Nexstar Media Group (NASDAQ:NXST - Get Free Report)'s stock had its "outperform" rating restated by Barrington Research in a research note issued on Tuesday,Benzinga reports. They presently have a $225.00 price target on the stock. Barrington Research's price target would suggest a potential upside of 10.12% from the stock's previous close.

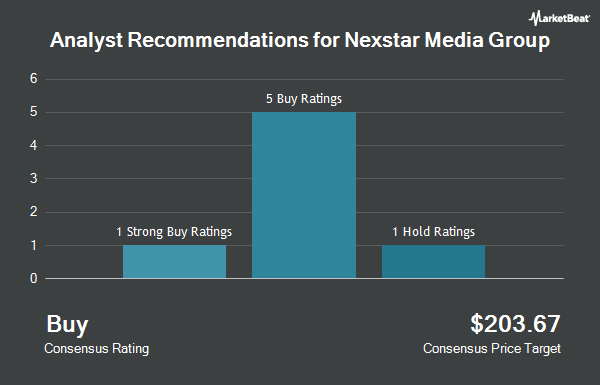

Several other analysts also recently weighed in on the stock. Zacks Research raised shares of Nexstar Media Group to a "hold" rating in a report on Friday, August 8th. Benchmark increased their target price on Nexstar Media Group from $220.00 to $225.00 and gave the stock a "buy" rating in a research report on Friday, August 8th. Finally, Wells Fargo & Company increased their price objective on shares of Nexstar Media Group from $206.00 to $250.00 and gave the stock an "overweight" rating in a research report on Friday, August 8th. Six equities research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $220.00.

Read Our Latest Stock Analysis on NXST

Nexstar Media Group Trading Down 1.0%

Nexstar Media Group stock traded down $2.0650 during mid-day trading on Tuesday, hitting $204.3150. The company's stock had a trading volume of 588,418 shares, compared to its average volume of 420,221. The company has a current ratio of 1.69, a quick ratio of 1.69 and a debt-to-equity ratio of 2.80. The stock's fifty day moving average is $182.86 and its two-hundred day moving average is $169.76. Nexstar Media Group has a 1 year low of $141.66 and a 1 year high of $223.36. The firm has a market capitalization of $6.19 billion, a PE ratio of 10.65, a price-to-earnings-growth ratio of 1.53 and a beta of 1.05.

Nexstar Media Group (NASDAQ:NXST - Get Free Report) last issued its quarterly earnings results on Thursday, August 7th. The company reported $3.06 earnings per share for the quarter, topping the consensus estimate of $2.95 by $0.11. The company had revenue of $1.23 billion for the quarter, compared to the consensus estimate of $1.21 billion. Nexstar Media Group had a return on equity of 28.40% and a net margin of 11.90%.Nexstar Media Group's revenue was down 3.2% on a year-over-year basis. During the same quarter in the prior year, the business earned $3.54 EPS. On average, analysts anticipate that Nexstar Media Group will post 21.62 EPS for the current year.

Insider Buying and Selling

In related news, EVP Rachel Morgan sold 329 shares of the stock in a transaction that occurred on Tuesday, June 17th. The stock was sold at an average price of $165.25, for a total transaction of $54,367.25. Following the sale, the executive vice president directly owned 2,122 shares in the company, valued at $350,660.50. This represents a 13.42% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Dana Zimmer sold 889 shares of Nexstar Media Group stock in a transaction that occurred on Tuesday, June 17th. The stock was sold at an average price of $165.25, for a total transaction of $146,907.25. Following the sale, the insider owned 6,201 shares of the company's stock, valued at approximately $1,024,715.25. This represents a 12.54% decrease in their position. The disclosure for this sale can be found here. Insiders sold 17,021 shares of company stock valued at $2,885,352 in the last ninety days. Company insiders own 6.70% of the company's stock.

Institutional Investors Weigh In On Nexstar Media Group

A number of hedge funds have recently made changes to their positions in the stock. State of Wyoming acquired a new position in Nexstar Media Group in the 2nd quarter worth about $54,000. Nomura Holdings Inc. raised its position in shares of Nexstar Media Group by 111.4% during the second quarter. Nomura Holdings Inc. now owns 1,186 shares of the company's stock worth $205,000 after purchasing an additional 11,586 shares during the period. Geneos Wealth Management Inc. raised its holdings in shares of Nexstar Media Group by 15.7% in the second quarter. Geneos Wealth Management Inc. now owns 589 shares of the company's stock valued at $102,000 after purchasing an additional 80 shares during the last quarter. Kestra Investment Management LLC boosted its position in Nexstar Media Group by 16.4% in the second quarter. Kestra Investment Management LLC now owns 3,729 shares of the company's stock worth $645,000 after purchasing an additional 525 shares during the last quarter. Finally, Corient Private Wealth LLC increased its stake in shares of Nexstar Media Group by 7.2% during the 2nd quarter. Corient Private Wealth LLC now owns 5,317 shares of the company's stock worth $921,000 after purchasing an additional 359 shares during the last quarter. 95.30% of the stock is currently owned by institutional investors and hedge funds.

About Nexstar Media Group

(

Get Free Report)

Nexstar Media Group, Inc operates as a diversified media company that produces and distributes engaging local and national news, sports and entertainment content across the television and digital platforms in the United States. It owns, operates, programs, or provides sales and other services to various markets; and offers television programming services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nexstar Media Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nexstar Media Group wasn't on the list.

While Nexstar Media Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.