PureCycle Technologies (NASDAQ:PCT - Get Free Report) is expected to issue its Q2 2025 quarterly earnings data after the market closes on Thursday, August 7th. Analysts expect the company to announce earnings of ($0.23) per share and revenue of $4.10 million for the quarter.

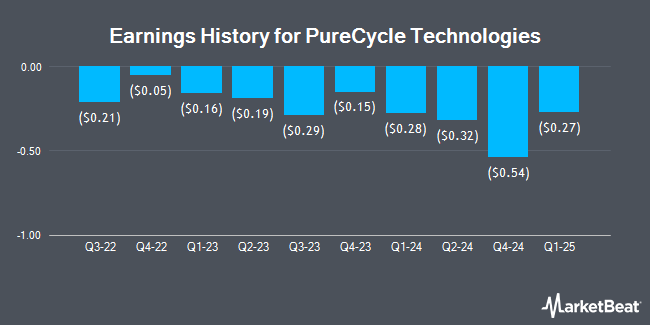

PureCycle Technologies (NASDAQ:PCT - Get Free Report) last posted its quarterly earnings data on Wednesday, May 7th. The company reported ($0.27) earnings per share for the quarter, missing analysts' consensus estimates of ($0.25) by ($0.02). The business had revenue of $1.58 million for the quarter, compared to analyst estimates of $4.27 million. On average, analysts expect PureCycle Technologies to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

PureCycle Technologies Trading Up 3.8%

PCT stock traded up $0.48 during mid-day trading on Monday, reaching $13.10. 1,224,067 shares of the stock traded hands, compared to its average volume of 3,079,019. The stock has a market capitalization of $2.36 billion, a PE ratio of -11.20 and a beta of 1.94. PureCycle Technologies has a one year low of $4.50 and a one year high of $17.37. The company has a debt-to-equity ratio of 1.43, a quick ratio of 0.45 and a current ratio of 0.55. The business has a 50-day moving average price of $13.20 and a two-hundred day moving average price of $9.83.

Analysts Set New Price Targets

A number of analysts have recently issued reports on the stock. Wall Street Zen lowered shares of PureCycle Technologies from a "hold" rating to a "sell" rating in a research note on Monday, July 21st. Cantor Fitzgerald reissued an "overweight" rating and set a $16.00 target price (up from $12.00) on shares of PureCycle Technologies in a research note on Tuesday, June 24th. Finally, TD Cowen raised shares of PureCycle Technologies to a "strong-buy" rating in a research note on Monday, June 23rd. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $12.50.

Read Our Latest Stock Analysis on PureCycle Technologies

Institutional Trading of PureCycle Technologies

A number of hedge funds have recently added to or reduced their stakes in the business. Royal Bank of Canada lifted its stake in PureCycle Technologies by 62.4% in the first quarter. Royal Bank of Canada now owns 1,042,338 shares of the company's stock worth $7,213,000 after acquiring an additional 400,520 shares during the period. Millennium Management LLC purchased a new stake in PureCycle Technologies in the first quarter worth about $3,770,000. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its stake in PureCycle Technologies by 9.0% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 284,860 shares of the company's stock worth $1,971,000 after acquiring an additional 23,609 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its stake in PureCycle Technologies by 4.5% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 73,249 shares of the company's stock worth $507,000 after acquiring an additional 3,161 shares during the period. Finally, Integrated Wealth Concepts LLC lifted its stake in PureCycle Technologies by 4.3% in the first quarter. Integrated Wealth Concepts LLC now owns 36,571 shares of the company's stock worth $253,000 after acquiring an additional 1,516 shares during the period. 63.01% of the stock is owned by hedge funds and other institutional investors.

PureCycle Technologies Company Profile

(

Get Free Report)

PureCycle Technologies, Inc engages in the production of recycled polypropylene (PP). The company holds a license for restoring waste PP into ultra-pure recycled polypropylene resin that has multiple applications, including packaging and labeling for consumer products, piping, ropes, cabling, and plastic parts for various industries.

Featured Articles

Before you consider PureCycle Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PureCycle Technologies wasn't on the list.

While PureCycle Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.