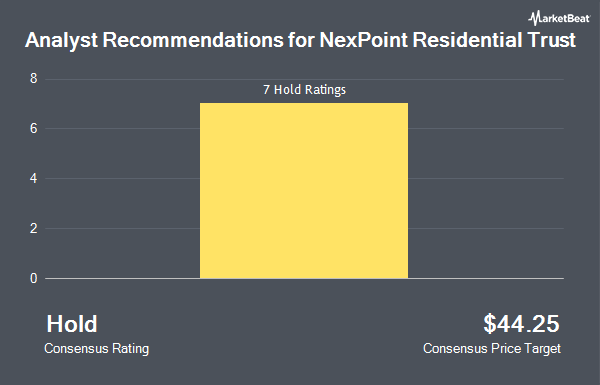

A number of other research firms have also recently weighed in on NXRT. Zacks Research upgraded shares of NexPoint Residential Trust from a "strong sell" rating to a "hold" rating in a report on Friday, October 10th. Truist Financial lowered their price target on shares of NexPoint Residential Trust from $38.00 to $34.00 and set a "hold" rating on the stock in a report on Tuesday, August 12th. Finally, Wall Street Zen upgraded shares of NexPoint Residential Trust from a "sell" rating to a "hold" rating in a report on Friday, October 3rd. Seven investment analysts have rated the stock with a Hold rating and one has issued a Sell rating to the company. According to data from MarketBeat, NexPoint Residential Trust currently has a consensus rating of "Reduce" and an average target price of $40.88.

Check Out Our Latest Stock Report on NXRT

NexPoint Residential Trust Trading Up 1.3%

NYSE NXRT opened at $31.50 on Friday. The company's 50-day moving average price is $32.45 and its 200-day moving average price is $33.71. The company has a current ratio of 1.89, a quick ratio of 1.89 and a debt-to-equity ratio of 4.22. The stock has a market cap of $798.84 million, a PE ratio of -16.07 and a beta of 1.08. NexPoint Residential Trust has a 12 month low of $29.98 and a 12 month high of $48.31.

NexPoint Residential Trust (NYSE:NXRT - Get Free Report) last posted its quarterly earnings results on Tuesday, July 29th. The financial services provider reported $0.80 EPS for the quarter, missing analysts' consensus estimates of $0.81 by ($0.01). NexPoint Residential Trust had a negative return on equity of 12.54% and a negative net margin of 19.55%.The company had revenue of $63.10 million during the quarter, compared to the consensus estimate of $63.32 million. NexPoint Residential Trust has set its FY 2025 guidance at 2.750-2.750 EPS. Equities research analysts forecast that NexPoint Residential Trust will post 2.86 earnings per share for the current year.

Insider Buying and Selling at NexPoint Residential Trust

In other news, Director Brian Mitts sold 5,000 shares of NexPoint Residential Trust stock in a transaction that occurred on Friday, August 15th. The shares were sold at an average price of $30.92, for a total transaction of $154,600.00. Following the completion of the transaction, the director directly owned 65,900 shares of the company's stock, valued at $2,037,628. The trade was a 7.05% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 15.36% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On NexPoint Residential Trust

Several institutional investors have recently made changes to their positions in NXRT. New Age Alpha Advisors LLC purchased a new stake in NexPoint Residential Trust in the 1st quarter worth $53,000. Ameritas Advisory Services LLC purchased a new stake in NexPoint Residential Trust in the 2nd quarter worth $47,000. Quantbot Technologies LP purchased a new stake in NexPoint Residential Trust in the 1st quarter worth $56,000. Vestcor Inc purchased a new stake in shares of NexPoint Residential Trust during the first quarter worth $102,000. Finally, Tower Research Capital LLC TRC grew its holdings in shares of NexPoint Residential Trust by 121.1% during the second quarter. Tower Research Capital LLC TRC now owns 2,656 shares of the financial services provider's stock worth $88,000 after buying an additional 1,455 shares in the last quarter. 76.61% of the stock is owned by hedge funds and other institutional investors.

NexPoint Residential Trust Company Profile

(

Get Free Report)

NexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange under the symbol "NXRT," primarily focused on acquiring, owning and operating well-located middle-income multifamily properties with "value-add" potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NexPoint Residential Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NexPoint Residential Trust wasn't on the list.

While NexPoint Residential Trust currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.