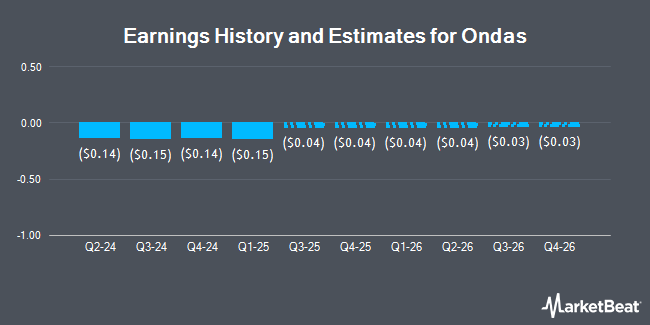

Ondas Holdings Inc. (NASDAQ:ONDS - Free Report) - Equities researchers at Northland Capmk cut their Q3 2025 earnings per share (EPS) estimates for Ondas in a research note issued to investors on Monday, August 18th. Northland Capmk analyst M. Latimore now forecasts that the company will earn ($0.06) per share for the quarter, down from their previous forecast of ($0.04). The consensus estimate for Ondas' current full-year earnings is ($0.53) per share. Northland Capmk also issued estimates for Ondas' Q4 2025 earnings at ($0.04) EPS, FY2025 earnings at ($0.32) EPS, Q1 2026 earnings at ($0.03) EPS and Q4 2026 earnings at ($0.03) EPS.

ONDS has been the topic of a number of other reports. Wall Street Zen upgraded Ondas from a "sell" rating to a "hold" rating in a report on Saturday, July 12th. Needham & Company LLC started coverage on Ondas in a report on Tuesday, August 19th. They issued a "buy" rating and a $5.00 target price on the stock. Finally, Lake Street Capital increased their target price on Ondas from $2.50 to $5.00 and gave the stock a "buy" rating in a report on Wednesday, August 13th. Three investment analysts have rated the stock with a Buy rating, According to data from MarketBeat, Ondas currently has a consensus rating of "Buy" and a consensus target price of $4.67.

Read Our Latest Stock Report on ONDS

Ondas Trading Up 5.4%

Shares of ONDS traded up $0.2440 during trading hours on Wednesday, reaching $4.7340. The stock had a trading volume of 31,279,617 shares, compared to its average volume of 15,584,532. Ondas has a 12 month low of $0.57 and a 12 month high of $4.90. The firm has a 50-day simple moving average of $2.44 and a 200 day simple moving average of $1.54. The company has a market capitalization of $1.04 billion, a price-to-earnings ratio of -9.19 and a beta of 2.29.

Ondas (NASDAQ:ONDS - Get Free Report) last released its earnings results on Tuesday, August 12th. The company reported ($0.08) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.11) by $0.03. Ondas had a negative net margin of 300.11% and a negative return on equity of 130.48%. The company had revenue of $6.27 million for the quarter, compared to the consensus estimate of $4.97 million.

Institutional Trading of Ondas

Institutional investors have recently made changes to their positions in the company. Wells Fargo & Company MN raised its stake in shares of Ondas by 119.2% during the 4th quarter. Wells Fargo & Company MN now owns 11,400 shares of the company's stock worth $29,000 after purchasing an additional 6,200 shares during the period. SBI Securities Co. Ltd. raised its stake in shares of Ondas by 154.9% during the 2nd quarter. SBI Securities Co. Ltd. now owns 16,299 shares of the company's stock worth $31,000 after purchasing an additional 9,904 shares during the period. Two Sigma Investments LP bought a new stake in shares of Ondas during the 4th quarter worth $31,000. Millennium Management LLC raised its stake in shares of Ondas by 150.0% during the 4th quarter. Millennium Management LLC now owns 28,366 shares of the company's stock worth $73,000 after purchasing an additional 17,021 shares during the period. Finally, B. Riley Wealth Advisors Inc. bought a new stake in shares of Ondas during the 4th quarter worth $46,000. Institutional investors own 37.73% of the company's stock.

Ondas Company Profile

(

Get Free Report)

Ondas Holdings Inc, through its subsidiaries, provides private wireless, drone, and automated data solutions. It operates in two segments, Ondas Networks and Ondas Autonomous Systems. The company designs, develops, manufactures, sells, and supports FullMAX, a software defined radio (SDR) platform for wide-area broadband networks.

Featured Stories

Before you consider Ondas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ondas wasn't on the list.

While Ondas currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.