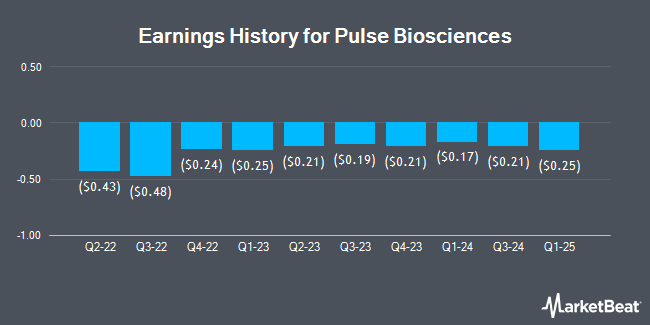

Pulse Biosciences (NASDAQ:PLSE - Get Free Report) is anticipated to announce its Q2 2025 earnings results after the market closes on Tuesday, August 12th. Analysts expect the company to announce earnings of ($0.26) per share for the quarter.

Pulse Biosciences (NASDAQ:PLSE - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The company reported ($0.25) EPS for the quarter.

Pulse Biosciences Trading Down 0.1%

Pulse Biosciences stock traded down $0.01 during trading hours on Friday, hitting $14.71. The stock had a trading volume of 101,099 shares, compared to its average volume of 140,769. The company has a 50-day moving average of $15.57 and a two-hundred day moving average of $17.03. Pulse Biosciences has a fifty-two week low of $13.77 and a fifty-two week high of $25.00.

Insider Buying and Selling at Pulse Biosciences

In other news, CTO Darrin Uecker sold 15,000 shares of the company's stock in a transaction that occurred on Thursday, June 12th. The stock was sold at an average price of $16.40, for a total value of $246,000.00. Following the sale, the chief technology officer directly owned 137,872 shares in the company, valued at approximately $2,261,100.80. This represents a 9.81% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Corporate insiders own 71.50% of the company's stock.

Institutional Investors Weigh In On Pulse Biosciences

A hedge fund recently bought a new stake in Pulse Biosciences stock. Jane Street Group LLC acquired a new stake in Pulse Biosciences, Inc (NASDAQ:PLSE - Free Report) during the 1st quarter, according to its most recent filing with the SEC. The institutional investor acquired 20,105 shares of the company's stock, valued at approximately $323,000. Institutional investors own 76.95% of the company's stock.

Analyst Ratings Changes

Separately, Oppenheimer started coverage on Pulse Biosciences in a report on Monday, July 7th. They issued an "outperform" rating and a $22.00 price target for the company.

View Our Latest Analysis on PLSE

About Pulse Biosciences

(

Get Free Report)

Pulse Biosciences, Inc operates as a novel bioelectric medicine company. The company offers CellFX System, a tunable, software-enabled, and console-based platform that delivers nano second duration pulses of electrical energy to non-thermally clear targeted cells while sparing adjacent non-cellular tissue to treat a various medical condition by using its Nano-Pulse Stimulation technology.

See Also

Before you consider Pulse Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pulse Biosciences wasn't on the list.

While Pulse Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.