NIO (NYSE:NIO - Get Free Report) is projected to release its Q2 2025 results before the market opens on Tuesday, September 2nd. Analysts expect NIO to post earnings of ($0.30) per share and revenue of $20.0732 billion for the quarter. NIO has set its Q2 2025 guidance at EPS.Interested persons may visit the the company's upcoming Q2 2025 earningresults page for the latest details on the call scheduled for Tuesday, September 2, 2025 at 8:00 AM ET.

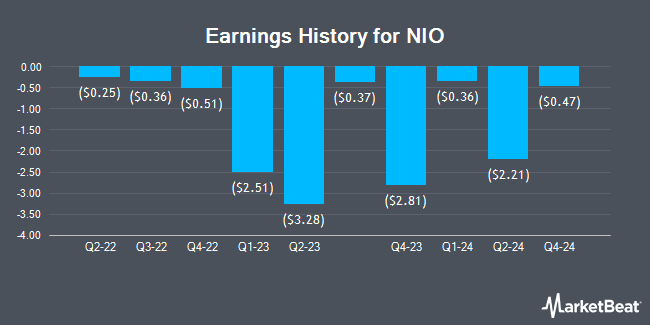

NIO (NYSE:NIO - Get Free Report) last released its quarterly earnings data on Tuesday, June 3rd. The company reported ($0.45) EPS for the quarter, missing the consensus estimate of ($0.22) by ($0.23). The business had revenue of $1.66 billion during the quarter, compared to the consensus estimate of $12.46 billion. NIO had a negative return on equity of 286.45% and a negative net margin of 35.51%.The firm's quarterly revenue was up 21.5% on a year-over-year basis. During the same period last year, the business posted ($2.39) earnings per share. On average, analysts expect NIO to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

NIO Stock Performance

NIO traded down $0.13 on Friday, hitting $6.38. The company's stock had a trading volume of 57,076,123 shares, compared to its average volume of 83,594,528. The company's 50 day simple moving average is $4.55 and its 200-day simple moving average is $4.19. The firm has a market cap of $13.31 billion, a P/E ratio of -3.94 and a beta of 1.42. NIO has a 12 month low of $3.02 and a 12 month high of $7.71. The company has a quick ratio of 0.69, a current ratio of 0.84 and a debt-to-equity ratio of 1.89.

Institutional Trading of NIO

Hedge funds have recently made changes to their positions in the stock. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its holdings in shares of NIO by 3,966.7% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 5,316,291 shares of the company's stock worth $20,255,000 after acquiring an additional 5,185,565 shares during the last quarter. Invesco Ltd. lifted its holdings in shares of NIO by 22.7% during the 2nd quarter. Invesco Ltd. now owns 2,738,308 shares of the company's stock worth $9,392,000 after acquiring an additional 506,618 shares during the last quarter. CANADA LIFE ASSURANCE Co lifted its holdings in shares of NIO by 16.0% during the 2nd quarter. CANADA LIFE ASSURANCE Co now owns 936,736 shares of the company's stock worth $3,220,000 after acquiring an additional 129,236 shares during the last quarter. Tidal Investments LLC lifted its holdings in shares of NIO by 0.9% during the 2nd quarter. Tidal Investments LLC now owns 287,140 shares of the company's stock worth $985,000 after acquiring an additional 2,433 shares during the last quarter. Finally, Vident Advisory LLC lifted its holdings in shares of NIO by 110.4% during the 2nd quarter. Vident Advisory LLC now owns 101,422 shares of the company's stock worth $348,000 after acquiring an additional 53,214 shares during the last quarter. 48.55% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research firms recently commented on NIO. JPMorgan Chase & Co. raised shares of NIO from a "neutral" rating to an "overweight" rating and raised their price objective for the stock from $4.80 to $8.00 in a report on Tuesday. The Goldman Sachs Group raised shares of NIO from a "sell" rating to a "neutral" rating and raised their price objective for the stock from $3.70 to $3.80 in a report on Tuesday, June 17th. Barclays cut their price objective on shares of NIO from $4.00 to $3.00 and set an "underweight" rating for the company in a report on Wednesday, June 4th. Mizuho cut their price target on shares of NIO from $4.00 to $3.50 and set a "neutral" rating for the company in a report on Tuesday, June 3rd. Finally, Morgan Stanley reissued a "buy" rating on shares of NIO in a report on Monday, July 14th. One analyst has rated the stock with a Strong Buy rating, three have issued a Buy rating, eight have assigned a Hold rating and one has assigned a Sell rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $5.21.

Get Our Latest Analysis on NIO

NIO Company Profile

(

Get Free Report)

NIO Inc designs, manufactures, and sells electric vehicles in the People's Republic of China. The company is also involved in the manufacture of e-powertrain, battery packs, and components; and racing management, technology development, and sales and after-sales management activities. In addition, it offers power solutions for battery charging needs; and other value-added services.

Further Reading

Before you consider NIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NIO wasn't on the list.

While NIO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.