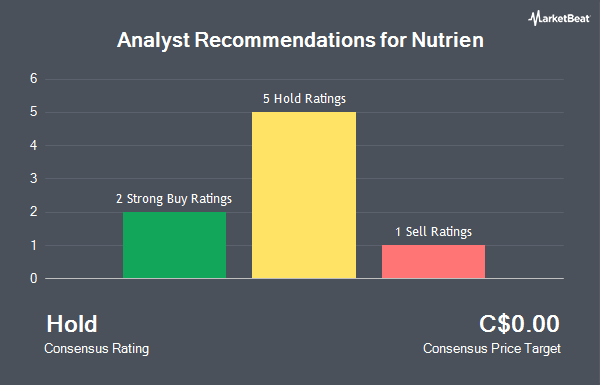

Shares of Nutrien Ltd. (TSE:NTR - Get Free Report) have been assigned a consensus rating of "Hold" from the nine ratings firms that are presently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a sell recommendation, six have assigned a hold recommendation and two have assigned a strong buy recommendation to the company.

Several research firms recently commented on NTR. BNP Paribas raised shares of Nutrien to a "strong-buy" rating in a report on Wednesday, April 9th. Raymond James Financial cut Nutrien from a "moderate buy" rating to a "hold" rating in a research note on Tuesday, June 17th. The Goldman Sachs Group raised Nutrien to a "strong sell" rating in a research note on Thursday, March 13th. Finally, Scotiabank lowered Nutrien from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, May 14th.

Check Out Our Latest Stock Analysis on NTR

Insider Buying and Selling

In related news, Senior Officer Christopher Reynolds sold 6,858 shares of Nutrien stock in a transaction on Monday, June 16th. The shares were sold at an average price of C$85.37, for a total value of C$585,448.26. Also, Senior Officer Andrew Kelemen sold 6,638 shares of the business's stock in a transaction on Monday, June 16th. The shares were sold at an average price of C$86.56, for a total transaction of C$574,611.83. Over the last ninety days, insiders have acquired 1,323 shares of company stock valued at $105,390 and have sold 42,822 shares valued at $3,632,828. 0.03% of the stock is owned by insiders.

Nutrien Price Performance

Shares of Nutrien stock traded down C$0.31 during trading on Friday, hitting C$79.35. 1,367,388 shares of the stock traded hands, compared to its average volume of 1,754,112. The stock has a market cap of C$27.32 billion, a price-to-earnings ratio of 37.36, a PEG ratio of 1.15 and a beta of 0.95. The company has a quick ratio of 0.65, a current ratio of 1.27 and a debt-to-equity ratio of 59.10. Nutrien has a 52 week low of C$60.74 and a 52 week high of C$88.03. The firm's fifty day moving average is C$80.38 and its 200-day moving average is C$74.56.

Nutrien Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, July 18th. Stockholders of record on Monday, June 30th will be paid a dividend of $0.545 per share. This represents a $2.18 annualized dividend and a dividend yield of 2.75%. Nutrien's dividend payout ratio (DPR) is 137.48%.

Nutrien Company Profile

(

Get Free ReportNutrien is the world's largest fertilizer producer by capacity. Nutrien produces the three main crop nutrientsnitrogen, potash, and phosphatealthough its main focus is potash, where it is the global leader in installed capacity with roughly 20% share. The company is also the largest agricultural retailer in the United States, selling fertilizers, crop chemicals, seeds, and services directly to farm customers through its brick-and-mortar stores and online platforms.

See Also

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.