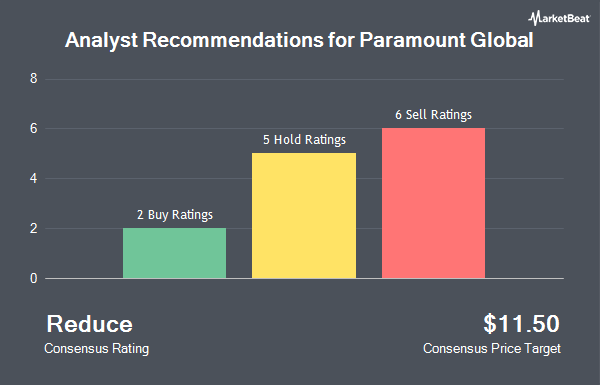

Paramount Global (NASDAQ:PARA - Get Free Report) has been assigned a consensus recommendation of "Reduce" from the thirteen brokerages that are currently covering the stock, Marketbeat Ratings reports. Six equities research analysts have rated the stock with a sell rating, five have given a hold rating and two have assigned a buy rating to the company. The average 12 month price objective among brokers that have covered the stock in the last year is $11.33.

Several brokerages recently commented on PARA. Morgan Stanley cut their price target on shares of Paramount Global from $11.00 to $10.00 and set an "underweight" rating on the stock in a research note on Tuesday, May 6th. Guggenheim reiterated a "buy" rating and issued a $14.00 price objective on shares of Paramount Global in a research note on Thursday, February 27th. Benchmark lowered their target price on shares of Paramount Global from $19.00 to $16.00 and set a "buy" rating on the stock in a research report on Tuesday, May 6th. Citigroup reaffirmed a "neutral" rating and issued a $12.00 target price (down from $13.00) on shares of Paramount Global in a report on Thursday, May 29th. Finally, JPMorgan Chase & Co. reduced their price target on shares of Paramount Global from $11.00 to $10.00 and set an "underweight" rating for the company in a research report on Wednesday, May 21st.

Check Out Our Latest Stock Report on Paramount Global

Paramount Global Trading Up 2.6%

NASDAQ:PARA opened at $12.35 on Friday. Paramount Global has a 1 year low of $9.83 and a 1 year high of $12.54. The stock has a market cap of $8.33 billion, a P/E ratio of -1.50, a P/E/G ratio of 3.64 and a beta of 1.19. The company has a debt-to-equity ratio of 0.84, a quick ratio of 1.18 and a current ratio of 1.29. The stock has a 50-day simple moving average of $11.72 and a 200-day simple moving average of $11.29.

Paramount Global (NASDAQ:PARA - Get Free Report) last announced its quarterly earnings results on Thursday, May 8th. The company reported $0.29 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.27 by $0.02. Paramount Global had a positive return on equity of 4.80% and a negative net margin of 19.09%. The firm had revenue of $7.19 billion during the quarter, compared to the consensus estimate of $7.14 billion. During the same period in the prior year, the company posted $0.62 earnings per share. The firm's quarterly revenue was down 6.4% compared to the same quarter last year. As a group, analysts anticipate that Paramount Global will post 1.77 earnings per share for the current fiscal year.

Paramount Global Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 1st. Shareholders of record on Monday, June 16th will be given a dividend of $0.05 per share. The ex-dividend date is Monday, June 16th. This represents a $0.20 dividend on an annualized basis and a yield of 1.62%. Paramount Global's payout ratio is currently -2.43%.

Institutional Trading of Paramount Global

Hedge funds and other institutional investors have recently made changes to their positions in the company. Vanguard Group Inc. lifted its position in Paramount Global by 1.6% in the first quarter. Vanguard Group Inc. now owns 68,119,342 shares of the company's stock valued at $814,707,000 after purchasing an additional 1,078,976 shares during the period. Lingotto Investment Management LLP lifted its holdings in shares of Paramount Global by 3.7% in the 4th quarter. Lingotto Investment Management LLP now owns 44,753,299 shares of the company's stock valued at $468,120,000 after buying an additional 1,593,579 shares during the period. Invesco Ltd. lifted its holdings in shares of Paramount Global by 5.7% in the 4th quarter. Invesco Ltd. now owns 20,593,954 shares of the company's stock valued at $215,413,000 after buying an additional 1,119,314 shares during the period. Geode Capital Management LLC boosted its stake in shares of Paramount Global by 4.9% in the fourth quarter. Geode Capital Management LLC now owns 15,567,531 shares of the company's stock valued at $162,731,000 after buying an additional 724,565 shares in the last quarter. Finally, Ariel Investments LLC grew its holdings in Paramount Global by 3.2% during the fourth quarter. Ariel Investments LLC now owns 14,663,907 shares of the company's stock worth $153,384,000 after acquiring an additional 460,539 shares during the period. Hedge funds and other institutional investors own 73.00% of the company's stock.

About Paramount Global

(

Get Free ReportParamount Global operates as a media, streaming, and entertainment company worldwide. It operates through TV Media, Direct-to-Consumer, and Filmed Entertainment segments. The TV Media segment operates CBS Television Network, a domestic broadcast television network; CBS Stations, a television station; and international free-to-air networks comprising Network 10, Channel 5, Telefe, and Chilevisión; domestic premium and basic cable networks, such as Paramount+ with Showtime, MTV, Comedy Central, Paramount Network, The Smithsonian Channel, Nickelodeon, BET Media Group, and CBS Sports Network; and international extensions of these brands.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Paramount Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paramount Global wasn't on the list.

While Paramount Global currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.