Orthofix Medical (NASDAQ:OFIX - Get Free Report)'s stock had its "sell (d-)" rating restated by investment analysts at Weiss Ratings in a research note issued to investors on Saturday,Weiss Ratings reports.

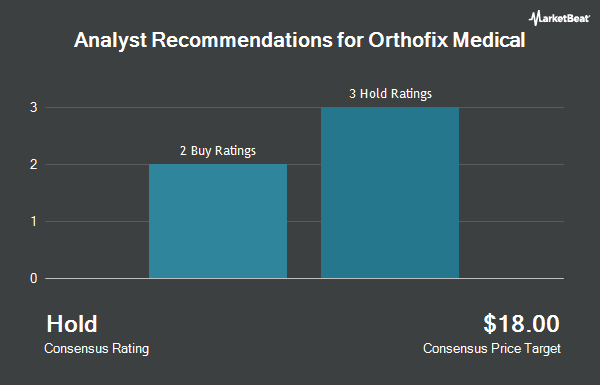

Other research analysts have also issued research reports about the company. Wall Street Zen upgraded Orthofix Medical from a "sell" rating to a "hold" rating in a research report on Saturday, August 9th. Barrington Research reissued an "outperform" rating and issued a $17.00 price objective on shares of Orthofix Medical in a research note on Thursday. Four investment analysts have rated the stock with a Buy rating, one has issued a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $21.75.

Read Our Latest Stock Report on Orthofix Medical

Orthofix Medical Trading Up 0.3%

OFIX opened at $15.97 on Friday. The firm has a market cap of $630.66 million, a P/E ratio of -5.04 and a beta of 0.89. Orthofix Medical has a 12 month low of $10.24 and a 12 month high of $20.73. The company has a current ratio of 2.67, a quick ratio of 1.50 and a debt-to-equity ratio of 0.38. The stock has a 50-day moving average of $14.77 and a 200 day moving average of $12.93.

Orthofix Medical (NASDAQ:OFIX - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The medical device company reported ($0.36) EPS for the quarter, missing the consensus estimate of $0.04 by ($0.40). The company had revenue of $203.12 million during the quarter, compared to analysts' expectations of $196.89 million. Orthofix Medical had a negative return on equity of 25.43% and a negative net margin of 15.29%. Orthofix Medical has set its FY 2025 guidance at EPS. As a group, research analysts forecast that Orthofix Medical will post -2.81 EPS for the current year.

Institutional Trading of Orthofix Medical

Several institutional investors and hedge funds have recently modified their holdings of OFIX. CWM LLC raised its stake in shares of Orthofix Medical by 99.0% during the third quarter. CWM LLC now owns 1,920 shares of the medical device company's stock valued at $28,000 after acquiring an additional 955 shares in the last quarter. State of Alaska Department of Revenue bought a new stake in shares of Orthofix Medical during the third quarter valued at approximately $30,000. US Bancorp DE raised its stake in shares of Orthofix Medical by 684.6% during the first quarter. US Bancorp DE now owns 5,673 shares of the medical device company's stock valued at $93,000 after acquiring an additional 4,950 shares in the last quarter. VIRGINIA RETIREMENT SYSTEMS ET Al bought a new stake in shares of Orthofix Medical during the second quarter valued at approximately $147,000. Finally, Empirical Financial Services LLC d.b.a. Empirical Wealth Management raised its stake in shares of Orthofix Medical by 32.6% during the second quarter. Empirical Financial Services LLC d.b.a. Empirical Wealth Management now owns 13,297 shares of the medical device company's stock valued at $148,000 after acquiring an additional 3,271 shares in the last quarter. Institutional investors own 89.76% of the company's stock.

Orthofix Medical Company Profile

(

Get Free Report)

Orthofix Medical Inc operates as a spine and orthopedics company in the United States, Italy, Germany, the United Kingdom, France, Brazil, and internationally. It operates through two segments, Global Spine and Global Orthopedics. The Global Spine segment manufactures and distributes bone growth stimulator devices for enhance of bone fusion, including adjunctive and noninvasive treatment of cervical and lumbar spine, as well as a therapeutic treatment for non-spine; designs, develops, and markets a portfolio of motion preservation and fixation implant products, which are used in surgical procedures of the spine; and offers biological products, such as fiber-based and particulate demineralized bone matrices, cellular bone allografts, collagen ceramic matrices, and synthetic bone void fillers, and tissue forms, which allow physicians to treat various spinal and orthopedic conditions.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Orthofix Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Orthofix Medical wasn't on the list.

While Orthofix Medical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.