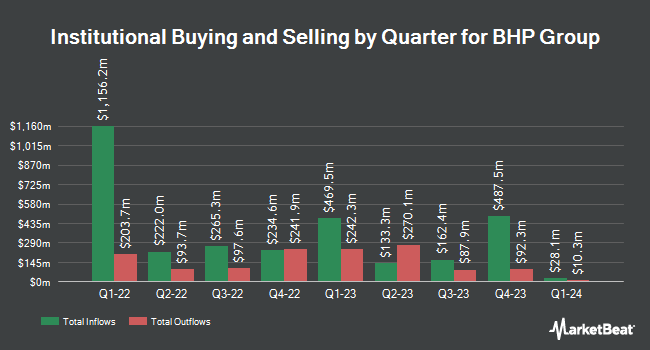

Price T Rowe Associates Inc. MD lessened its holdings in shares of BHP Group Limited (NYSE:BHP - Free Report) by 20.8% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 359,804 shares of the mining company's stock after selling 94,443 shares during the period. Price T Rowe Associates Inc. MD's holdings in BHP Group were worth $17,571,000 as of its most recent SEC filing.

Several other large investors have also recently bought and sold shares of the business. Barclays PLC increased its holdings in BHP Group by 93.7% in the third quarter. Barclays PLC now owns 226,083 shares of the mining company's stock valued at $14,042,000 after buying an additional 109,337 shares in the last quarter. JPMorgan Chase & Co. grew its holdings in BHP Group by 10.1% in the third quarter. JPMorgan Chase & Co. now owns 600,086 shares of the mining company's stock valued at $37,271,000 after purchasing an additional 55,095 shares during the last quarter. Range Financial Group LLC purchased a new position in shares of BHP Group in the fourth quarter valued at $1,301,000. FNY Investment Advisers LLC acquired a new position in shares of BHP Group during the 4th quarter worth $2,130,000. Finally, Fifth Third Wealth Advisors LLC purchased a new stake in shares of BHP Group in the 4th quarter worth about $249,000. Hedge funds and other institutional investors own 3.79% of the company's stock.

BHP Group Trading Down 0.5 %

NYSE:BHP traded down $0.24 on Wednesday, reaching $48.59. The stock had a trading volume of 571,936 shares, compared to its average volume of 2,931,693. BHP Group Limited has a 12-month low of $39.73 and a 12-month high of $63.21. The company has a market cap of $123.21 billion, a price-to-earnings ratio of 11.03 and a beta of 0.86. The firm's fifty day moving average is $47.71 and its two-hundred day moving average is $50.23. The company has a debt-to-equity ratio of 0.40, a current ratio of 1.70 and a quick ratio of 1.25.

BHP Group Cuts Dividend

The company also recently announced a semi-annual dividend, which was paid on Thursday, March 27th. Investors of record on Friday, March 7th were given a dividend of $1.00 per share. The ex-dividend date of this dividend was Friday, March 7th. This represents a yield of 4.8%. BHP Group's dividend payout ratio (DPR) is currently 44.77%.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on BHP shares. Clarkson Capital upgraded shares of BHP Group to a "strong-buy" rating in a report on Friday, February 28th. StockNews.com downgraded BHP Group from a "strong-buy" rating to a "buy" rating in a research report on Wednesday, February 19th. Two equities research analysts have rated the stock with a hold rating, three have assigned a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Buy" and a consensus price target of $53.00.

Get Our Latest Report on BHP Group

BHP Group Profile

(

Free Report)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through Copper, Iron Ore, and Coal segments. It engages in the mining of copper, uranium, gold, zinc, lead, molybdenum, silver, iron ore, cobalt, and metallurgical and energy coal.

Further Reading

Before you consider BHP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BHP Group wasn't on the list.

While BHP Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.