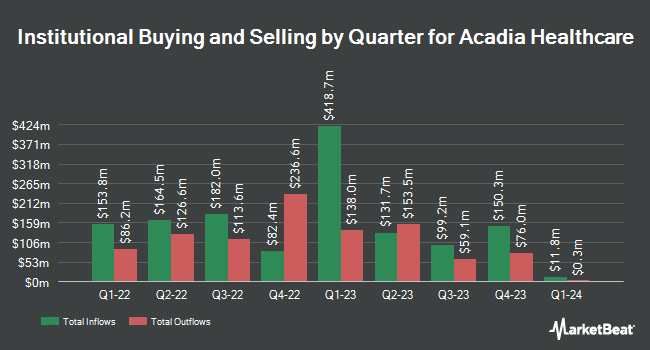

Prosight Management LP raised its position in Acadia Healthcare Company, Inc. (NASDAQ:ACHC - Free Report) by 12,113.2% in the fourth quarter, according to its most recent disclosure with the SEC. The firm owned 692,000 shares of the company's stock after acquiring an additional 686,334 shares during the period. Acadia Healthcare makes up about 7.6% of Prosight Management LP's holdings, making the stock its 2nd largest position. Prosight Management LP owned 0.74% of Acadia Healthcare worth $27,438,000 at the end of the most recent reporting period.

Several other large investors have also bought and sold shares of the stock. Quantinno Capital Management LP raised its stake in Acadia Healthcare by 9.0% in the 4th quarter. Quantinno Capital Management LP now owns 8,695 shares of the company's stock valued at $345,000 after acquiring an additional 721 shares during the period. Madison Avenue Partners LP bought a new position in shares of Acadia Healthcare during the fourth quarter valued at about $76,339,000. Nomura Holdings Inc. purchased a new position in Acadia Healthcare during the 4th quarter valued at $489,000. Nuveen Asset Management LLC boosted its position in Acadia Healthcare by 47.9% during the 4th quarter. Nuveen Asset Management LLC now owns 560,637 shares of the company's stock valued at $22,229,000 after acquiring an additional 181,676 shares in the last quarter. Finally, Occudo Quantitative Strategies LP purchased a new stake in Acadia Healthcare in the fourth quarter worth $672,000.

Acadia Healthcare Price Performance

Shares of NASDAQ:ACHC traded up $0.21 during midday trading on Tuesday, hitting $25.29. The company's stock had a trading volume of 459,172 shares, compared to its average volume of 2,306,357. Acadia Healthcare Company, Inc. has a 12-month low of $20.36 and a 12-month high of $82.40. The company has a market cap of $2.33 billion, a P/E ratio of 8.29, a price-to-earnings-growth ratio of 1.46 and a beta of 1.01. The company has a debt-to-equity ratio of 0.60, a quick ratio of 1.07 and a current ratio of 1.07. The business's 50 day simple moving average is $26.12 and its 200 day simple moving average is $35.37.

Acadia Healthcare (NASDAQ:ACHC - Get Free Report) last issued its quarterly earnings data on Monday, May 12th. The company reported $0.40 earnings per share for the quarter, topping the consensus estimate of $0.35 by $0.05. The company had revenue of $770.51 million during the quarter, compared to analyst estimates of $769.90 million. Acadia Healthcare had a return on equity of 11.12% and a net margin of 8.99%. The firm's revenue for the quarter was up .3% compared to the same quarter last year. During the same period in the prior year, the business posted $0.84 earnings per share. On average, analysts forecast that Acadia Healthcare Company, Inc. will post 3.38 EPS for the current year.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently commented on ACHC shares. Bank of America cut their target price on Acadia Healthcare from $50.00 to $44.50 and set a "buy" rating on the stock in a research note on Friday, February 28th. Barclays lowered their target price on shares of Acadia Healthcare from $35.00 to $28.00 and set an "equal weight" rating on the stock in a research note on Wednesday, May 14th. Mizuho reduced their price objective on Acadia Healthcare from $37.00 to $32.00 and set a "neutral" rating on the stock in a research note on Wednesday, May 14th. KeyCorp dropped their target price on Acadia Healthcare from $65.00 to $55.00 and set an "overweight" rating for the company in a research report on Wednesday, May 14th. Finally, Royal Bank of Canada dropped their price target on Acadia Healthcare from $64.00 to $43.00 and set an "outperform" rating on the stock in a research report on Monday, March 3rd. One research analyst has rated the stock with a sell rating, three have given a hold rating and six have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $47.94.

Check Out Our Latest Research Report on ACHC

Acadia Healthcare Company Profile

(

Free Report)

Acadia Healthcare Company, Inc provides behavioral healthcare services in the United States and Puerto Rico. The company develops and operates acute inpatient psychiatric facilities, specialty treatment facilities comprising residential recovery facilities and eating disorder facilities, comprehensive treatment centers, and residential treatment centers, as well as facilities offering outpatient behavioral healthcare services for the behavioral healthcare and recovery needs of communities.

Featured Articles

Before you consider Acadia Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acadia Healthcare wasn't on the list.

While Acadia Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.