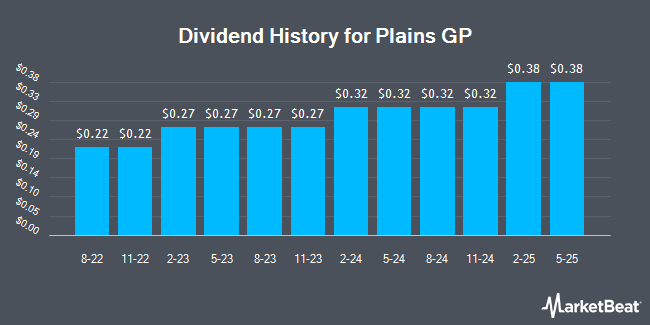

Plains GP Holdings, L.P. (NYSE:PAGP - Get Free Report) announced a quarterly dividend on Thursday, October 2nd, RTT News reports. Stockholders of record on Friday, October 31st will be given a dividend of 0.38 per share by the pipeline company on Friday, November 14th. This represents a c) annualized dividend and a dividend yield of 8.3%.

Plains GP Stock Down 0.5%

Shares of Plains GP stock traded down $0.09 during trading on Thursday, reaching $18.21. 888,231 shares of the company traded hands, compared to its average volume of 1,606,676. The firm has a market capitalization of $3.60 billion, a PE ratio of 34.36 and a beta of 0.76. Plains GP has a 1-year low of $16.60 and a 1-year high of $22.31. The company has a 50 day moving average price of $18.89 and a 200-day moving average price of $19.03. The company has a debt-to-equity ratio of 0.49, a current ratio of 1.01 and a quick ratio of 0.92.

Hedge Funds Weigh In On Plains GP

Several large investors have recently bought and sold shares of PAGP. Invesco Ltd. raised its position in shares of Plains GP by 42.9% in the first quarter. Invesco Ltd. now owns 4,190,610 shares of the pipeline company's stock valued at $89,511,000 after purchasing an additional 1,258,315 shares during the period. Hsbc Holdings PLC grew its stake in Plains GP by 25.8% in the 1st quarter. Hsbc Holdings PLC now owns 2,563,031 shares of the pipeline company's stock valued at $54,746,000 after buying an additional 526,215 shares in the last quarter. Turtle Creek Wealth Advisors LLC purchased a new position in Plains GP in the 1st quarter valued at approximately $10,322,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in Plains GP by 17.9% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 2,559,937 shares of the pipeline company's stock valued at $54,680,000 after acquiring an additional 389,096 shares during the period. Finally, HRT Financial LP lifted its position in shares of Plains GP by 80.6% during the second quarter. HRT Financial LP now owns 836,999 shares of the pipeline company's stock worth $16,262,000 after acquiring an additional 373,578 shares in the last quarter. 88.30% of the stock is currently owned by institutional investors.

About Plains GP

(

Get Free Report)

Plains GP Holdings, L.P., through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada. It operates in two segments, Crude Oil and Natural Gas Liquids (NGLs). The company engages in the gathering and transporting crude oil and NGLs using pipelines, gathering systems, and trucks.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Plains GP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plains GP wasn't on the list.

While Plains GP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.