Whitbread (LON:WTB - Get Free Report)'s stock had its "buy" rating reissued by equities researchers at Peel Hunt in a research report issued to clients and investors on Thursday,Digital Look reports. They currently have a GBX 3,500 price target on the stock. Peel Hunt's target price would suggest a potential upside of 20.77% from the company's previous close.

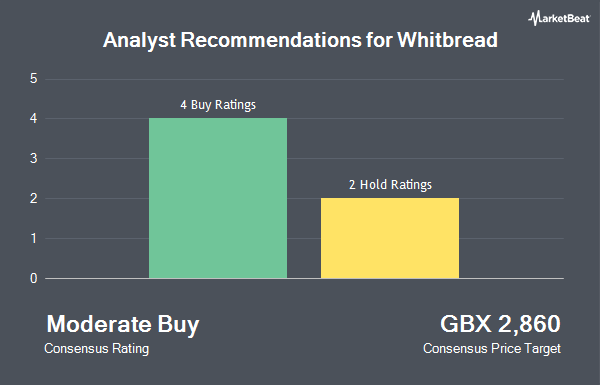

Other analysts also recently issued reports about the stock. Citigroup lifted their price objective on shares of Whitbread from GBX 3,600 to GBX 3,800 and gave the company a "buy" rating in a research report on Thursday, August 21st. Shore Capital reiterated a "buy" rating on shares of Whitbread in a research report on Thursday. Finally, Berenberg Bank cut their price objective on shares of Whitbread from GBX 3,900 to GBX 3,500 and set a "buy" rating on the stock in a research report on Wednesday, July 9th. Four analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of GBX 3,600.

Read Our Latest Research Report on WTB

Whitbread Stock Performance

Shares of Whitbread stock traded down GBX 326 during trading hours on Thursday, reaching GBX 2,898. The company's stock had a trading volume of 291,400,281 shares, compared to its average volume of 3,119,427. The company's 50 day simple moving average is GBX 3,152.79 and its 200 day simple moving average is GBX 2,921.34. The company has a debt-to-equity ratio of 33.18, a quick ratio of 1.74 and a current ratio of 0.96. Whitbread has a one year low of GBX 2,253 and a one year high of GBX 3,352. The stock has a market cap of £5.00 billion, a P/E ratio of 2,061.17, a price-to-earnings-growth ratio of -3.09 and a beta of 1.11.

Whitbread (LON:WTB - Get Free Report) last issued its quarterly earnings data on Thursday, October 16th. The company reported GBX 133.70 earnings per share for the quarter. Whitbread had a net margin of 8.08% and a return on equity of 6.83%. As a group, analysts expect that Whitbread will post 227.1851852 EPS for the current fiscal year.

About Whitbread

(

Get Free Report)

Whitbread is the owner of Premier Inn, the UK's biggest

hotel brand, with 86,000 rooms in over 850 hotels

and a growing presence in Germany with 10,500 rooms in

59 hotels, offering quality accommodation at affordable

prices in great locations.

People are at the heart of our business. We employ over

38,000 team members in over 900 Premier Inn hotels

across the UK and Germany.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Whitbread, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Whitbread wasn't on the list.

While Whitbread currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.