Analysts at Oppenheimer started coverage on shares of SoundHound AI (NASDAQ:SOUN - Get Free Report) in a research note issued to investors on Thursday,Briefing.com Automated Import reports. The firm set a "market perform" rating on the stock.

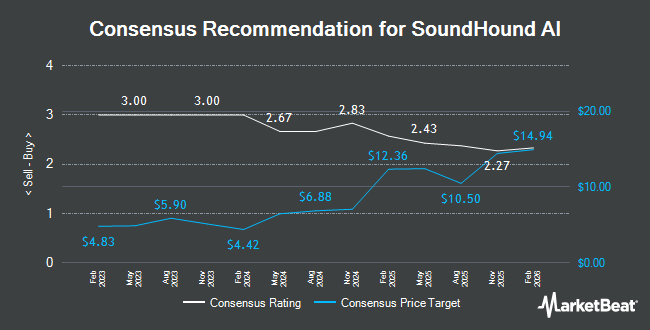

Other research analysts also recently issued reports about the stock. Wedbush restated an "outperform" rating and set a $16.00 price objective on shares of SoundHound AI in a research report on Thursday. Piper Sandler reaffirmed a "neutral" rating and set a $12.00 target price on shares of SoundHound AI in a research note on Monday, July 14th. Northland Capmk raised shares of SoundHound AI from a "hold" rating to a "strong-buy" rating in a research note on Friday, August 8th. LADENBURG THALM/SH SH raised shares of SoundHound AI from a "neutral" rating to a "buy" rating and boosted their price objective for the stock from $9.00 to $16.00 in a research note on Monday, August 11th. Finally, DA Davidson boosted their price objective on shares of SoundHound AI from $15.00 to $17.00 and gave the stock a "buy" rating in a research note on Wednesday. One analyst has rated the stock with a Strong Buy rating, five have issued a Buy rating and four have given a Hold rating to the company's stock. According to MarketBeat, SoundHound AI presently has an average rating of "Moderate Buy" and a consensus target price of $14.36.

Read Our Latest Stock Report on SoundHound AI

SoundHound AI Trading Down 5.4%

NASDAQ SOUN opened at $14.05 on Thursday. SoundHound AI has a 1-year low of $4.45 and a 1-year high of $24.98. The company has a 50 day moving average of $12.60 and a 200-day moving average of $10.52. The company has a market cap of $5.73 billion, a price-to-earnings ratio of -22.30 and a beta of 2.58.

SoundHound AI (NASDAQ:SOUN - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The company reported ($0.19) EPS for the quarter, missing the consensus estimate of ($0.06) by ($0.13). SoundHound AI had a negative net margin of 171.81% and a negative return on equity of 73.13%. The firm had revenue of $42.68 million for the quarter, compared to analyst estimates of $32.88 million. During the same quarter in the prior year, the firm earned ($0.11) earnings per share. The firm's revenue for the quarter was up 216.3% on a year-over-year basis. SoundHound AI has set its FY 2025 guidance at EPS. On average, equities research analysts forecast that SoundHound AI will post -0.38 earnings per share for the current year.

Insider Activity

In other news, CFO Nitesh Sharan sold 111,111 shares of the company's stock in a transaction dated Friday, June 20th. The shares were sold at an average price of $9.36, for a total transaction of $1,039,998.96. Following the transaction, the chief financial officer owned 1,442,900 shares in the company, valued at approximately $13,505,544. This represents a 7.15% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider James Ming Hom sold 79,530 shares of the company's stock in a transaction dated Friday, June 20th. The shares were sold at an average price of $9.36, for a total transaction of $744,400.80. Following the transaction, the insider owned 637,560 shares in the company, valued at $5,967,561.60. This represents a 11.09% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 780,965 shares of company stock valued at $7,350,999. Corporate insiders own 9.17% of the company's stock.

Institutional Investors Weigh In On SoundHound AI

A number of institutional investors and hedge funds have recently made changes to their positions in the business. Osaic Holdings Inc. raised its holdings in shares of SoundHound AI by 14.0% in the 2nd quarter. Osaic Holdings Inc. now owns 498,691 shares of the company's stock worth $5,351,000 after acquiring an additional 61,212 shares during the last quarter. B. Riley Wealth Advisors Inc. acquired a new stake in shares of SoundHound AI in the 2nd quarter worth about $157,000. Newbridge Financial Services Group Inc. raised its holdings in shares of SoundHound AI by 6.3% in the 2nd quarter. Newbridge Financial Services Group Inc. now owns 31,050 shares of the company's stock worth $333,000 after acquiring an additional 1,850 shares during the last quarter. Marex Group plc acquired a new stake in shares of SoundHound AI in the 2nd quarter worth about $3,728,000. Finally, Tyler Stone Wealth Management raised its holdings in shares of SoundHound AI by 20.7% in the 2nd quarter. Tyler Stone Wealth Management now owns 32,190 shares of the company's stock worth $345,000 after acquiring an additional 5,510 shares during the last quarter. Institutional investors and hedge funds own 19.28% of the company's stock.

SoundHound AI Company Profile

(

Get Free Report)

SoundHound AI, Inc develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers. Its products include Houndify platform that offers a suite of Houndify tools to help brands build conversational voice assistants, such as Application Programming Interfaces (API) for text and voice queries, support for custom commands, extensive library of content domains, inclusive software development kit platforms, collaboration capabilities, diagnostic tools, and built-in analytics; SoundHound Chat AI that integrates with knowledge domains, pulling real-time data like weather, sports, stocks, flight status, and restaurants; and SoundHound Smart Answering is built to offer customer establishments custom AI-powered voice assistant.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SoundHound AI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SoundHound AI wasn't on the list.

While SoundHound AI currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.