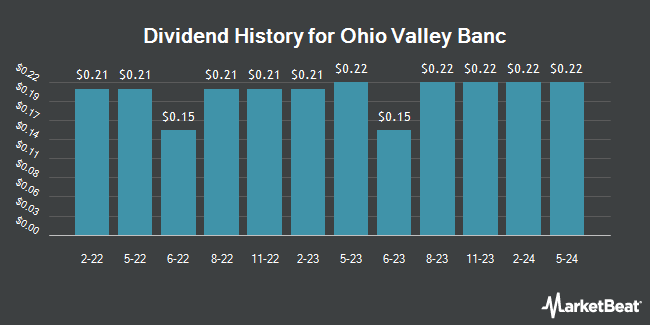

Ohio Valley Banc Corp. (NASDAQ:OVBC - Get Free Report) declared a quarterly dividend on Tuesday, October 21st. Shareholders of record on Friday, October 31st will be given a dividend of 0.23 per share by the bank on Monday, November 10th. This represents a c) annualized dividend and a dividend yield of 2.6%. The ex-dividend date of this dividend is Friday, October 31st.

Ohio Valley Banc Price Performance

Ohio Valley Banc stock opened at $35.90 on Wednesday. Ohio Valley Banc has a 52 week low of $21.86 and a 52 week high of $40.99. The company's 50 day moving average price is $36.52 and its two-hundred day moving average price is $34.62. The company has a quick ratio of 0.90, a current ratio of 0.90 and a debt-to-equity ratio of 0.28. The stock has a market cap of $169.12 million, a P/E ratio of 12.21 and a beta of 0.05.

Ohio Valley Banc (NASDAQ:OVBC - Get Free Report) last posted its earnings results on Friday, July 25th. The bank reported $0.89 EPS for the quarter. Ohio Valley Banc had a net margin of 14.81% and a return on equity of 8.95%. The firm had revenue of $17.38 million for the quarter.

About Ohio Valley Banc

(

Get Free Report)

Ohio Valley Banc Corp. operates as the bank holding company for The Ohio Valley Bank Company that provides commercial and consumer banking products and services. The company operates in two segments, Banking and Consumer Finance. It accepts various deposit products, including checking, savings, time, and money market accounts, as well as individual retirement accounts, demand deposits, NOW accounts, and certificates of deposit.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ohio Valley Banc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ohio Valley Banc wasn't on the list.

While Ohio Valley Banc currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.