PolyPid (NASDAQ:PYPD - Get Free Report) was upgraded by stock analysts at Wall Street Zen from a "sell" rating to a "hold" rating in a research report issued to clients and investors on Friday.

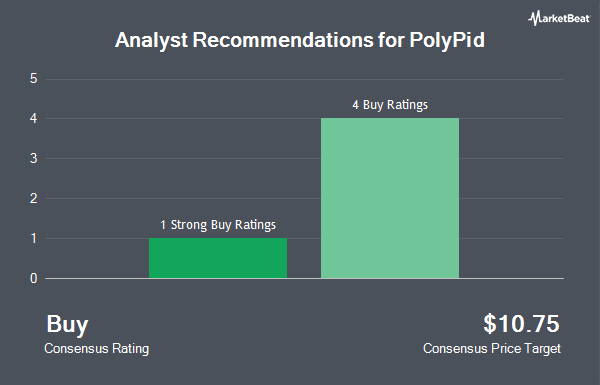

Several other analysts have also commented on the stock. Craig Hallum restated a "buy" rating and set a $13.00 price target (down previously from $15.00) on shares of PolyPid in a research report on Thursday, August 14th. Roth Capital reiterated a "buy" rating on shares of PolyPid in a report on Thursday, August 14th. JMP Securities reduced their price target on shares of PolyPid from $16.00 to $14.00 and set a "market outperform" rating on the stock in a research note on Tuesday, June 17th. Finally, HC Wainwright reissued a "buy" rating and issued a $13.00 price target on shares of PolyPid in a research note on Wednesday, August 13th. One research analyst has rated the stock with a Strong Buy rating and five have given a Buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Buy" and an average target price of $12.40.

View Our Latest Analysis on PYPD

PolyPid Trading Down 0.9%

NASDAQ PYPD opened at $3.34 on Friday. The company has a fifty day simple moving average of $3.45 and a two-hundred day simple moving average of $3.15. The stock has a market cap of $53.11 million, a P/E ratio of -0.87 and a beta of 1.48. PolyPid has a 12-month low of $2.30 and a 12-month high of $3.93.

PolyPid (NASDAQ:PYPD - Get Free Report) last posted its quarterly earnings results on Wednesday, August 13th. The company reported ($0.78) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.53) by ($0.25). As a group, sell-side analysts forecast that PolyPid will post -1.79 earnings per share for the current year.

Institutional Investors Weigh In On PolyPid

An institutional investor recently bought a new position in PolyPid stock. Lumbard & Kellner LLC acquired a new stake in PolyPid Ltd. (NASDAQ:PYPD - Free Report) during the second quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 38,200 shares of the company's stock, valued at approximately $135,000. Lumbard & Kellner LLC owned about 0.24% of PolyPid at the end of the most recent quarter. 26.47% of the stock is currently owned by hedge funds and other institutional investors.

PolyPid Company Profile

(

Get Free Report)

PolyPid Ltd., a clinical-stage biopharmaceutical company, developing targeted, locally administered, and prolonged-release therapeutics using its proprietary polymer-lipid encapsulation matrix (PLEX) technology to address unmet medical needs. Its lead product candidate is D-PLEX100, which is in a pivotal Phase 3 confirmatory trial for prevention of surgical site infections (SSIs) in patients undergoing abdominal colorectal surgery with large incisions.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PolyPid, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PolyPid wasn't on the list.

While PolyPid currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.