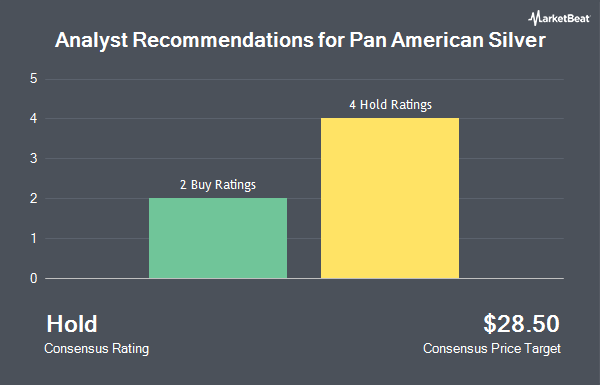

Pan American Silver Corp. (NYSE:PAAS - Get Free Report) TSE: PAAS has been given an average recommendation of "Hold" by the six brokerages that are currently covering the company, Marketbeat.com reports. Four investment analysts have rated the stock with a hold recommendation and two have assigned a buy recommendation to the company. The average twelve-month price target among brokerages that have issued a report on the stock in the last year is $30.60.

Several brokerages recently commented on PAAS. TD Securities reduced their target price on shares of Pan American Silver from $30.00 to $26.00 and set a "hold" rating for the company in a report on Thursday, May 22nd. Wall Street Zen upgraded shares of Pan American Silver from a "buy" rating to a "strong-buy" rating in a research report on Thursday, May 15th. Scotiabank reaffirmed a "sector perform" rating on shares of Pan American Silver in a research report on Monday, April 14th. CIBC increased their target price on Pan American Silver from $38.00 to $42.00 and gave the stock an "outperformer" rating in a research note on Thursday, May 8th. Finally, BMO Capital Markets initiated coverage on Pan American Silver in a research note on Wednesday, April 16th. They issued a "market perform" rating for the company.

Check Out Our Latest Research Report on PAAS

Pan American Silver Stock Performance

Pan American Silver stock traded down $1.42 during midday trading on Wednesday, reaching $27.71. 4,914,373 shares of the company's stock were exchanged, compared to its average volume of 3,940,265. The stock's 50-day simple moving average is $26.06 and its 200 day simple moving average is $24.44. The firm has a market cap of $10.03 billion, a price-to-earnings ratio of 31.85, a P/E/G ratio of 0.50 and a beta of 0.63. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.94 and a current ratio of 2.93. Pan American Silver has a 52 week low of $17.86 and a 52 week high of $29.66.

Pan American Silver (NYSE:PAAS - Get Free Report) TSE: PAAS last issued its earnings results on Wednesday, May 7th. The basic materials company reported $0.42 EPS for the quarter, topping the consensus estimate of $0.19 by $0.23. Pan American Silver had a return on equity of 9.25% and a net margin of 10.45%. The company had revenue of $773.20 million during the quarter, compared to the consensus estimate of $696.62 million. During the same period in the previous year, the company posted $0.01 EPS. The firm's revenue for the quarter was up 28.6% compared to the same quarter last year. On average, analysts expect that Pan American Silver will post 1.26 earnings per share for the current fiscal year.

Pan American Silver Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, June 2nd. Investors of record on Tuesday, May 20th were paid a $0.10 dividend. The ex-dividend date was Tuesday, May 20th. This represents a $0.40 dividend on an annualized basis and a yield of 1.44%. Pan American Silver's dividend payout ratio (DPR) is 45.98%.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in PAAS. Bank Julius Baer & Co. Ltd Zurich bought a new position in shares of Pan American Silver in the 4th quarter valued at $32,000. Graybill Wealth Management LTD. bought a new position in Pan American Silver in the first quarter valued at about $33,000. Farther Finance Advisors LLC grew its position in Pan American Silver by 164.3% in the fourth quarter. Farther Finance Advisors LLC now owns 1,945 shares of the basic materials company's stock valued at $39,000 after acquiring an additional 1,209 shares during the last quarter. SBI Securities Co. Ltd. acquired a new position in Pan American Silver during the fourth quarter worth about $43,000. Finally, Kohmann Bosshard Financial Services LLC bought a new position in shares of Pan American Silver in the fourth quarter worth about $53,000. 55.43% of the stock is currently owned by institutional investors and hedge funds.

About Pan American Silver

(

Get Free ReportPan American Silver Corp. engages in the exploration, mine development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. The company was formerly known as Pan American Minerals Corp. and changed its name to Pan American Silver Corp.

Read More

Before you consider Pan American Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pan American Silver wasn't on the list.

While Pan American Silver currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.