Portillo's (NASDAQ:PTLO - Get Free Report) was downgraded by equities researchers at Wall Street Zen from a "hold" rating to a "sell" rating in a research report issued to clients and investors on Saturday.

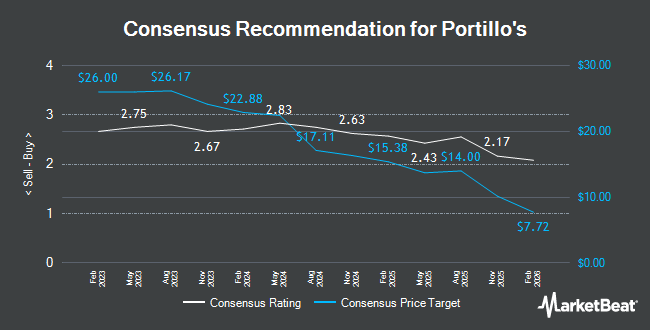

PTLO has been the topic of several other reports. Piper Sandler reduced their price target on Portillo's from $17.00 to $13.00 and set an "overweight" rating on the stock in a report on Wednesday, May 7th. Morgan Stanley reduced their price target on Portillo's from $12.00 to $10.00 and set an "equal weight" rating on the stock in a report on Wednesday, August 6th. UBS Group reduced their price target on Portillo's from $12.00 to $9.00 and set a "neutral" rating on the stock in a report on Wednesday, August 6th. Stephens reduced their price target on Portillo's from $13.00 to $10.00 and set an "equal weight" rating on the stock in a report on Friday. Finally, Bank of America decreased their price target on Portillo's from $19.00 to $16.00 and set a "buy" rating for the company in a research note on Friday, July 18th. One analyst has rated the stock with a sell rating, five have assigned a hold rating and five have given a buy rating to the company's stock. According to MarketBeat, Portillo's presently has an average rating of "Hold" and a consensus price target of $12.50.

Get Our Latest Report on Portillo's

Portillo's Price Performance

Shares of Portillo's stock traded up $0.06 during trading on Friday, reaching $7.91. 3,291,829 shares of the company's stock were exchanged, compared to its average volume of 2,088,595. The company has a debt-to-equity ratio of 0.49, a quick ratio of 0.23 and a current ratio of 0.29. Portillo's has a 1-year low of $7.20 and a 1-year high of $15.78. The company has a market cap of $591.45 million, a P/E ratio of 17.57, a PEG ratio of 5.12 and a beta of 1.81. The firm's 50-day moving average price is $10.93 and its 200 day moving average price is $12.02.

Portillo's (NASDAQ:PTLO - Get Free Report) last posted its quarterly earnings results on Tuesday, August 5th. The company reported $0.12 EPS for the quarter, hitting analysts' consensus estimates of $0.12. Portillo's had a return on equity of 6.25% and a net margin of 4.19%. The company had revenue of $188.46 million during the quarter, compared to analysts' expectations of $197.04 million. During the same quarter in the previous year, the firm earned $0.10 EPS. Portillo's's revenue was up 3.6% on a year-over-year basis. As a group, research analysts anticipate that Portillo's will post 0.35 earnings per share for the current year.

Insiders Place Their Bets

In other news, General Counsel Kelly M. Kaiser purchased 27,000 shares of the business's stock in a transaction on Thursday, August 7th. The shares were acquired at an average price of $7.68 per share, for a total transaction of $207,360.00. Following the completion of the acquisition, the general counsel owned 68,495 shares in the company, valued at approximately $526,041.60. The trade was a 65.07% increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CFO Michelle Greig Hook purchased 40,000 shares of the business's stock in a transaction on Thursday, August 7th. The stock was purchased at an average price of $7.67 per share, for a total transaction of $306,800.00. Following the acquisition, the chief financial officer owned 173,405 shares of the company's stock, valued at approximately $1,330,016.35. This represents a 29.98% increase in their position. The disclosure for this purchase can be found here. In the last quarter, insiders have purchased 210,570 shares of company stock valued at $1,614,474. 6.14% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. PNC Financial Services Group Inc. raised its stake in shares of Portillo's by 135.8% in the second quarter. PNC Financial Services Group Inc. now owns 2,596 shares of the company's stock worth $30,000 after purchasing an additional 1,495 shares during the last quarter. Allworth Financial LP purchased a new stake in shares of Portillo's in the second quarter worth approximately $32,000. CWM LLC raised its stake in shares of Portillo's by 58.3% in the first quarter. CWM LLC now owns 3,194 shares of the company's stock worth $38,000 after purchasing an additional 1,176 shares during the last quarter. North Star Investment Management Corp. raised its stake in shares of Portillo's by 137.6% in the first quarter. North Star Investment Management Corp. now owns 3,517 shares of the company's stock worth $42,000 after purchasing an additional 2,037 shares during the last quarter. Finally, Comerica Bank raised its stake in shares of Portillo's by 172.6% in the fourth quarter. Comerica Bank now owns 5,395 shares of the company's stock worth $51,000 after purchasing an additional 3,416 shares during the last quarter. Institutional investors own 98.34% of the company's stock.

Portillo's Company Profile

(

Get Free Report)

Portillo's Inc owns and operates fast casual restaurants in the United States. The company offers Chicago-style hot dogs and sausages, Italian beef sandwiches, char-grilled burgers, chopped salads, crinkle-cut French fries, homemade chocolate cakes, and chocolate cake shake. It offers its products through its website, application, and certain third-party platforms.

Recommended Stories

Before you consider Portillo's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Portillo's wasn't on the list.

While Portillo's currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.