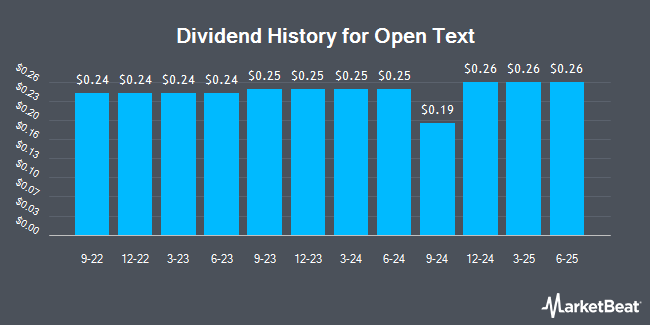

Open Text Corporation (NASDAQ:OTEX - Get Free Report) TSE: OTC announced a quarterly dividend on Monday, August 11th, Wall Street Journal reports. Shareholders of record on Friday, September 5th will be given a dividend of 0.275 per share by the software maker on Friday, September 19th. This represents a c) dividend on an annualized basis and a yield of 3.6%. The ex-dividend date of this dividend is Friday, September 5th. This is a 4.8% increase from Open Text's previous quarterly dividend of $0.26.

Open Text has a dividend payout ratio of 25.2% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect Open Text to earn $3.78 per share next year, which means the company should continue to be able to cover its $1.05 annual dividend with an expected future payout ratio of 27.8%.

Open Text Stock Performance

Shares of NASDAQ OTEX traded down $0.69 during mid-day trading on Monday, hitting $30.22. The company had a trading volume of 3,198,827 shares, compared to its average volume of 1,258,778. The company has a market capitalization of $7.69 billion, a price-to-earnings ratio of 18.32 and a beta of 1.12. Open Text has a 1 year low of $22.79 and a 1 year high of $34.20. The stock's 50-day moving average price is $28.95 and its 200-day moving average price is $27.60. The company has a current ratio of 0.80, a quick ratio of 0.80 and a debt-to-equity ratio of 1.61.

Open Text (NASDAQ:OTEX - Get Free Report) TSE: OTC last issued its quarterly earnings results on Thursday, August 7th. The software maker reported $0.97 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.86 by $0.11. Open Text had a return on equity of 22.52% and a net margin of 8.43%. The firm had revenue of $1.32 billion during the quarter, compared to analyst estimates of $1.30 billion. During the same quarter in the previous year, the company posted $0.98 earnings per share. The company's revenue was down 3.8% compared to the same quarter last year. On average, sell-side analysts forecast that Open Text will post 3.45 earnings per share for the current year.

Wall Street Analysts Forecast Growth

OTEX has been the topic of a number of recent research reports. Jefferies Financial Group reaffirmed a "buy" rating on shares of Open Text in a report on Friday. Royal Bank Of Canada cut their price objective on Open Text from $31.00 to $30.00 and set a "sector perform" rating for the company in a research report on Tuesday, April 22nd. UBS Group cut their price objective on Open Text from $32.00 to $28.00 and set a "neutral" rating for the company in a research report on Friday, May 2nd. Scotiabank dropped their price target on Open Text from $35.00 to $30.00 and set a "sector perform" rating for the company in a research report on Monday, April 28th. Finally, National Bankshares dropped their price target on Open Text from $38.00 to $34.00 and set a "sector perform" rating for the company in a research report on Friday, April 25th. One analyst has rated the stock with a sell rating, six have assigned a hold rating and four have given a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $32.00.

Read Our Latest Stock Analysis on Open Text

About Open Text

(

Get Free Report)

Open Text Corporation provides information management software and solutions. The company offers content services, which includes content collaboration and intelligent capture to records management, collaboration, e-signatures, and archiving; and operates experience cloud platform that provides customer experience and web content management, digital asset management, customer analytics, AI and insights, e-discovery, digital fax, omnichannel communications, secure messaging, and voice of customer, as well as customer journey, testing, and segmentation.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Open Text, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Open Text wasn't on the list.

While Open Text currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.