Darling Ingredients (NYSE:DAR - Get Free Report) had its price objective decreased by stock analysts at Piper Sandler from $54.00 to $50.00 in a note issued to investors on Monday,Benzinga reports. The brokerage currently has an "overweight" rating on the stock. Piper Sandler's price target indicates a potential upside of 54.28% from the company's current price.

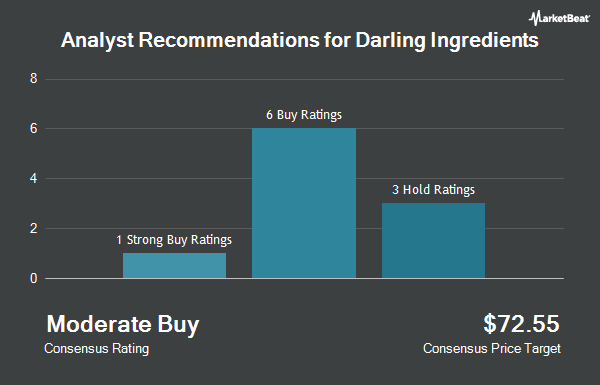

Several other brokerages have also recently commented on DAR. Jefferies Financial Group boosted their price target on shares of Darling Ingredients from $45.00 to $46.00 and gave the stock a "buy" rating in a research note on Monday, July 7th. Baird R W cut shares of Darling Ingredients from a "strong-buy" rating to a "hold" rating in a research note on Friday, July 25th. Tudor Pickering upgraded shares of Darling Ingredients from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, June 11th. TD Cowen lowered their price target on shares of Darling Ingredients from $37.00 to $34.00 and set a "hold" rating for the company in a report on Friday, April 25th. Finally, Robert W. Baird reaffirmed a "neutral" rating and issued a $36.00 price target (down previously from $40.00) on shares of Darling Ingredients in a report on Friday, July 25th. Four research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, Darling Ingredients currently has a consensus rating of "Moderate Buy" and a consensus target price of $45.86.

Get Our Latest Stock Report on DAR

Darling Ingredients Price Performance

Darling Ingredients stock traded down $0.56 during mid-day trading on Monday, hitting $32.41. The stock had a trading volume of 1,761,386 shares, compared to its average volume of 2,391,975. The firm has a market capitalization of $5.13 billion, a P/E ratio of 49.10 and a beta of 1.23. Darling Ingredients has a one year low of $26.00 and a one year high of $43.49. The company has a current ratio of 1.40, a quick ratio of 0.83 and a debt-to-equity ratio of 0.84. The firm's 50 day moving average is $35.25 and its 200 day moving average is $34.29.

Darling Ingredients (NYSE:DAR - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The company reported $0.09 EPS for the quarter, missing the consensus estimate of $0.12 by ($0.03). The company had revenue of $1.48 billion during the quarter, compared to analysts' expectations of $1.49 billion. Darling Ingredients had a return on equity of 2.37% and a net margin of 1.85%. The firm's revenue for the quarter was up 1.8% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.49 EPS. On average, sell-side analysts forecast that Darling Ingredients will post 2.81 earnings per share for the current fiscal year.

Institutional Trading of Darling Ingredients

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in DAR. American Century Companies Inc. raised its position in Darling Ingredients by 1,003.0% in the 4th quarter. American Century Companies Inc. now owns 578,908 shares of the company's stock worth $19,503,000 after purchasing an additional 526,425 shares during the period. KLP Kapitalforvaltning AS purchased a new stake in Darling Ingredients in the 4th quarter worth about $1,088,000. LPL Financial LLC raised its position in Darling Ingredients by 13.6% in the 4th quarter. LPL Financial LLC now owns 33,100 shares of the company's stock worth $1,115,000 after purchasing an additional 3,954 shares during the period. Vanguard Group Inc. raised its position in Darling Ingredients by 1.3% in the 4th quarter. Vanguard Group Inc. now owns 15,567,996 shares of the company's stock worth $524,486,000 after purchasing an additional 203,921 shares during the period. Finally, Norges Bank purchased a new stake in Darling Ingredients in the 4th quarter worth about $63,956,000. 94.44% of the stock is owned by hedge funds and other institutional investors.

About Darling Ingredients

(

Get Free Report)

Darling Ingredients Inc develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally. The company operates through three segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients. It offers ingredients and customized specialty solutions for customers in the pharmaceutical, food, pet food, feed, industrial, fuel, bioenergy, and fertilizer industries.

Recommended Stories

Before you consider Darling Ingredients, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Darling Ingredients wasn't on the list.

While Darling Ingredients currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.