OPKO Health (NASDAQ:OPK - Get Free Report) will likely be posting its Q3 2025 results before the market opens on Wednesday, October 29th. Analysts expect OPKO Health to post earnings of ($0.03) per share and revenue of $165.74 million for the quarter. Individuals may visit the the company's upcoming Q3 2025 earningresults page for the latest details on the call scheduled for Wednesday, October 29, 2025 at 4:30 PM ET.

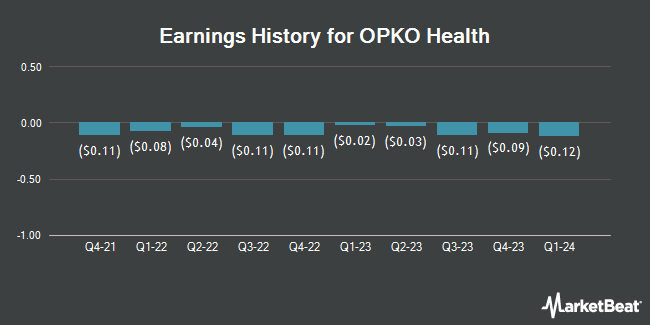

OPKO Health (NASDAQ:OPK - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The biotechnology company reported ($0.19) earnings per share for the quarter, missing analysts' consensus estimates of ($0.12) by ($0.07). The company had revenue of $156.80 million during the quarter, compared to analyst estimates of $165.74 million. OPKO Health had a negative net margin of 26.68% and a negative return on equity of 13.17%. The business's revenue for the quarter was down 13.9% on a year-over-year basis. During the same quarter in the previous year, the company earned ($0.01) earnings per share. On average, analysts expect OPKO Health to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

OPKO Health Stock Performance

NASDAQ OPK opened at $1.52 on Friday. The company has a market capitalization of $1.21 billion, a price-to-earnings ratio of -6.08 and a beta of 1.50. OPKO Health has a twelve month low of $1.11 and a twelve month high of $2.04. The stock has a fifty day simple moving average of $1.45 and a 200 day simple moving average of $1.38. The company has a quick ratio of 3.02, a current ratio of 3.41 and a debt-to-equity ratio of 0.25.

Wall Street Analyst Weigh In

A number of analysts recently weighed in on the company. LADENBURG THALM/SH SH upgraded OPKO Health to a "strong-buy" rating in a report on Tuesday, July 8th. Weiss Ratings restated a "sell (d-)" rating on shares of OPKO Health in a report on Wednesday, October 8th. Finally, Zacks Research upgraded OPKO Health from a "strong sell" rating to a "hold" rating in a report on Thursday, August 14th. One investment analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating, two have issued a Hold rating and one has issued a Sell rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $2.63.

Read Our Latest Analysis on OPKO Health

Insiders Place Their Bets

In other OPKO Health news, CEO Phillip Md Et Al Frost purchased 675,000 shares of the firm's stock in a transaction on Friday, August 8th. The stock was purchased at an average cost of $1.32 per share, for a total transaction of $891,000.00. Following the acquisition, the chief executive officer owned 214,676,448 shares in the company, valued at approximately $283,372,911.36. The trade was a 0.32% increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Insiders own 49.69% of the company's stock.

Hedge Funds Weigh In On OPKO Health

Institutional investors and hedge funds have recently made changes to their positions in the stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its stake in OPKO Health by 4.7% in the second quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 198,148 shares of the biotechnology company's stock valued at $262,000 after acquiring an additional 8,954 shares during the last quarter. The Manufacturers Life Insurance Company increased its stake in OPKO Health by 11.2% in the second quarter. The Manufacturers Life Insurance Company now owns 138,643 shares of the biotechnology company's stock valued at $183,000 after acquiring an additional 13,912 shares during the last quarter. Prudential Financial Inc. increased its stake in OPKO Health by 75.0% in the second quarter. Prudential Financial Inc. now owns 46,842 shares of the biotechnology company's stock valued at $62,000 after acquiring an additional 20,076 shares during the last quarter. Strs Ohio bought a new position in OPKO Health in the first quarter valued at $53,000. Finally, Rhumbline Advisers increased its stake in OPKO Health by 8.0% in the second quarter. Rhumbline Advisers now owns 529,553 shares of the biotechnology company's stock valued at $699,000 after acquiring an additional 39,274 shares during the last quarter. Institutional investors own 64.63% of the company's stock.

OPKO Health Company Profile

(

Get Free Report)

OPKO Health, Inc, a healthcare company, engages in the diagnostics and pharmaceuticals businesses in the United States, Ireland, Chile, Spain, Israel, Mexico, and internationally. The company's Diagnostics segment operates BioReference Laboratories that offers laboratory testing services for the detection, diagnosis, evaluation, monitoring, and treatment of diseases, including esoteric testing, molecular diagnostics, anatomical pathology, genetics, women's health, and correctional healthcare to physician offices, clinics, hospitals, employers, and governmental units; and 4Kscore prostate cancer test.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider OPKO Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OPKO Health wasn't on the list.

While OPKO Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.