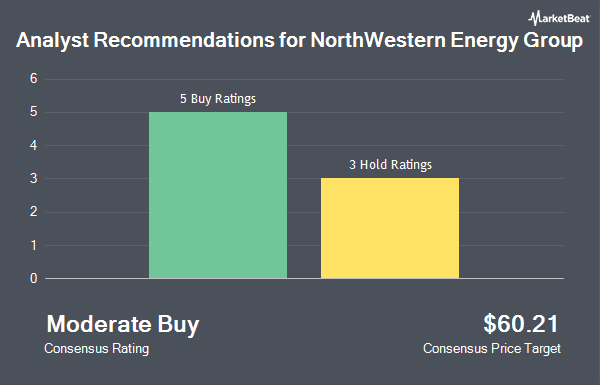

NorthWestern Energy Group, Inc. (NYSE:NWE - Get Free Report) has been given a consensus recommendation of "Moderate Buy" by the eight ratings firms that are currently covering the company, MarketBeat Ratings reports. Three investment analysts have rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average twelve-month target price among analysts that have issued a report on the stock in the last year is $60.21.

A number of research analysts have issued reports on the company. Barclays boosted their price target on NorthWestern Energy Group from $56.00 to $59.00 and gave the company an "overweight" rating in a report on Tuesday, April 22nd. Wells Fargo & Company increased their target price on NorthWestern Energy Group from $62.00 to $64.00 and gave the stock an "overweight" rating in a research note on Thursday, May 1st. Finally, BMO Capital Markets began coverage on NorthWestern Energy Group in a research report on Tuesday, May 13th. They issued a "market perform" rating and a $60.00 price target on the stock.

Get Our Latest Stock Report on NWE

NorthWestern Energy Group Stock Performance

Shares of NYSE NWE traded up $0.55 during midday trading on Friday, hitting $55.05. 341,009 shares of the company's stock traded hands, compared to its average volume of 395,558. The firm has a fifty day moving average of $56.72 and a 200 day moving average of $54.96. The stock has a market capitalization of $3.38 billion, a price-to-earnings ratio of 15.08, a price-to-earnings-growth ratio of 2.40 and a beta of 0.40. NorthWestern Energy Group has a 1 year low of $48.52 and a 1 year high of $59.89. The company has a debt-to-equity ratio of 0.94, a quick ratio of 0.37 and a current ratio of 0.52.

NorthWestern Energy Group (NYSE:NWE - Get Free Report) last issued its quarterly earnings results on Wednesday, April 30th. The company reported $1.22 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.18 by $0.04. NorthWestern Energy Group had a return on equity of 7.40% and a net margin of 14.81%. The business's quarterly revenue was down 1.8% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.09 earnings per share. On average, analysts forecast that NorthWestern Energy Group will post 3.63 earnings per share for the current year.

NorthWestern Energy Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Monday, June 30th. Shareholders of record on Friday, June 13th will be issued a $0.66 dividend. The ex-dividend date of this dividend is Friday, June 13th. This represents a $2.64 dividend on an annualized basis and a yield of 4.80%. NorthWestern Energy Group's payout ratio is presently 68.75%.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the stock. S.A. Mason LLC purchased a new position in NorthWestern Energy Group during the fourth quarter worth about $30,000. Farther Finance Advisors LLC boosted its stake in shares of NorthWestern Energy Group by 155.3% in the 1st quarter. Farther Finance Advisors LLC now owns 845 shares of the company's stock worth $49,000 after buying an additional 514 shares during the last quarter. Steward Partners Investment Advisory LLC boosted its stake in shares of NorthWestern Energy Group by 91.9% in the 4th quarter. Steward Partners Investment Advisory LLC now owns 971 shares of the company's stock worth $52,000 after buying an additional 465 shares during the last quarter. EverSource Wealth Advisors LLC boosted its stake in shares of NorthWestern Energy Group by 280.7% in the 4th quarter. EverSource Wealth Advisors LLC now owns 1,203 shares of the company's stock worth $64,000 after buying an additional 887 shares during the last quarter. Finally, Asset Management One Co. Ltd. purchased a new position in shares of NorthWestern Energy Group in the 4th quarter worth $73,000. Hedge funds and other institutional investors own 96.07% of the company's stock.

About NorthWestern Energy Group

(

Get Free ReportNorthWestern Energy Group, Inc provides electricity and natural gas to residential, commercial, and various industrial customers. It generates, purchases, transmits, and distributes electricity; and produces, purchases, stores, transmits, and distributes natural gas, as well as owns municipal franchises to provide natural gas service in the communities.

Further Reading

Before you consider NorthWestern Energy Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NorthWestern Energy Group wasn't on the list.

While NorthWestern Energy Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.