Parkwood LLC purchased a new position in Fiserv, Inc. (NYSE:FI - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 54,631 shares of the business services provider's stock, valued at approximately $11,222,000. Fiserv makes up about 1.2% of Parkwood LLC's holdings, making the stock its 25th biggest position.

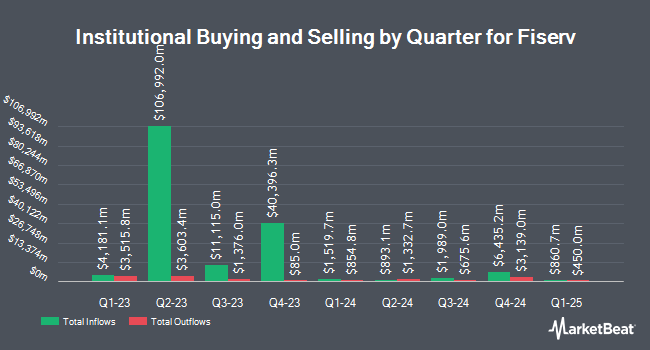

A number of other institutional investors and hedge funds have also recently modified their holdings of FI. Norges Bank purchased a new stake in Fiserv in the fourth quarter valued at approximately $1,406,452,000. Raymond James Financial Inc. bought a new position in shares of Fiserv in the fourth quarter worth approximately $614,982,000. Kovitz Investment Group Partners LLC grew its holdings in shares of Fiserv by 343.7% in the fourth quarter. Kovitz Investment Group Partners LLC now owns 2,806,579 shares of the business services provider's stock worth $576,527,000 after purchasing an additional 2,174,025 shares during the last quarter. Alliancebernstein L.P. grew its holdings in shares of Fiserv by 65.6% in the fourth quarter. Alliancebernstein L.P. now owns 5,437,246 shares of the business services provider's stock worth $1,116,919,000 after purchasing an additional 2,153,554 shares during the last quarter. Finally, FMR LLC boosted its holdings in Fiserv by 22.5% in the fourth quarter. FMR LLC now owns 11,568,895 shares of the business services provider's stock valued at $2,376,482,000 after acquiring an additional 2,126,419 shares in the last quarter. 90.98% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other news, COO Guy Chiarello sold 45,000 shares of the company's stock in a transaction dated Thursday, February 20th. The shares were sold at an average price of $235.55, for a total transaction of $10,599,750.00. Following the completion of the sale, the chief operating officer now owns 227,711 shares of the company's stock, valued at $53,637,326.05. This represents a 16.50% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 0.74% of the stock is owned by insiders.

Analyst Ratings Changes

FI has been the topic of several recent analyst reports. Piper Sandler set a $218.00 price target on shares of Fiserv in a report on Friday, April 25th. The Goldman Sachs Group cut their price target on shares of Fiserv from $223.00 to $194.00 and set a "buy" rating on the stock in a report on Monday. Redburn Atlantic reiterated a "sell" rating and issued a $150.00 price target on shares of Fiserv in a report on Thursday, April 17th. JPMorgan Chase & Co. cut their price target on shares of Fiserv from $211.00 to $210.00 and set an "overweight" rating on the stock in a report on Monday. Finally, Mizuho set a $200.00 price objective on Fiserv in a research report on Thursday. Two analysts have rated the stock with a sell rating, one has given a hold rating, twenty-two have issued a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $225.80.

Check Out Our Latest Stock Analysis on Fiserv

Fiserv Stock Performance

NYSE:FI traded up $2.40 during mid-day trading on Monday, reaching $169.06. The company's stock had a trading volume of 2,597,566 shares, compared to its average volume of 2,985,773. Fiserv, Inc. has a 12-month low of $146.25 and a 12-month high of $238.59. The firm's fifty day moving average price is $202.24 and its two-hundred day moving average price is $210.41. The company has a current ratio of 1.06, a quick ratio of 1.07 and a debt-to-equity ratio of 0.86. The stock has a market cap of $93.73 billion, a P/E ratio of 31.37, a PEG ratio of 1.52 and a beta of 0.97.

Fiserv (NYSE:FI - Get Free Report) last issued its earnings results on Thursday, April 24th. The business services provider reported $2.14 earnings per share for the quarter, topping analysts' consensus estimates of $2.08 by $0.06. Fiserv had a return on equity of 17.93% and a net margin of 15.31%. The business had revenue of $4.79 billion during the quarter, compared to analyst estimates of $4.86 billion. During the same quarter in the previous year, the firm earned $1.88 EPS. Fiserv's revenue was up 5.1% on a year-over-year basis. On average, equities analysts forecast that Fiserv, Inc. will post 10.23 EPS for the current fiscal year.

Fiserv announced that its board has approved a stock buyback plan on Thursday, February 20th that allows the company to buyback 60,000,000 shares. This buyback authorization allows the business services provider to buy shares of its stock through open market purchases. Shares buyback plans are generally a sign that the company's leadership believes its shares are undervalued.

About Fiserv

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

See Also

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report