Nutrien (NYSE:NTR - Get Free Report)'s stock had its "hold" rating reaffirmed by equities research analysts at Jefferies Financial Group in a research note issued to investors on Friday, MarketBeat reports. They presently have a $66.00 target price on the stock, up from their previous target price of $63.00. Jefferies Financial Group's price target indicates a potential upside of 8.53% from the company's current price.

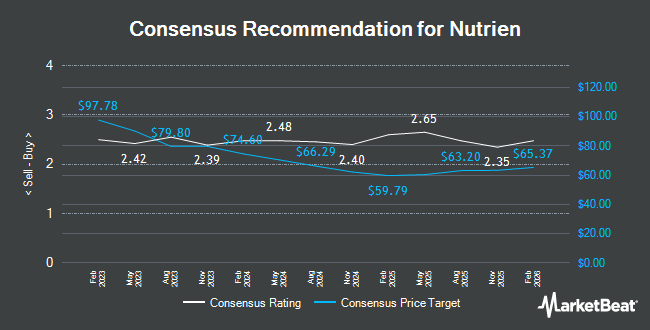

NTR has been the subject of several other reports. UBS Group lifted their price target on shares of Nutrien from $52.00 to $56.00 and gave the company a "neutral" rating in a report on Thursday, May 8th. Raymond James Financial lowered shares of Nutrien from an "outperform" rating to a "market perform" rating and set a $68.00 target price for the company. in a research note on Tuesday, June 17th. Scotiabank lowered shares of Nutrien from an "outperform" rating to a "sector perform" rating and set a $62.00 target price for the company. in a research note on Thursday, May 22nd. Barclays boosted their target price on shares of Nutrien from $61.00 to $64.00 and gave the company an "equal weight" rating in a research note on Monday. Finally, TD Securities boosted their target price on shares of Nutrien from $64.00 to $67.00 and gave the company a "buy" rating in a research note on Monday, May 12th. Two investment analysts have rated the stock with a sell rating, nine have issued a hold rating, seven have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Hold" and an average price target of $62.50.

Check Out Our Latest Report on NTR

Nutrien Stock Performance

Nutrien stock opened at $60.81 on Friday. The firm's fifty day moving average price is $59.33 and its 200 day moving average price is $53.72. The company has a market capitalization of $29.62 billion, a price-to-earnings ratio of 56.83, a price-to-earnings-growth ratio of 1.18 and a beta of 0.80. Nutrien has a 12-month low of $43.70 and a 12-month high of $65.08. The company has a debt-to-equity ratio of 0.41, a current ratio of 1.22 and a quick ratio of 0.59.

Nutrien (NYSE:NTR - Get Free Report) last released its earnings results on Wednesday, May 7th. The company reported $0.11 earnings per share for the quarter, missing the consensus estimate of $0.35 by ($0.24). The company had revenue of $4.67 billion during the quarter, compared to the consensus estimate of $5.16 billion. Nutrien had a return on equity of 6.08% and a net margin of 2.05%. Nutrien's revenue for the quarter was down 5.4% on a year-over-year basis. During the same period in the previous year, the firm posted $0.46 EPS. On average, research analysts forecast that Nutrien will post 3.72 EPS for the current fiscal year.

Institutional Trading of Nutrien

Several large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. grew its position in Nutrien by 7.1% in the first quarter. Vanguard Group Inc. now owns 21,191,003 shares of the company's stock worth $1,051,709,000 after acquiring an additional 1,412,503 shares in the last quarter. Dodge & Cox grew its holdings in Nutrien by 0.3% during the fourth quarter. Dodge & Cox now owns 12,523,259 shares of the company's stock valued at $560,416,000 after purchasing an additional 40,800 shares during the last quarter. First Eagle Investment Management LLC grew its holdings in Nutrien by 0.8% during the fourth quarter. First Eagle Investment Management LLC now owns 9,529,311 shares of the company's stock valued at $426,436,000 after purchasing an additional 77,174 shares during the last quarter. Canada Pension Plan Investment Board grew its stake in Nutrien by 17.1% in the 1st quarter. Canada Pension Plan Investment Board now owns 8,786,309 shares of the company's stock valued at $436,137,000 after buying an additional 1,284,181 shares during the last quarter. Finally, Mackenzie Financial Corp grew its stake in Nutrien by 0.7% in the 1st quarter. Mackenzie Financial Corp now owns 7,855,609 shares of the company's stock valued at $389,860,000 after buying an additional 54,918 shares during the last quarter. 63.10% of the stock is owned by institutional investors.

Nutrien Company Profile

(

Get Free Report)

Nutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.