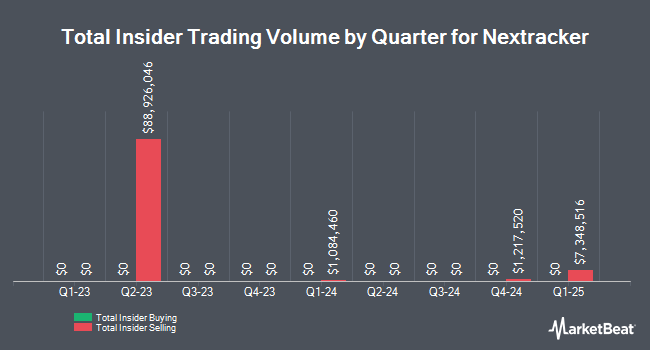

Nextracker Inc. (NASDAQ:NXT - Get Free Report) insider Bruce Ledesma sold 6,980 shares of the business's stock in a transaction dated Friday, August 8th. The shares were sold at an average price of $56.24, for a total value of $392,555.20. Following the completion of the transaction, the insider directly owned 195,790 shares of the company's stock, valued at approximately $11,011,229.60. The trade was a 3.44% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink.

Bruce Ledesma also recently made the following trade(s):

- On Thursday, May 29th, Bruce Ledesma sold 83,561 shares of Nextracker stock. The shares were sold at an average price of $55.71, for a total value of $4,655,183.31.

- On Friday, May 23rd, Bruce Ledesma sold 3,017 shares of Nextracker stock. The shares were sold at an average price of $55.95, for a total value of $168,801.15.

- On Friday, May 16th, Bruce Ledesma sold 27,453 shares of Nextracker stock. The shares were sold at an average price of $60.17, for a total value of $1,651,847.01.

Nextracker Trading Down 4.3%

NASDAQ:NXT traded down $2.41 during trading hours on Monday, hitting $53.80. 1,730,318 shares of the company were exchanged, compared to its average volume of 2,308,027. The stock has a market capitalization of $7.96 billion, a price-to-earnings ratio of 14.66, a price-to-earnings-growth ratio of 1.30 and a beta of 2.25. Nextracker Inc. has a one year low of $30.93 and a one year high of $67.87. The company has a fifty day simple moving average of $59.89 and a 200 day simple moving average of $50.73.

Analyst Ratings Changes

A number of research firms have issued reports on NXT. Robert W. Baird boosted their target price on Nextracker from $67.00 to $76.00 and gave the company an "outperform" rating in a research note on Tuesday, July 8th. Mizuho set a $66.00 price target on Nextracker in a report on Wednesday, July 30th. Northland Securities restated a "market perform" rating on shares of Nextracker in a report on Wednesday, July 30th. UBS Group boosted their price target on Nextracker from $71.00 to $75.00 and gave the company a "buy" rating in a report on Thursday, July 31st. Finally, Piper Sandler restated an "overweight" rating on shares of Nextracker in a report on Thursday, May 15th. Nine analysts have rated the stock with a hold rating, thirteen have given a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $64.37.

Get Our Latest Analysis on Nextracker

Institutional Inflows and Outflows

Several large investors have recently bought and sold shares of NXT. State of Michigan Retirement System grew its stake in shares of Nextracker by 0.6% in the 2nd quarter. State of Michigan Retirement System now owns 34,600 shares of the company's stock valued at $1,881,000 after buying an additional 200 shares during the period. Flputnam Investment Management Co. grew its stake in shares of Nextracker by 2.4% in the 1st quarter. Flputnam Investment Management Co. now owns 8,621 shares of the company's stock valued at $363,000 after buying an additional 201 shares during the period. Shell Asset Management Co. grew its stake in shares of Nextracker by 0.4% in the 4th quarter. Shell Asset Management Co. now owns 57,329 shares of the company's stock valued at $2,094,000 after buying an additional 228 shares during the period. Signaturefd LLC grew its stake in shares of Nextracker by 10.2% in the 1st quarter. Signaturefd LLC now owns 2,583 shares of the company's stock valued at $109,000 after buying an additional 239 shares during the period. Finally, Trust Investment Advisors grew its stake in shares of Nextracker by 2.8% in the 1st quarter. Trust Investment Advisors now owns 9,609 shares of the company's stock valued at $405,000 after buying an additional 258 shares during the period. 67.41% of the stock is owned by institutional investors.

About Nextracker

(

Get Free Report)

Nextracker Inc, an energy solutions company, provides solar tracker and software solutions for utility-scale and distributed generation solar projects in the United States and internationally. The company offers tracking solutions, which includes NX Horizon, a solar tracking solution; and NX Horizon-XTR, a terrain-following tracker designed to expand the addressable market for trackers on sites with sloped, uneven, and challenging terrain.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nextracker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nextracker wasn't on the list.

While Nextracker currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.