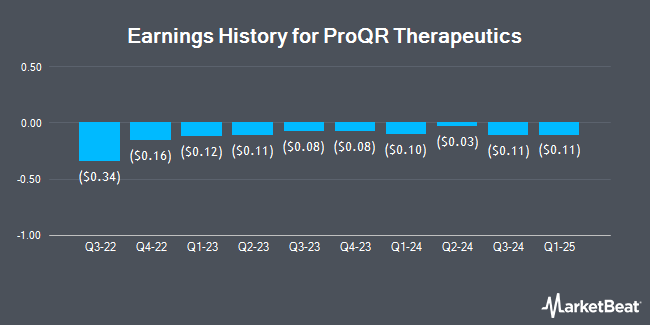

ProQR Therapeutics (NASDAQ:PRQR - Get Free Report) is projected to release its Q2 2025 earnings data before the market opens on Thursday, August 7th. Analysts expect the company to announce earnings of ($0.08) per share and revenue of $5.01 million for the quarter.

ProQR Therapeutics (NASDAQ:PRQR - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The biopharmaceutical company reported ($0.14) EPS for the quarter, missing the consensus estimate of ($0.08) by ($0.06). ProQR Therapeutics had a negative return on equity of 53.49% and a negative net margin of 157.04%. The company had revenue of $4.33 million during the quarter, compared to the consensus estimate of $5.01 million. On average, analysts expect ProQR Therapeutics to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

ProQR Therapeutics Trading Up 5.9%

NASDAQ PRQR traded up $0.12 during trading on Friday, hitting $2.17. The company had a trading volume of 312,555 shares, compared to its average volume of 210,915. ProQR Therapeutics has a one year low of $1.07 and a one year high of $4.62. The company has a market cap of $228.31 million, a price-to-earnings ratio of -4.72 and a beta of 0.43. The company's fifty day moving average is $2.09 and its 200-day moving average is $1.88.

Institutional Trading of ProQR Therapeutics

An institutional investor recently raised its position in ProQR Therapeutics stock. Jane Street Group LLC boosted its position in shares of ProQR Therapeutics N.V. (NASDAQ:PRQR - Free Report) by 699.3% during the 1st quarter, according to its most recent 13F filing with the SEC. The fund owned 91,120 shares of the biopharmaceutical company's stock after purchasing an additional 79,720 shares during the quarter. Jane Street Group LLC owned about 0.09% of ProQR Therapeutics worth $121,000 at the end of the most recent reporting period. Hedge funds and other institutional investors own 32.65% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts recently issued reports on the stock. JMP Securities reiterated a "market outperform" rating and issued a $8.00 price target on shares of ProQR Therapeutics in a research note on Friday, June 27th. Evercore ISI reiterated an "outperform" rating on shares of ProQR Therapeutics in a research note on Friday, July 11th. Chardan Capital reiterated a "buy" rating and issued a $4.00 price target on shares of ProQR Therapeutics in a research note on Friday. Oppenheimer decreased their price target on shares of ProQR Therapeutics from $15.00 to $9.00 and set an "outperform" rating for the company in a research note on Tuesday, May 13th. Finally, Cantor Fitzgerald reiterated an "overweight" rating and issued a $8.00 price target on shares of ProQR Therapeutics in a research note on Friday, June 27th. One investment analyst has rated the stock with a sell rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $8.00.

Read Our Latest Stock Report on ProQR Therapeutics

ProQR Therapeutics Company Profile

(

Get Free Report)

ProQR Therapeutics N.V., a biotechnology company, focuses on the discovery and development of novel therapeutic medicines. The company's products pipeline includes AX-0810 for cholestatic diseases targeting Na-taurocholate cotransporting polypeptide (NTCP); and AX-1412 for cardiovascular diseases (CVDs) targeting Beta-1,4-galactosyltransferase 1 (B4GALT1).

Recommended Stories

Before you consider ProQR Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProQR Therapeutics wasn't on the list.

While ProQR Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.