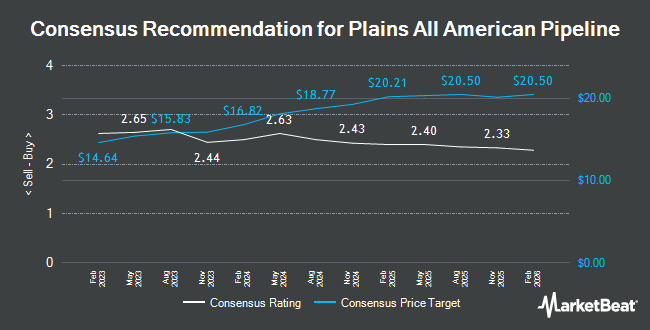

Plains All American Pipeline (NYSE:PAA - Free Report) had its target price hoisted by Scotiabank from $18.00 to $20.00 in a report published on Monday morning,Benzinga reports. The brokerage currently has a sector outperform rating on the pipeline company's stock.

Other equities analysts have also recently issued reports about the company. Barclays reaffirmed an "underweight" rating on shares of Plains All American Pipeline in a report on Friday, August 8th. Royal Bank Of Canada reaffirmed a "sector perform" rating and issued a $20.00 target price on shares of Plains All American Pipeline in a report on Friday, May 16th. Citigroup set a $18.00 target price on Plains All American Pipeline and gave the stock a "neutral" rating in a report on Friday, August 8th. Mizuho set a $22.00 target price on Plains All American Pipeline and gave the stock an "outperform" rating in a report on Wednesday, June 18th. Finally, JPMorgan Chase & Co. set a $20.00 target price on Plains All American Pipeline in a report on Friday, August 8th. One investment analyst has rated the stock with a Strong Buy rating, three have issued a Buy rating, eight have assigned a Hold rating and one has assigned a Sell rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $20.58.

View Our Latest Stock Report on Plains All American Pipeline

Plains All American Pipeline Stock Performance

Shares of NYSE PAA traded up $0.11 during midday trading on Monday, hitting $17.46. 2,027,699 shares of the stock traded hands, compared to its average volume of 3,491,412. The firm has a 50-day moving average of $18.01 and a two-hundred day moving average of $18.05. The firm has a market capitalization of $12.28 billion, a P/E ratio of 23.92 and a beta of 0.80. The company has a debt-to-equity ratio of 0.64, a quick ratio of 0.92 and a current ratio of 1.01. Plains All American Pipeline has a one year low of $15.57 and a one year high of $21.00.

Plains All American Pipeline (NYSE:PAA - Get Free Report) last released its quarterly earnings results on Friday, August 8th. The pipeline company reported $0.36 earnings per share for the quarter, beating the consensus estimate of $0.33 by $0.03. Plains All American Pipeline had a return on equity of 11.69% and a net margin of 1.54%.Plains All American Pipeline's revenue was down 16.6% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.31 EPS. On average, equities analysts forecast that Plains All American Pipeline will post 1.52 EPS for the current fiscal year.

Plains All American Pipeline Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, August 14th. Shareholders of record on Thursday, July 31st were paid a $0.38 dividend. This represents a $1.52 dividend on an annualized basis and a yield of 8.7%. The ex-dividend date was Thursday, July 31st. Plains All American Pipeline's dividend payout ratio is presently 172.73%.

Institutional Investors Weigh In On Plains All American Pipeline

Institutional investors have recently bought and sold shares of the business. Farther Finance Advisors LLC increased its stake in Plains All American Pipeline by 107.0% in the 1st quarter. Farther Finance Advisors LLC now owns 1,271 shares of the pipeline company's stock worth $26,000 after buying an additional 657 shares in the last quarter. Blue Trust Inc. increased its stake in Plains All American Pipeline by 76.1% in the 2nd quarter. Blue Trust Inc. now owns 1,761 shares of the pipeline company's stock worth $32,000 after buying an additional 761 shares in the last quarter. Oliver Lagore Vanvalin Investment Group purchased a new position in shares of Plains All American Pipeline during the second quarter valued at about $40,000. Atwood & Palmer Inc. bought a new stake in shares of Plains All American Pipeline in the second quarter worth about $42,000. Finally, Ameritas Advisory Services LLC bought a new stake in shares of Plains All American Pipeline in the second quarter worth about $58,000. Hedge funds and other institutional investors own 41.78% of the company's stock.

About Plains All American Pipeline

(

Get Free Report)

Plains All American Pipeline, L.P., through its subsidiaries, engages in the pipeline transportation, terminaling, storage, and gathering of crude oil and natural gas liquids (NGL) in the United States and Canada. The company operates through two segments, Crude Oil and NGL. The Crude Oil segment offers gathering and transporting crude oil through pipelines, gathering systems, trucks, and on barges or railcars.

Recommended Stories

Before you consider Plains All American Pipeline, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plains All American Pipeline wasn't on the list.

While Plains All American Pipeline currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.