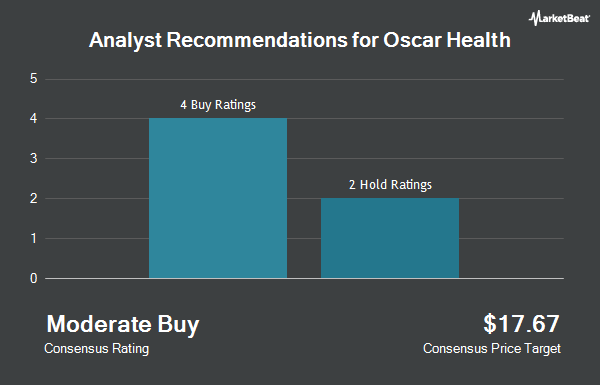

Oscar Health, Inc. (NYSE:OSCR - Get Free Report) has been given a consensus rating of "Reduce" by the five research firms that are currently covering the company, Marketbeat Ratings reports. Two investment analysts have rated the stock with a sell recommendation, two have assigned a hold recommendation and one has issued a buy recommendation on the company. The average twelve-month price target among brokers that have updated their coverage on the stock in the last year is $16.50.

A number of equities analysts recently weighed in on the stock. Wall Street Zen downgraded shares of Oscar Health from a "buy" rating to a "hold" rating in a report on Sunday, June 8th. Wells Fargo & Company downgraded shares of Oscar Health from an "overweight" rating to an "equal weight" rating and lowered their target price for the stock from $20.00 to $16.00 in a report on Thursday, March 13th. Finally, Piper Sandler lowered their target price on shares of Oscar Health from $25.00 to $18.00 and set an "overweight" rating on the stock in a report on Monday, June 9th.

Check Out Our Latest Report on OSCR

Insider Buying and Selling at Oscar Health

In other Oscar Health news, Director Elbert O. Jr. Robinson sold 25,000 shares of the company's stock in a transaction on Monday, May 12th. The shares were sold at an average price of $16.43, for a total value of $410,750.00. Following the transaction, the director now directly owns 64,512 shares in the company, valued at $1,059,932.16. The trade was a 27.93% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Corporate insiders own 24.39% of the company's stock.

Hedge Funds Weigh In On Oscar Health

Several institutional investors and hedge funds have recently modified their holdings of OSCR. Vontobel Holding Ltd. acquired a new position in shares of Oscar Health in the fourth quarter valued at about $370,000. Rhumbline Advisers grew its stake in shares of Oscar Health by 2.4% in the fourth quarter. Rhumbline Advisers now owns 271,227 shares of the company's stock valued at $3,645,000 after acquiring an additional 6,483 shares in the last quarter. State of New Jersey Common Pension Fund D grew its stake in shares of Oscar Health by 6.4% in the fourth quarter. State of New Jersey Common Pension Fund D now owns 116,555 shares of the company's stock valued at $1,566,000 after acquiring an additional 6,965 shares in the last quarter. Alberta Investment Management Corp acquired a new position in shares of Oscar Health in the fourth quarter valued at about $138,000. Finally, Ieq Capital LLC acquired a new position in shares of Oscar Health in the fourth quarter valued at about $203,000. 75.70% of the stock is currently owned by institutional investors and hedge funds.

Oscar Health Stock Down 2.7%

Shares of NYSE:OSCR traded down $0.39 during midday trading on Wednesday, hitting $13.95. The stock had a trading volume of 8,657,001 shares, compared to its average volume of 4,791,654. The company has a market cap of $3.55 billion, a P/E ratio of -697.10 and a beta of 1.73. Oscar Health has a 12 month low of $11.20 and a 12 month high of $23.79. The business's 50-day simple moving average is $14.03 and its 200-day simple moving average is $14.49. The company has a quick ratio of 0.73, a current ratio of 0.73 and a debt-to-equity ratio of 0.26.

Oscar Health (NYSE:OSCR - Get Free Report) last issued its earnings results on Wednesday, May 7th. The company reported $0.92 earnings per share for the quarter, topping analysts' consensus estimates of $0.83 by $0.09. The business had revenue of $3 billion for the quarter, compared to the consensus estimate of $2.87 billion. Oscar Health had a net margin of 0.28% and a return on equity of 2.28%. The firm's revenue for the quarter was up 42.2% on a year-over-year basis. During the same period in the previous year, the company earned $0.62 earnings per share. On average, sell-side analysts forecast that Oscar Health will post 0.69 earnings per share for the current fiscal year.

About Oscar Health

(

Get Free ReportOscar Health, Inc operates as a health insurance in the United States. The company offers health plans in individual and small group markets, as well as +Oscar, a technology driven platform that help providers and payors directly enable their shift to value-based care. It also provides reinsurance products.

See Also

Before you consider Oscar Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oscar Health wasn't on the list.

While Oscar Health currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.