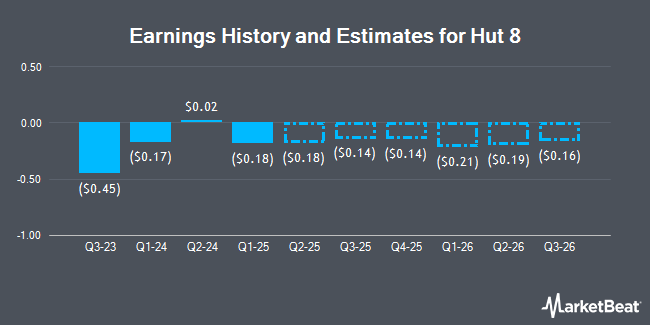

Hut 8 Corp. (NASDAQ:HUT - Free Report) - Investment analysts at Northland Capmk upped their Q4 2026 earnings per share estimates for shares of Hut 8 in a research note issued on Thursday, August 7th. Northland Capmk analyst M. Grondahl now anticipates that the company will post earnings per share of $0.09 for the quarter, up from their previous estimate of $0.08. Northland Capmk has a "Strong-Buy" rating on the stock. The consensus estimate for Hut 8's current full-year earnings is ($0.53) per share.

HUT has been the subject of a number of other research reports. Maxim Group raised their target price on Hut 8 from $23.00 to $30.00 and gave the company a "buy" rating in a research note on Monday. Citigroup initiated coverage on Hut 8 in a research note on Thursday, May 22nd. They issued an "outperform" rating for the company. HC Wainwright restated a "buy" rating and issued a $25.00 target price on shares of Hut 8 in a research note on Friday, May 9th. Canaccord Genuity Group restated a "buy" rating and issued a $32.00 target price on shares of Hut 8 in a research note on Monday, May 12th. Finally, B. Riley started coverage on Hut 8 in a research note on Wednesday, May 14th. They set a "buy" rating and a $25.00 price objective for the company. Fifteen equities research analysts have rated the stock with a buy rating and four have assigned a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Buy" and a consensus price target of $26.71.

Read Our Latest Report on HUT

Hut 8 Stock Down 1.9%

Shares of HUT traded down $0.46 on Monday, reaching $23.34. The stock had a trading volume of 1,590,020 shares, compared to its average volume of 5,629,026. The company has a current ratio of 1.81, a quick ratio of 1.81 and a debt-to-equity ratio of 0.19. The company has a 50-day simple moving average of $19.98 and a 200-day simple moving average of $16.72. Hut 8 has a 12-month low of $8.73 and a 12-month high of $31.95.

Hut 8 (NASDAQ:HUT - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported ($0.14) EPS for the quarter, beating analysts' consensus estimates of ($0.15) by $0.01. The company had revenue of $41.72 million during the quarter, compared to analysts' expectations of $49.10 million. Hut 8 had a return on equity of 8.73% and a net margin of 112.81%.

Institutional Trading of Hut 8

A number of institutional investors and hedge funds have recently modified their holdings of the business. LPL Financial LLC grew its holdings in shares of Hut 8 by 4.5% in the fourth quarter. LPL Financial LLC now owns 41,019 shares of the company's stock worth $840,000 after acquiring an additional 1,777 shares during the period. JPMorgan Chase & Co. grew its holdings in shares of Hut 8 by 23.1% in the fourth quarter. JPMorgan Chase & Co. now owns 322,927 shares of the company's stock worth $6,617,000 after acquiring an additional 60,542 shares during the period. Alliancebernstein L.P. grew its holdings in shares of Hut 8 by 3.0% in the fourth quarter. Alliancebernstein L.P. now owns 86,428 shares of the company's stock worth $1,771,000 after acquiring an additional 2,518 shares during the period. Franklin Resources Inc. bought a new stake in shares of Hut 8 in the fourth quarter worth $693,000. Finally, Wells Fargo & Company MN grew its holdings in shares of Hut 8 by 28.6% in the fourth quarter. Wells Fargo & Company MN now owns 52,563 shares of the company's stock worth $1,077,000 after acquiring an additional 11,687 shares during the period. Institutional investors own 31.75% of the company's stock.

Insider Activity at Hut 8

In other Hut 8 news, Director Joseph Flinn sold 11,069 shares of Hut 8 stock in a transaction on Monday, June 23rd. The stock was sold at an average price of $15.77, for a total value of $174,558.13. Following the completion of the sale, the director owned 19,791 shares of the company's stock, valued at approximately $312,104.07. This trade represents a 35.87% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Insiders own 11.20% of the company's stock.

About Hut 8

(

Get Free Report)

Hut 8 Corp., together with its subsidiaries, acquires, builds, manages, and operates data centers for digital assets mining, computing, and artificial intelligence in the United States. It operates in four segments: Digital Assets Mining, Managed Services, High Performance Computing Colocation and Cloud, and Other.

Featured Articles

Before you consider Hut 8, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hut 8 wasn't on the list.

While Hut 8 currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.