Nicolet Bankshares (NYSE:NIC - Get Free Report) is expected to issue its Q3 2025 results before the market opens on Tuesday, October 21st. Analysts expect the company to announce earnings of $2.34 per share and revenue of $76.8270 million for the quarter. Parties can find conference call details on the company's upcoming Q3 2025 earningreport page for the latest details on the call scheduled for Tuesday, October 21, 2025 at 4:00 PM ET.

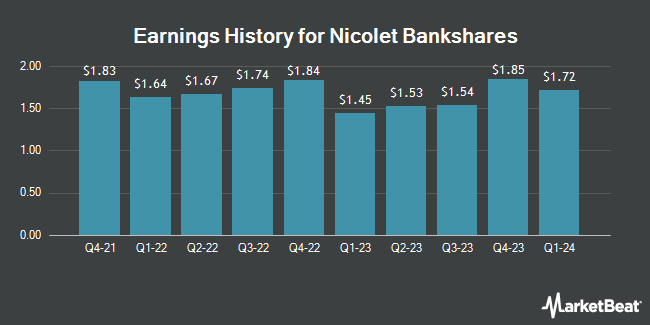

Nicolet Bankshares (NYSE:NIC - Get Free Report) last issued its quarterly earnings results on Tuesday, July 15th. The company reported $2.35 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.14 by $0.21. The firm had revenue of $95.74 million for the quarter, compared to analyst estimates of $72.89 million. Nicolet Bankshares had a return on equity of 11.48% and a net margin of 25.12%. On average, analysts expect Nicolet Bankshares to post $8 EPS for the current fiscal year and $9 EPS for the next fiscal year.

Nicolet Bankshares Stock Performance

NYSE NIC opened at $130.65 on Tuesday. The firm has a market capitalization of $1.94 billion, a P/E ratio of 15.00 and a beta of 0.73. Nicolet Bankshares has a 1-year low of $95.74 and a 1-year high of $141.92. The company has a debt-to-equity ratio of 0.11, a current ratio of 0.96 and a quick ratio of 0.96. The business's 50-day simple moving average is $133.02 and its 200-day simple moving average is $124.92.

Nicolet Bankshares Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, September 15th. Stockholders of record on Tuesday, September 2nd were paid a $0.32 dividend. This represents a $1.28 annualized dividend and a dividend yield of 1.0%. The ex-dividend date of this dividend was Tuesday, September 2nd. Nicolet Bankshares's payout ratio is currently 14.70%.

Insider Activity at Nicolet Bankshares

In other Nicolet Bankshares news, Director Robert Bruce Atwell sold 6,904 shares of Nicolet Bankshares stock in a transaction that occurred on Monday, July 21st. The stock was sold at an average price of $139.47, for a total transaction of $962,900.88. Following the sale, the director directly owned 34,220 shares in the company, valued at $4,772,663.40. The trade was a 16.79% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Eric James Witczak sold 5,000 shares of Nicolet Bankshares stock in a transaction that occurred on Friday, July 18th. The stock was sold at an average price of $139.77, for a total value of $698,850.00. Following the sale, the executive vice president owned 28,901 shares in the company, valued at $4,039,492.77. This represents a 14.75% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 15,056 shares of company stock worth $2,096,949 over the last three months. 14.20% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Nicolet Bankshares

Several hedge funds and other institutional investors have recently bought and sold shares of the business. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its holdings in Nicolet Bankshares by 6.9% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 29,778 shares of the company's stock worth $3,245,000 after purchasing an additional 1,922 shares during the last quarter. Bank of America Corp DE increased its holdings in Nicolet Bankshares by 57.0% during the 2nd quarter. Bank of America Corp DE now owns 22,698 shares of the company's stock worth $2,803,000 after purchasing an additional 8,245 shares during the last quarter. Royal Bank of Canada increased its holdings in Nicolet Bankshares by 150.8% during the 1st quarter. Royal Bank of Canada now owns 13,987 shares of the company's stock worth $1,524,000 after purchasing an additional 8,410 shares during the last quarter. California State Teachers Retirement System increased its holdings in Nicolet Bankshares by 1.8% during the 2nd quarter. California State Teachers Retirement System now owns 12,515 shares of the company's stock worth $1,545,000 after purchasing an additional 225 shares during the last quarter. Finally, AQR Capital Management LLC increased its holdings in Nicolet Bankshares by 15.2% during the 1st quarter. AQR Capital Management LLC now owns 11,819 shares of the company's stock worth $1,288,000 after purchasing an additional 1,557 shares during the last quarter. 43.06% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the company. Wall Street Zen raised Nicolet Bankshares from a "sell" rating to a "hold" rating in a research note on Friday, July 18th. Maxim Group lifted their price objective on Nicolet Bankshares from $131.00 to $161.00 and gave the company a "buy" rating in a research note on Thursday, July 17th. Piper Sandler reaffirmed a "neutral" rating and issued a $140.00 price objective (up from $122.50) on shares of Nicolet Bankshares in a research note on Wednesday, July 16th. Weiss Ratings reaffirmed a "buy (b)" rating on shares of Nicolet Bankshares in a research note on Wednesday, October 8th. Finally, Keefe, Bruyette & Woods boosted their price target on Nicolet Bankshares from $118.00 to $135.00 and gave the stock a "market perform" rating in a research report on Thursday, July 17th. Two analysts have rated the stock with a Buy rating and two have issued a Hold rating to the company's stock. According to MarketBeat, Nicolet Bankshares presently has an average rating of "Moderate Buy" and a consensus price target of $145.33.

Check Out Our Latest Research Report on Nicolet Bankshares

Nicolet Bankshares Company Profile

(

Get Free Report)

Nicolet Bankshares, Inc operates as the bank holding company for Nicolet National Bank that provides banking products and services for businesses and individuals in Wisconsin and Michigan. The company accepts checking, savings, and money market accounts; various certificates of deposit; and individual retirement accounts.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nicolet Bankshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nicolet Bankshares wasn't on the list.

While Nicolet Bankshares currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.