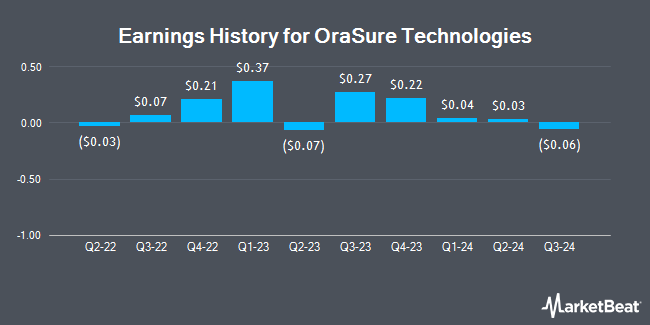

OraSure Technologies (NASDAQ:OSUR - Get Free Report) posted its quarterly earnings results on Tuesday. The medical instruments supplier reported ($0.23) EPS for the quarter, missing the consensus estimate of ($0.15) by ($0.08), Zacks reports. OraSure Technologies had a negative net margin of 36.84% and a negative return on equity of 10.81%. The business had revenue of $31.24 million during the quarter, compared to the consensus estimate of $30.52 million. OraSure Technologies updated its Q3 2025 guidance to EPS.

OraSure Technologies Stock Up 1.5%

Shares of NASDAQ OSUR traded up $0.04 during trading hours on Friday, hitting $2.78. 547,602 shares of the stock were exchanged, compared to its average volume of 762,809. OraSure Technologies has a 12 month low of $2.36 and a 12 month high of $4.61. The company has a market cap of $203.33 million, a PE ratio of -4.15 and a beta of 0.27. The firm has a fifty day moving average price of $3.04 and a 200-day moving average price of $3.20.

Institutional Inflows and Outflows

A number of hedge funds have recently bought and sold shares of the stock. Geode Capital Management LLC increased its stake in OraSure Technologies by 6.4% during the 2nd quarter. Geode Capital Management LLC now owns 1,869,868 shares of the medical instruments supplier's stock valued at $5,611,000 after purchasing an additional 112,851 shares in the last quarter. Envestnet Asset Management Inc. increased its stake in OraSure Technologies by 32.7% during the 2nd quarter. Envestnet Asset Management Inc. now owns 33,018 shares of the medical instruments supplier's stock valued at $99,000 after purchasing an additional 8,133 shares in the last quarter. Empowered Funds LLC increased its stake in OraSure Technologies by 7.2% during the 1st quarter. Empowered Funds LLC now owns 405,216 shares of the medical instruments supplier's stock valued at $1,366,000 after purchasing an additional 27,310 shares in the last quarter. NewEdge Advisors LLC increased its stake in OraSure Technologies by 32,595.9% during the 1st quarter. NewEdge Advisors LLC now owns 47,736 shares of the medical instruments supplier's stock valued at $161,000 after purchasing an additional 47,590 shares in the last quarter. Finally, AQR Capital Management LLC increased its stake in OraSure Technologies by 48.3% during the 1st quarter. AQR Capital Management LLC now owns 1,041,875 shares of the medical instruments supplier's stock valued at $3,511,000 after purchasing an additional 339,493 shares in the last quarter. Institutional investors and hedge funds own 93.50% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have recently commented on OSUR. Wall Street Zen upgraded shares of OraSure Technologies from a "sell" rating to a "hold" rating in a report on Saturday, May 17th. Evercore ISI reiterated an "in-line" rating and set a $3.00 price objective on shares of OraSure Technologies in a research note on Monday, May 19th.

Get Our Latest Analysis on OSUR

About OraSure Technologies

(

Get Free Report)

OraSure Technologies, Inc, together with its subsidiaries, provides point-of-care and home diagnostic tests, specimen collection devices, and microbiome laboratory and analytical services in the United States, Europe, and internationally. The company's products include InteliSwab COVID-19 rapid test, InteliSwab COVID-19 rapid test pro, InteliSwab COVID-19 rapid test rx, OraQuick Rapid HIV test, OraQuick In-Home HIV test, OraQuick HIV self-test, OraQuick HCV rapid antibody test, OraQuick Ebola rapid antigen test, OraSure oral fluid collection device used in conjunction with screening and confirmatory tests for HIV-1 antibodies; Intercept drug testing systems; immunoassay tests and reagents; and Q.E.D.

Featured Stories

Before you consider OraSure Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OraSure Technologies wasn't on the list.

While OraSure Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.